Capital budgeting is perhaps the most important decision for a financial manager. Since it involves buying expensive assets for long-term use, capital budgeting decisions may have a role to play in the company’s future success. The right decisions made by the process of capital budgeting will help the manager and the company to maximize the shareholder value, which is the primary goal of any business.

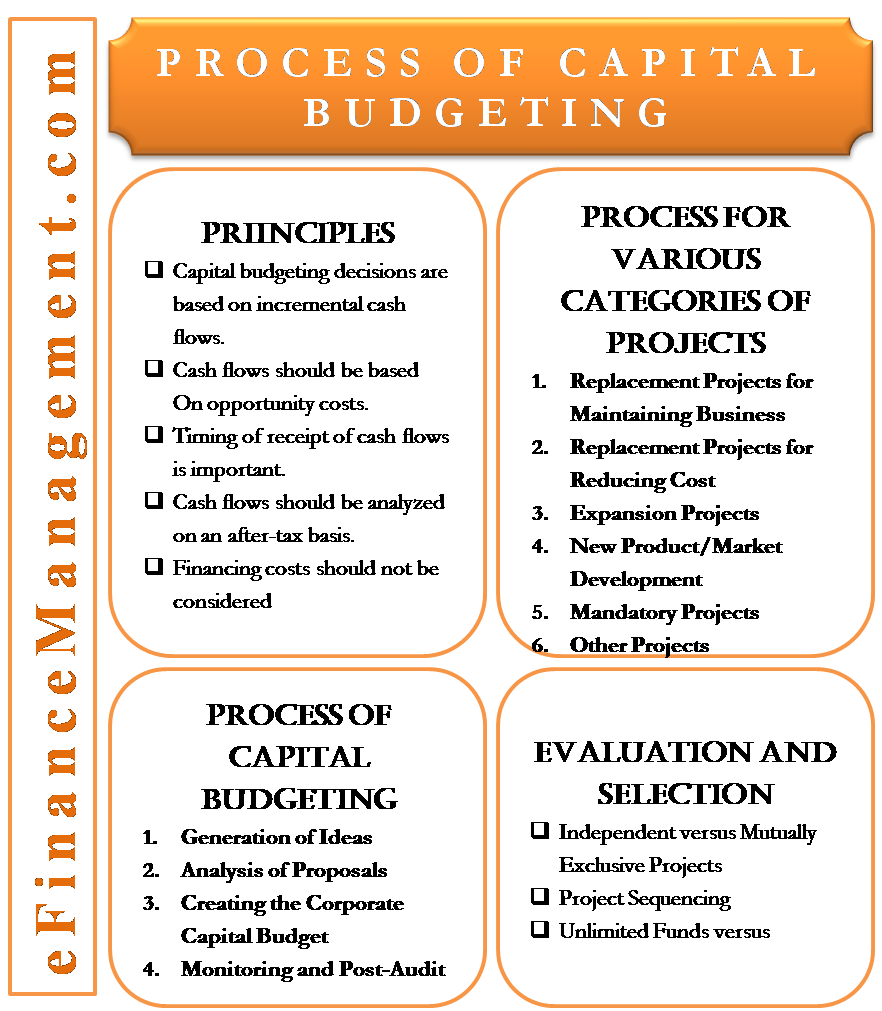

Capital Budgeting Process

The capital budgeting process includes identifying and then evaluating capital projects for the company. Capital projects are the ones where the company receives the cash flows over long periods of time, which exceeds a year. Almost all the corporate decisions that impact the company’s future earnings can be studied using this framework. This process can be used to examine various decisions like buying a new machine, expanding operations at another geographic location, moving the headquarters, or even replacing the old asset. These decisions have the power to impact the future success of the company. This is the reason why the capital budgeting process is an invaluable part of any company.

The capital budgeting process has the following four steps:

Generation of Ideas

The generation of good quality project ideas is the most important capital budgeting step. Ideas can be generated from a number of sources like senior management, employees, and functional divisions or even from outside the company.

Analysis of Proposals

The basis of accepting or rejecting a capital project is the project’s expected cash flows in the future. Hence, all the project proposals are analyzed by forecasting their cash flows to determine the expected profitability of each project.

Also Read: Importance of Capital Budgeting

Creating the Corporate Capital Budget

Once the profitable projects are shortlisted, they are prioritized according to the available company resources, the timing of the project’s cash flows, and the company’s overall strategic plan. Some projects may be attractive on their own but may not be a fit for the overall strategy.

