Intrinsic Value Definition

Intrinsic value, in general, is defined as the fair or inherent value of any asset, whether real or financial, company, its stock, derivatives like options, etc. This term is most prominent in defining the value of a company’s stock. Only God may know the exact intrinsic value of any company because there are innumerable quantitative and qualitative factors that affect the value of a company or its stock. Qualitative factors may include all the information like sales, earnings, capital, etc., available in financial statements and reports, customer base, orders on hand, and whatnot. Qualitative factors could be past track record, goodwill, branding, management quality, intellectual capital, etc.

What is the Intrinsic Value of Stock?

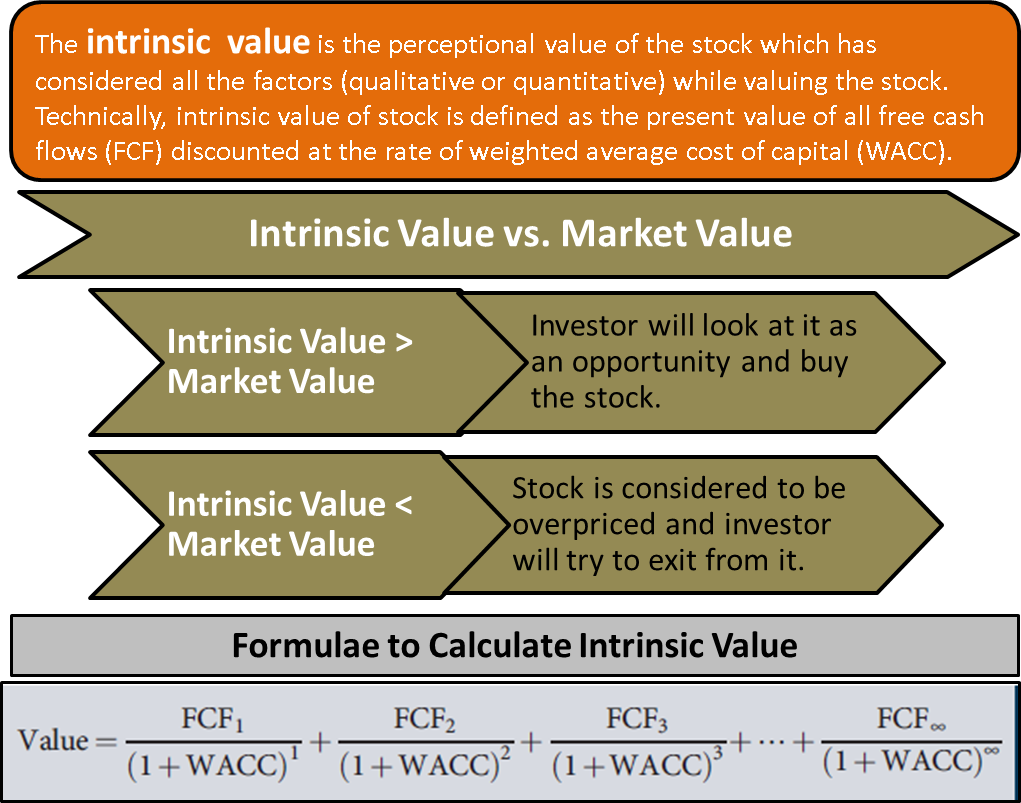

The intrinsic value of a stock is the perceptional value of the stock, which has taken into consideration all the factors, whether qualitative or quantitative, while valuing the stock.

Intrinsic Value vs. Market Value

Different value investors find out the value of a stock based on their own philosophy or list of factors. These investors may have different weightage for different factors. An investor who focuses on quantitative factors will have a different risk perception than one whose focus is on qualitative factors. The intrinsic value of the stock will be different for both of them. Since the market is full of all types of investors, the market determines the price based on demand and supply. Therefore, most often than not, you will find intrinsic value different from the market value of a stock. There are two such possibilities, and we have already ruled out the third.

Intrinsic Value > Market Value

Suppose the intrinsic value of a stock is greater than the market value of the stock. In that case, an intrinsic value investor will look at it as an opportunity and buy the stock at its current market value in expectation of gain. Investor expects gain because they believe that the market will keep correcting itself by incorporating more information as and when public. Therefore the market price tends to move towards the intrinsic value.

Intrinsic Value < Market Value

If the intrinsic value of a stock is less than market value, the stock is considered overpriced, and the investors relying on fundamental analysis will exit from it.

Why is Intrinsic Value different from Market Value?

Following are the reasons why the intrinsic value is different from the market value of a stock:

- An investor may not have all the relevant information for valuing a company’s stock.

- Different investors have different information, and market price may be perceived as the weighted average of all the information of investors.

- A company does not disclose everything in public to protect the information from reaching its competitors. If confidential information is shared, the competitors can take strategic advantage of the information.

- Thoughtful misguidance by the management of the company due to agency problems. Agency problems mean the non-congruence between investors’ goals and the management of a company.

Intrinsic Value vs. Book Value

Book value is an accounting representation of the net asset value of a company, whereas intrinsic value also takes care of the company’s future value.

How to Calculate Intrinsic Value?

There are many methods of calculating an intrinsic value of a stock. These methods demonstrate the close relationship between intrinsic value and the time value of money. The most common methods known are as follows:

Dividend Discount Model

This model believes that the discounted value of all the future dividends is the intrinsic value of a company or its stock. Dividend discount models are of various types based on their level of complexity which is as follows:

Also Read: Enterprise Value

- Single period Model

- Multi-period Model

- Zero Growth Model

- Constant Growth Model

- Two-Stage Growth Model

- H Model

Discounted Cash Flow Model (DCF)

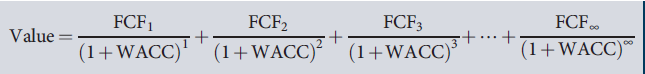

Technically, the intrinsic value of a stock is defined as the present value of all the free cash flows (FCF) discounted at the rate of weighted average cost of capital (WACC).

Intrinsic Value Formula

The formula for calculating the intrinsic value under the DCF method is as follows:

Intrinsic Value Example

Suppose there is a stock whose current market price is $100 and, say, based on a DCF analysis, the intrinsic value of the stock is calculated at $125. There is a good difference of 25% margin between the two prices, and you can buy this stock now and wait for its market value to move towards its intrinsic value.

Intrinsic Value Philosophy and Ethics

The philosophy of intrinsic value believes that ‘intrinsic value maximization’ as a business goal is good for society. We know that there are both good and bad means of achieving anything. If the maximization is through malpractices like fraud, monopoly establishment, violation of the law and environmental standards, etc., it is not good for society. Let’s see some points to understand how it is good:

- Stocks holders or investors are also part of society.

- There are visible consumer benefits because no company can achieve its goal of intrinsic value without delighting its customers well.

- The employee gets long-term and sustainable benefits with such companies. It helps an economy in generating more employment.

- Suppliers and all other stakeholders benefit from profitable companies and sustainable businesses.