Weighted Average Shares Outstanding incorporates any changes in the outstanding shares over a reporting period. This number is of great significance as it is useful for creating key financial measures such as earnings per share (EPS). The amount of shares might change due to several reasons, such as companies issuing new shares, retiring existing shares, repurchasing, etc.

For investors with a long-term perspective, the number of outstanding shares is an important number. Since the stock prices keep changing on a daily basis, estimating the cost of accumulated shares over the years is challenging. Thus, to calculate the average cost that an investor paid for the total number of shares, it is better to use the weighted average share price.

Weighted Average Shares Outstanding and EPS

The earnings per share or EPS is an important measure to assess the financial health of the company. To have an undistorted and unbiased view of earnings per share, the weighted average shares outstanding metric is important.

Basic EPS = (Net Income – Preferred Dividends)/Weighted Average Shares Outstanding

For instance, suppose a company exercises share buyback towards the end of the year. If this buyback figure is taken into consideration while calculating the earnings per share (EPS), the final number would be very high and would, therefore, distort the final financial figures. So, in this case, calculating the weighted average shares outstanding will ease the effect of the buyback at the end of the year.

Also Read: Earnings Per Share

Why Use a Weighted Average?

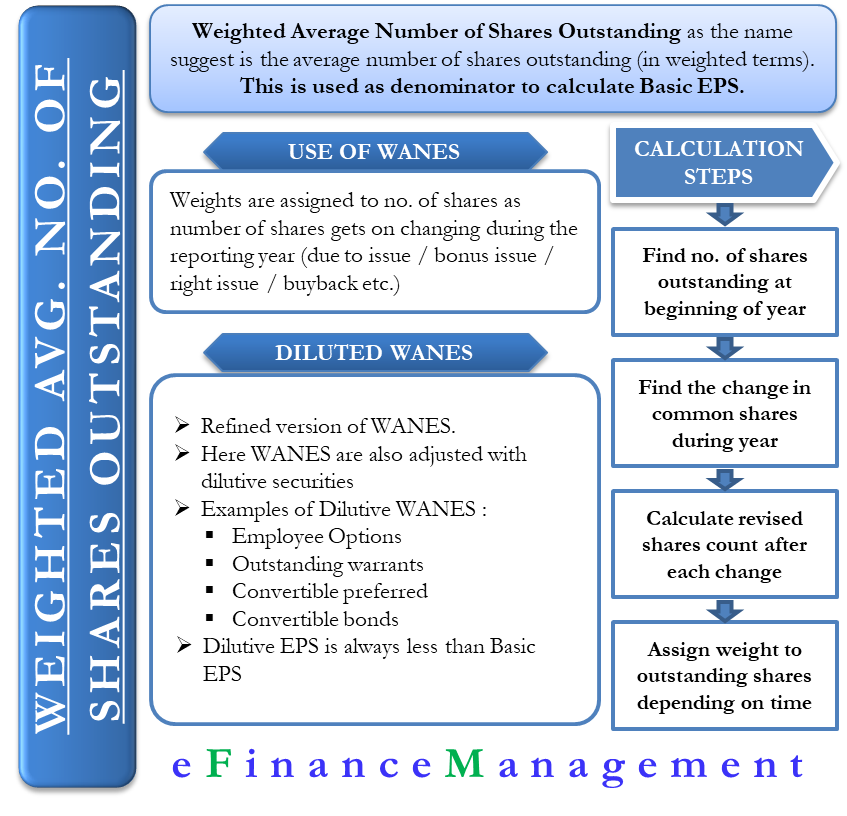

The primary reason for assigning weights to the shares is because the funds that the company gets from the issue of new shares are only available for part of the year. Therefore, a company does not get the full year to use that fund for productive purposes.

However, in case the company issues new shares due to a share split or bonus issue, the treatment is different. In such a case, the new shares are given away for free. Thus, they get the same treatment as they had been in issue for the entire year.

Steps to Calculate Weighted Average Shares Outstanding

First, find the number of common shares outstanding at the start of the year.

Second, find the change in the common shares during a reporting year.

Third, calculate the updated common share count after each change. A point to note is that the issue of new shares raises the common share count, while a buyback or repurchase lowers the common share count.

Fourth, now assign a weight to the outstanding shares depending on the time of the year between the first change and the next, and then so on. To calculate the weight, we could use days outstanding (/ 365) or months outstanding (/ 12).

Also Read: What is a Good EPS?

Let’s understand the calculation with the help of an example.

Example

A company with the name XTZ Corporation has 500,000 shares towards the start of the fiscal year, April 1, 2016. In the second quarter, debenture holders of the company convert their holdings into equity shares totaling 100,000 shares. At the beginning of the fourth quarter, the company buys back 50,000 shares with surplus cash.

Now, at the end of the year, total shares outstanding will be 500,000 + 100,000 – 50,000 = 550,000. Calculating EPS on this figure might not give us a true understanding of the company’s financial health. To get an accurate picture, we should determine the weighted average of shares outstanding and then calculate earnings per share.

| Date | Shares O/S | Weights | Weighted Average |

| 01/04/2016 | 500,000 | 0.25 | 125,000 |

| 01/07/2016 | 600,000 | 0.5 | 300,000 |

| 01/10/2016 | 550,000 | 0.25 | 137,500 |

| TOTAL | 562,500 |

For the calculation of EPS, the companies should use 562,500. In the above table, weights are assigned on the basis of time proportion the share outstanding figure remained the same. For instance, the opening figure of 500,000 remains unchanged for three months, it means 25% of the total time of the year.

Diluted Weighted Average Shares

Diluted weighted average share is a more refined version of weighted average shares outstanding. In this, the weighted average number of shares is adjusted by the number of shares resulting from converting any dilutive securities to common shares. Thereafter, it is adjusted again for any shares that could be purchased in the open market from the proceeds of the conversion.

Some of the dilutive securities to look for are:

- Employee Options

- Outstanding warrants

- Convertible preferred

- Convertible bonds

One uses “Weighted Average Shares Outstanding” to calculate Basic EPS. On the other hand, for the dilutive EPS, the denominator takes into account all the possible conversion that may take place. A point to note is that Diluted EPS is always less than the Basic EPS as the denominator in the former is higher. Usually, companies with options, convertible bonds and more, reveal both basic and diluted EPS. If the difference between the basic and diluted EPS is bigger, then investors should study the possible increase in the outstanding shares in the future.

It is worth noting that the treatment of dilution of different types of securities is not the same. For instance, even though the proceeds from warrants and options are used by the organizations to repurchase the common stock, convertible preferred would affect the preferred dividends paid, and this, in turn, would affect the net income.

This helps the financial analysts to study the impact of the potential dilution in the future. Financial analysts do the forward evaluation by calculating forward PE, P/BV, dividend payout ratio and so on. Therefore, knowing how the dilution will change the equation becomes important.