What is Operational Risk?

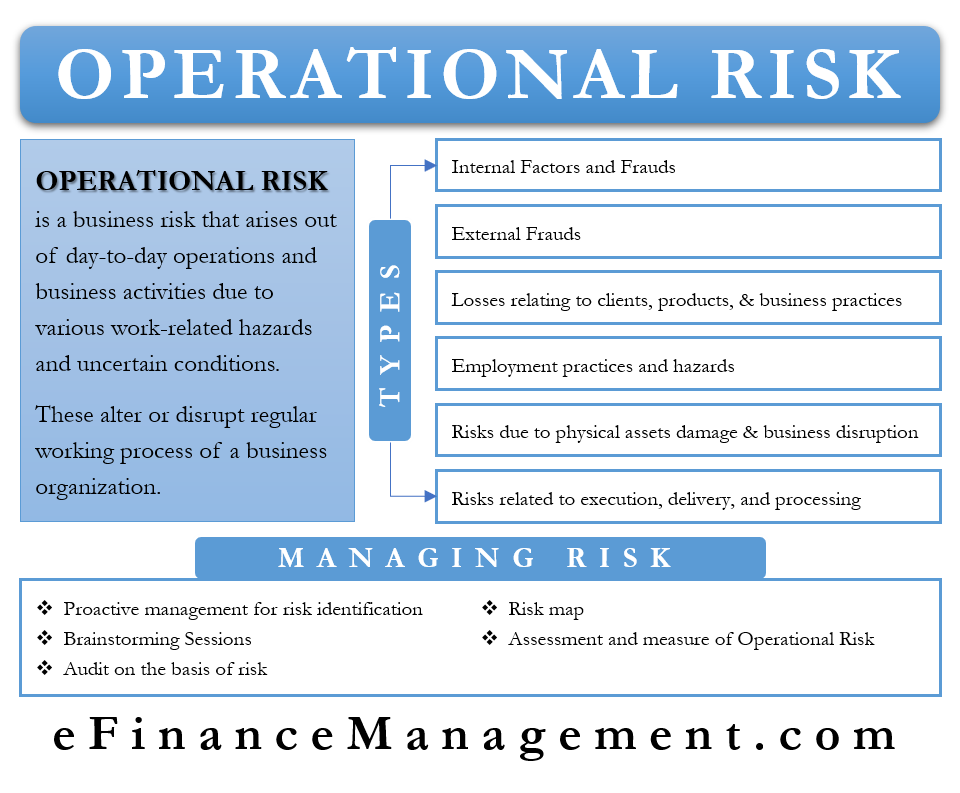

Operational Risk is a business risk that arises out of day-to-day operations and business activities due to various work-related hazards and uncertain conditions. Such risk may arise from systems, structure, personnel, processes, and products. It is beyond the control of any organization and occurs due to internal failures, breakdowns, or even mismanagement. It does not happen due to external events or factors such as economic turbulence, political uncertainty, etc. Therefore, it is a type of “unsystematic risk” and is unique to a particular company or industry.

Operational risk is any risk that may alter or disrupt the regular working process of a business organization. Also, there is a risk of financial and reputational loss to the organization.

Types of Operational Risk

Internal Factors and Frauds

Several internal factors and activities may lead to internal fraud within the organization. These acts are done with the intention of fraud, misappropriate property, etc., and involve an internal party. There may be activities happening within the organization with an intention to hide a transaction to siphon off funds. Also, there may be thefts and frauds within the organization like misappropriation of assets, smuggling, bribes, insider trading, etc.

External Frauds

Third parties commit external frauds intending to defraud or misappropriate property. Such acts may cause loss to the organization. Hence, they are a risk. These acts include thefts, forgery, hacking, etc.

Losses Relating to Clients, Products, and Practices of Business

Such risks comprise losses resulting from unintentional non-fulfillment of orders and professional obligations. This category includes improper business and market practices like market manipulation, unlawful activity, product defects and flaws, account churning, breach of privacy, etc.

Employment Practices and Hazards

An organization faces risks with regard to activities that are inconsistent with health, safety, and labor laws. This may result in losses with injury claims, strikes, blockages, etc.

Risks due to Damage to Physical Assets and Business Disruption

A business faces a risk of damages to its physical assets from natural disasters and calamities, terrorism and vandalism, etc. Also, there may be business disruptions due to damages to software or hardware, power failures, etc.

