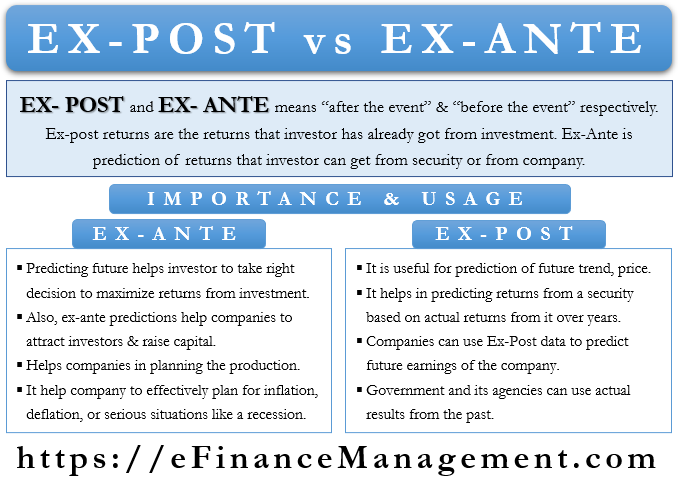

Ex- Post and Ex- Ante is terms of Latin origin that mean “after the event” and “before the event,” respectively. In the field of finance, these terminologies depict the returns from an investment or any other economic activity.

Ex-Post: Understanding the Term

Ex-post returns are the returns that an investor has already got from an investment. In other words, it is the actual or historical return from security.

Ex-Ante: Understanding the Term

Ex-Ante is a prediction of the returns that an investor can get from a security or from a company. In other words, it is a futuristic prediction. And the prediction can also be with regard to the future performance of a business, security, or policymaking. However, all such Ex-Ante predictions have an element of uncertainty in it. Because one cannot be certain of the returns from a particular security or investment or about future performance, a comparison of Ex-Ante prediction can be made with the actual results. This will help us to find out the accuracy or deviation from the prediction.

What is the Use and Importance of Ex-Ante?

For Investor

Ex-Ante is a prediction and is useful for an investor, a company, the various economic sectors, and the overall economy as a whole. An investor buys a security on the basis of Ex-Ante predictions of analysts, news agencies and portals, trade reports, or maybe of the investor himself. This helps him to make the right decision to maximize his returns from investment.

Also Read: Financial Forecasting Techniques

For Corporates

Similarly, a company makes a number of Ex-Ante predictions on its performance and financial results, market conditions, demand scenario amount receivables and payables, interest rates, and the performance of the economy. All these predictions help it to attract investors and raise capital. It also helps it to effectively plan what and how much to produce according to the probable demand scenario. It can also calculate its cost of capital as per the future interest rates and cash-flow prediction. Predictions of the future economic scenario can help it to effectively plan in advance for inflation, deflation, or serious situations like a recession.

All top-level executives, whether in the government or in the corporate, in charge of different sectors of the economy such as agriculture, pharmaceuticals, industry, etc., look for Ex-Ante predictions. It is to determine their future course of action considering the predictions. The Central Bank of a country makes a number of Ex-Ante predictions with regards to interest rates, money supply, Gross Domestic Product, etc. These predictions are the basis for critical policy formulation by the Central bank and the government of that country.

What is the Use and Importance of Ex-Post?

Ex-Post is the opposite of the term Ex-Ante. It means after the occurrence of an event. Hence, the term is important for those who rely upon actual or historical results of security for further decision-making. This information can be of use to individual investors, analysts, investment companies, mutual funds, corporations, and the government and its agencies.

Investors and analysts can use Ex-Post data for the prediction of future trends, prices, etc. They can predict the returns from a security on the basis of actual returns from it over the years. Investment companies can create prediction models for performance and returns on the basis of Ex-Post data. Companies can use Ex-Post data to predict the future earnings of the company. Similarly, the government and its agencies can use actual results from the past. It can help them correctly predict what to expect in the economy. Ex-Post data is critical for policy formulation and implementation. This data is more accurate and hence, very important. Its basis is actual and historical occurrences rather than mere predictions.

Also Read: Forecasting Models

Comparison and Variation

A comparison of the value of an asset at the beginning of the year or matching period is done with its current value. This helps to assess the appreciation in the price of the security. Gauging any substantial increase or decrease can easily be done from this exercise. We also consider the income that the asset or security yields over the period under consideration. A comparison of expected returns on the basis of Ex-Post data is made with the earlier estimates and predictions or the Ex-Ante data. The prediction models in place are working fine if there is little variation in the results obtained. If the variation is large, the prediction models and the risk-assessment methods have to be re-assessed. Accordingly, changes will have to be made.

Summary

Ex-Post data is important for planning, implementation, and, more importantly, the control function of the management. It is an effective tool for variance analysis. It helps take corrective measures to bring down the variations between the predictions given by Ex-Ante data and the actual results.

Quiz on Ex-Post and Ex-Ante