What is the Market Value of Equity?

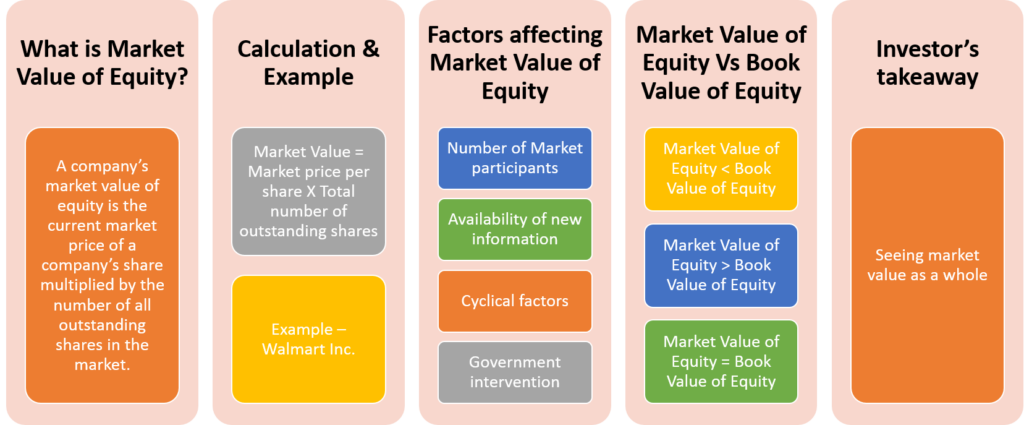

A company’s market value of equity is the current market price of a company’s share multiplied by the number of all outstanding shares in the market. The market value of equity is also known as market capitalization.

The market value is different from the book value of the shares. Book value of equity includes value or equity share capital plus reserves and surplus less loss, if any. A situation where the market value of equity is more than its book value is most preferable. The majority of the well-to-do listed companies have market prices of their shares more than their book value. It determines that the company is in the growing stage and has a very good scope of growth in the future. At the same time, a market value less than the book value is not usual. It means the market has no interest in investing in the shares of such a company. And, a market value equal to the book value means the company does not command the premium vis-a-vis its book value due to various factors.

Formula

For calculating the market value of equity, you will require the following two variables:

- Market price per share

- Total number of outstanding shares

The formula to calculate it is:

Market Value of Equity = Market Price per Share * Total Number of Outstanding Equity Shares

Example

Let us take an example to understand the calculation of the market value of equity.

Assume that a company has an authorized capital of 50,000 shares of $15 each. Out of these, it has issued 35,000 shares @ $20 per share. The current market price of one share is $57.9. Therefore, the market value of equity or market capitalization is equal to:

Market Capitalization = 35,000 * 57.9 = $2,026,500

You can also use our Market Value of Equity Calculator

Factors affecting Market Value of Equity

The market value of equity is extremely volatile as it is affected by the market price of a share. There are various factors that affect the market value of equity as follows:

Also Read: Market Value of Equity Calculator

Number of Market Participants

The larger the number of traders, investors, and analysts who participate and follow the equity market, the more volatile and efficient a market is. In the long term, these participants push the market price of the equity to reflect its actual value and thus bring market value closer to the intrinsic value.

Availability of New Information

When new information such as the next quarter’s financial results of the company, the company’s expansion plans, etc., is available to the market, it affects the price of a share of the company, thereby affecting the company’s market value. For example, the Market Value of Apple Inc. is usually higher after the release of its new iPhones.

Cyclical Factors

Like businesses, equity markets also go through cycles of boom & recession. During the recession, the market value of equity is usually low, whereas, during bullish sentiment, the market value is generally high.

Government Intervention

Government interventions extremely affect the market values of the companies. For example, some countries prevent foreigners from trading in their markets. The market value of companies in such closed markets will not be as volatile as the market value of the ones in open markets.

Also Read: Book Value of Equity

Market Value of Equity Vs. Book Value of Equity

The market value of equity is very different from the book value of equity. Book Value of Equity of any company is calculated from its financial statements, whereas its market value of equity is calculated from the market price of each share.

To be precise-

Book Value of Equity = Total Assets – Total Liabilities

Market Value of Equity = Market price per share X Total number of outstanding shares

In practical terms, Market Value reflects the theoretical cost of buying all company shares. This doesn’t necessarily mean that the company will be sold at the market value during a takeover or a merger. Thus we can say that market value or market capitalization is a measure of the company’s size, whereas book value is a measure of the accounting value of the company.

Market Value of Equity less than Book Value of Equity

When the market value of equity is less than book value, value investors will interpret it as an opportunity to invest. This is like a sure-shot gain situation.

There is only one situation where the MV less than BV is justified. This situation could be fraudulent accounting and inflated assets figures on the balance sheet. For example, high-value machinery is already obsolete in terms of its technology and has not been written off. The value of this machine should be zero in place of, say, $250 Million. This will keep the book value on the higher side, but this value will not be realized if the business’s assets are sold at this time. Effectively, the company has not followed the accounting policies.

Market Value of Equity greater than Book Value of Equity

Conversely, when the market value of equity is more than book value, it implies a strong financial position for the company. It shows that investors believe in the strong growth prospects of the company. This helps a company in obtaining additional capital at favorable prices. It cannot much speak of the under or overvaluation of the company till it is not seen with more metrics like industry averages of Market to Book Ratio, P/E Ratio, etc.

Market Value of Equity equal to Book Value of Equity

First of all, it is an imaginary situation. If it still exists for a company, there are no future prospects for the company. It is a company that may have shut its business, and the book value of assets and liabilities are no different than the current market realizable value.

Per Share Market Price vs. Market Value

At times, the term market value is interchangeably used for per share market price also. Many small investors get obsessed with the per-share price of a stock. It is easy to understand why this happens. For instance, when we buy a slice of cake, it is based on the price of the slice. We might not think of calculating how much we are paying for the entire cake. We start comparing slices of one cake with another without looking at their different weights and the per kg value of each cake. That may be OK with cakes but not with equity shares.

The best example to explain this is to compare the market value and the market price of Visa & Master Card.

Market Value of Master Card as on December 2017:

US$ 179.47 a share price X 1040 million shares = US$ 186.65 billion

Market Value of Visa as on December 2017:

US$ 118.94 a share price X 2353 million shares = US$ 279.88 billion

Comparing Visa & Master Card by price per share, we might feel that at almost US$ 180 per share, Master Card is a bigger company than Visa at US$ 119 per share. But when we compare the market value of equity, it is clear that Visa is a bigger company. Visa is bigger than Master Card in terms of its market capitalization. It’s possible that Master Card may be bigger in terms of its brand name, no. of subscribers, etc.

is there a between market cap and equity value?

Does market price of an index include minority interest value.?

If we need a like for comparison between market cap and equity value, do we need to add the minority share to equity value?