Risks related to Execution, Delivery, and Processing

There may be operational risks arising out of a failure in the processing of transactions or from processes and procedures going wrong. Such risks comprise miscommunication, failure in delivery, failure in statutory reporting, missing legal documents, disputes with vendors, etc.

Also Read: Legal Risks

How to Manage Operational Risk?

Proactive Management for Risk Identification

The management should be proactive so as to correctly recognize, predict, and prepare in advance for such operational risks and hazards. Proper streamlining of processes has to be done. There should be no friction between them and the departments looking after them. Also, the management’s proactive attitude will result in better quality products, timely deliveries and help to improve the goodwill and brand image of the firm.

Brainstorming Sessions

A common method to identify risk is to conduct the Brainstorming sessions”. A proper flow of ideas from all management levels can help tackle such risks.

Audit on the Basis of Risk

It is an effective tool to check and verify the effectiveness of the organization’s framework for risk management. Identification of any loopholes and shortcomings can help in their removal and cure.

Risk Map

A Risk map can also help identify the probability of occurrence of an event. It can assess the damage the event can cause in the organization on such occurrence. Every probable event can then be put into a risk category. Such categories can be helpful in case of future occurrences of these events. The management will be ready beforehand according to the severity of the risk. Also, the identification of key risk indicators should be made. This can decrease the probability of occurrence of any unfortunate event.

Proper evaluation of how different departments, processes, people, systems, and structures that are not internal to the organization depends on each other needs to be done continuously. Management of these dependencies should be done to make them fail-proof. This will remove friction between all the elements and ensure the minimization of operational risk.

Assessment and Measure of Operational Risk

Proper assessment and measurement of risk ensure that they get due priority according to their significance. A measure of risk can be done by making an impact and likelihood matrix. This will help to rate overall risk. The matrix can divide the likelihood of occurrence of a risk element into five categories. The categories are negligible, rare, unlikely, possible, and probable.

Similarly, the impact that the event will have on the organization can be insignificant, minor, moderate, significant, and catastrophic. Plotting of the event on this matrix is then done. The importance of an event from the risk point of view can be successfully known.

Also, risk assessment can be done by its frequency of occurrence, how recent it was, how the management perceives the risk, and how they deal with it.

Data collection is a significant step that pertains to the losses happening in the organization. It can help to make sure the same mistakes do not happen again. People facing problems fill out forms that are fed into a database. Such databases turn very valuable with every passing year. They help the management to deal with situations in case of their re-occurrence. Many times, sample data from other organizations can also be very useful. It can be fed to the existing database to prepare the company for unforeseen situations.

Approaches to Risk Measurement

Statistical Approaches

“Loss distribution approach” is the most common statistical method to measure risks. A curve is drawn that depicts how frequently the loss event occurs in the organization. Another curve is drawn that depicts how severe these risks and losses are. The approach then uses simulation models to draw an aggregate curve of distribution of loss over the given time period.

Analysis of Scenarios

A survey can be done on experts from different business lines and those of risk management. The survey tells how probable operational incidents are and their costs of treatment. This helps assess the impact an event may have on the organization and its severity.

Scorecard Method

Risk indicators are the basis of this method. It does not depend upon those events that have already taken place. An assessment grid is made for each risk category on the basis of both quantitative and qualitative indicators such as turnover, number of operation cycles, etc. Calculation of the amount of capital the organization will require is done that can cover the operational risk. Calculation of a “score” is done for every business line according to the operational risk. Allocation of capital is then done for each business line.

Control of Operational Risk

The control function comes after the assessment and measurement of the risk factors. The management then has to mitigate these risks to the organization. It should first determine what level of risk it is ready to take and accept. Then it should act to bring the risks the business faces back to acceptable levels.

The management may revise business processes and policies or create altogether new processes and functions. It should decide on the measures that can mitigate and reduce risks. It can accept the risks and continue with its operations, share or transfer the risk, reduce it, or finally avoid it. However, these decisions depend upon the amount of capital the management is willing to spend on them.

Insurance is an effective way to transfer risk to the insurance company and thus control it. It applies to various operational risks such as damages to plants, buildings, etc. The senior management should be proactive and clearly identifiable. It should lead to situations of risk and management. A solid framework for risk management should be in place. It should allow for repeat and transparent processes.

A proper communication channel is a must with all the staff in the organization. It ensures all the functions take place seamlessly. Also, risk management should be in alignment with the organization’s goals and objectives.

good