Monitoring and Post-Audit

A follow up on all decisions is equally important in the capital budgeting process. The analysts compare the actual results of the projects to the projected ones. And the project managers are responsible if the projections match or do not match the actual results. A post-audit to recognize systematic errors in the cash flow forecasting process is also essential as the capital budgeting process is as good as the inputs’ estimates into the forecasting model.

Capital Budgeting Process for various Categories of Projects:

Capital budgeting projects are categorized as follows:

Replacement Projects for Maintaining Business

Such projects are implemented without any detailed analysis. The only issues pertaining to these types of projects are first whether the existing operations continue and, if they do so, whether the existing processes should be changed or maintained as such.

Replacement Projects for Reducing Cost

Such projects are implemented after a detailed analysis because these determine whether the obsolete but still operational equipment should be replaced.

Expansion Projects

Such projects require a very detailed analysis. These projects are undertaken to expand the business operations. And involve a process of making complex decisions as they are based on an accurate forecast of future demand.

New Product/Market Development

Such projects also consist of making complex decisions that require a detailed analysis as there is a great amount of uncertainty involved.

Mandatory Projects

Such projects are required by an insurance company or a governmental agency and often involve environmental or safety-related concerns. These projects will not generate any revenue, but they surely accompany new projects started by the company to produce revenue.

Other Projects

Some projects that cannot be easily analyzed fall into this category. A pet project involving senior management or a high-risk project that cannot be analyzed easily with typical assessment methods are included in such projects.

Read more about Types of Real Options in Capital Budgeting.

Principles of Capital Budgeting Process

The capital budgeting process is based on the following five principles:

- All the capital budgeting decisions are based on the project’s incremental cash flows and not on the accounting income generated by it. Sunk costs are not considered in the analysis. The external factors that can impact the project’s implementation and eventually the company’s cash flow have to be fully considered while preparing/planning the capital budgeting.

- All the cash flows of the project should be based on the opportunity costs. Opportunity costs account for the money that the company will lose by implementing the project under analysis. These are the existing cash flows already generated by an asset of the company that will be forgone if the project under analysis is undertaken.

- The timing of the receipt of the cash flows is important. As per the time value of money concept, the project’s cash flows received earlier have more value than the cash flows received later.

- All the cash flows from the project should be analyzed on an after-tax basis. The company should evaluate only those cash flows that they will keep, not those that they will pay to the government.

- The financing costs pertaining to a project should not be considered while evaluating incremental cash flows. These costs are already reflected in the project’s required rate of return.

Evaluation and Selection of Capital Projects

All the capital projects are thoroughly analyzed on the basis of their cash flows forecast. However, the evaluation and selection of capital projects are also affected by the following categories:

Independent versus Mutually Exclusive Projects

Independent projects are unrelated to each other and are thus, evaluated independently based on the individual profitability of each project. For example, assume both projects X and Y are independent and profitable, then there is a probability that the company will accept both projects. However, mutually exclusive implies that only one of the projects from a set will be accepted. And that there is a competition among the projects themselves. For example, if projects X and Y are mutually exclusive, the company cannot select both but only either X or Y. Crossover rate is an important tool to decide on the better one among the mutually exclusive projects.

Project Sequencing

Some projects are implemented in a certain sequence or order. So that the investment in one project today generates the opportunity to invest in other future projects. If a project implemented today is profitable, it will create the option to invest in the second project next year. However, if the same current project becomes unprofitable, the company won’t invest in the next project.

Unlimited Funds versus Capital Rationing

If a company has unlimited funds, it can execute all the projects where expected returns are in excess of the cost of capital. However, many companies have capital constraints and have to use capital rationing. If the company’s profitable projects exceed the funds available for investing, the company resorts to rationing or prioritizing capital expenditures. This helps the company to achieve the goal of maximum increase in the shareholders’ value given the available capital.

Unequal Lives

Sometimes, a company may not be able to decide on a project amongst the various alternatives available due to the unequal lives of projects. Say, for example, a company is evaluating 4 projects – A, B, C, and D. The lives of these four projects are 4, 7, 3, and 5 years respectively. Hence, it is not easy to compare such projects even if all of them have a positive NPV. Such decisions are taken with the help of the equivalent annual cost approach.

Conclusion

The capital budgeting process is an amalgamation of very complex decisions and their assessments. A single project can easily harm or enable the company to a large extent. Hence, an analyst needs to understand all the steps involved and the basic principles of the capital budgeting process.

More thanks for these.

I’m gonna say to my little brother, that he should also pay a quick visit this blog on regular basis to get updated from most up-to-date reports.

There is certainly a great deal to know about this issue. I really like all of the points you have made.