What is Political Risk?

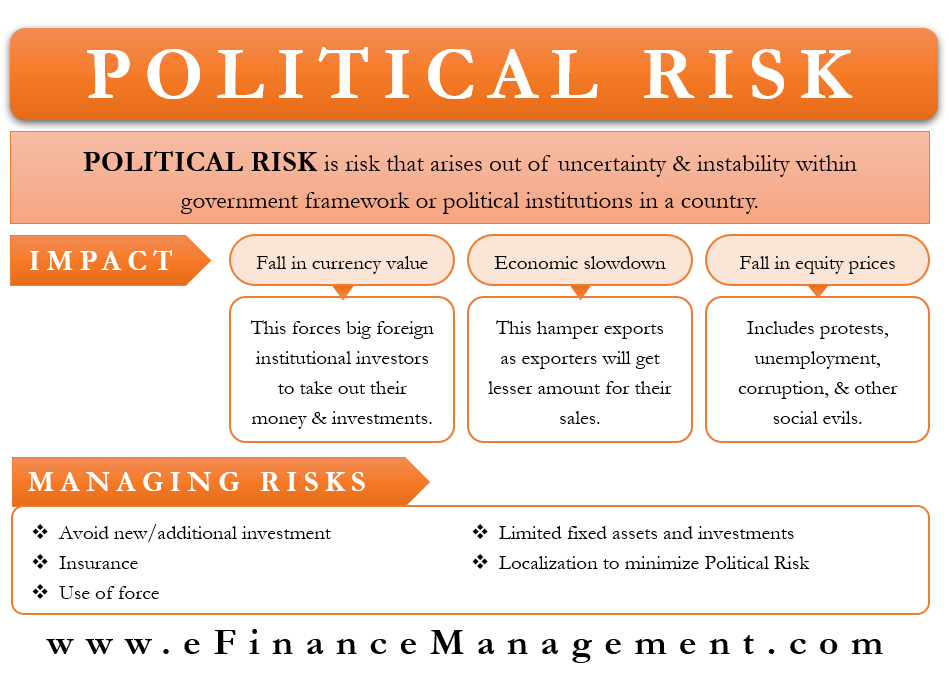

Political risk is the risk that arises out of uncertainty and instability within the government framework or political institutions in a country. It is a type of financial risk. Such a situation can lead to a change in policies and regulations that govern the businesses in the country. It can lead to chaos, uncertainty, and negative returns for businesses. Also, it may lead to closures of businesses and an exodus of foreign investment from the country. Hence, it is critical for a country to provide a stable political environment to retain and attract more business to the economy.

Countries with a strong opposition party usually will have a higher political risk. On the other hand, a weak opposition will usually have no or little say in policy and regulation formulation. Hence, these rules have little chance of being changed or scrapped in a sudden manner out of political pressure. A strong opposition will always keep the government on edge. It can create an environment of political uncertainty. Because it will have the power to force policymakers to change and bend existing policies and rules.

What Impact does Political Risk have?

Fall in Equity Prices

Political instability is one of the major reasons for the fall in equity prices and stock market crashes in any country. It can force big foreign institutional investors to take out their money and investments. This is so because of fear of political turmoil and destabilization of the economy. Also, such an environment is detrimental to foreign direct investment. FDI is essential to boost the economy and the equity markets because a higher inflow of FDI is a symbol of trust and confidence in the economy of a country.

Proper diversification is essential to combat the effect of the political risk on investments and the overall portfolio. International investors can invest in a number of countries. They can keep a check on their losses in case of political turbulence in any country by gains from investments in other countries. Also, they can use trading techniques such as “options” to mitigate losses in case of sudden political turbulence.

Also Read: Market Risk

Fall in Currency Value

A situation of aggravated political risk can result in a crash in markets and a fall in the value of a country’s currency in the international market. This can further hamper exports as exporters will get a lesser amount for their sales due to lower currency value. All this will result in the slower economic growth of the country and dampen the spirits of the businesses.

Economic Slowdown

A situation of political unrest in a country results in widespread protests, unemployment, corruption, and other social evils. This may result in a widening gap between the rich and the poor and unstable operating conditions for the businesses. All this will cause a slowing down of the economy and affect loan repayments by the country in the international market. This results in a spiral-like situation with a falling growth rate, falling production and sales, falling foreign investment and equity markets, and falling exports, leading to deflation and even recession.

Investors should look out for shifts in political power or rising new political parties that can impact the political scene in a country. This will help them to prepare in advance for changes in the political environment in a country and invest wisely. Also, they can shift their investments to other avenues or countries according to the upcoming situation.

How can we Avoid or Manage Political Risk?

Avoid New / Additional Investment

Investors should avoid investing in countries with political turbulence or future political uncertainty. Also, they should pull out their investments slowly from such countries, even if they have to bear little loss. They can shift their investments and production/trading facilities to safer and politically stable countries.

Localization to Minimize Political Risk

A key measure to fight a political disturbance situation is to go “local” with what one manufactures or trades. The products should adhere to the tastes, beliefs, and customs in which the company operates. For example, a food company should totally avoid using beef in its products if it is investing and serving in a country like India. It is so because it will hurt local sentiments and feelings of Indians and result in complete failure of the venture. Also, adaptation to local trends and tastes will help avoid any disruptive acts against the company, its employees, and its assets in case of political unrest and violence.

Also, foreign companies should look for local investors and the government for finance. Partnering with locals will ensure their full cooperation and protective custody in case of political turmoil in the country.

Use of Force

A company investing in a country may often begin to have control over essential raw materials or finished goods supply. Also, it may control some essential technology without which the host country may fail to operate or face major losses. Hence, investors should try to gain such a commanding position that may force the government and authorities to take care of it in case of a political disturbance scenario.

Limited Fixed Assets and Investments

Investors can go for minimum fixed asset investments in the case of countries with probable political risk scenarios. They can lease manufacturing facilities to limit their local exposure. Also, they can partner with local manufacturers, suppliers, and service providers rather than going alone for any activity. This will help minimize their exposure to foreign countries in situations of political disturbance.

Insurance

Investors also have an option to get insurance against political risk in a country. Such insurance can cover risks arising from restrictions on foreign currency conversion and its repatriation or from violence or arson arising out of local political conflicts and turmoil. Also, it may protect the investors from extreme situations such as war arising out of political collapse or terrorist activities due to weak governments or policy failures.