What is Equity Risk Premium?

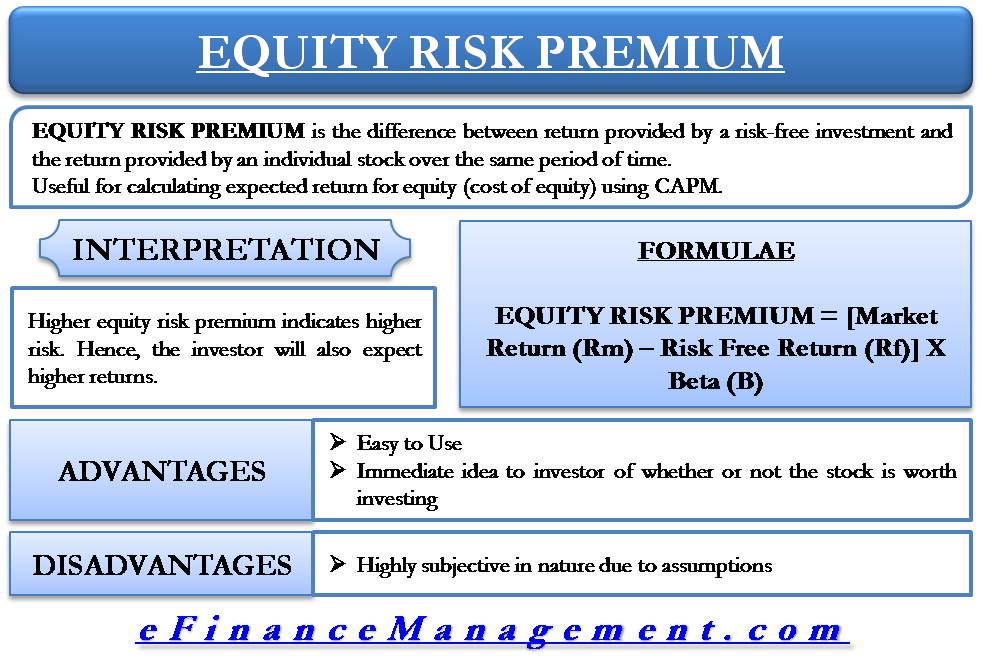

Investing in equity is not risk-free. The risk is not only associated with returns, but the capital is also not guaranteed. So, to compensate for the risk, the investor must get an extra/excess return. It is actually the difference between the return provided by a risk-free investment and the return provided by individual stock over the same period of time. This difference in return is known as the equity risk premium.

Usefulness

It is one of the key elements while calculating expected return from equity (cost of equity) using CAPM. CAPM is used for evaluating the expected rate of return from a stock. It actually helps the investor decide whether his investment in the stock is worth it or not, and does the return commensurate with the risk he is taking?

Calculation

Let’s see how to calculate equity risk premium.

- Take Equity Market expected return. Generally, broader market indices represent the market. So, take the expected return from the broader market index. E.g. in the case of the U.S., S&P500 represents the broader market; in the case of India, the Nifty/Sensex represents the broader market.

- Take return of the risk-free bond, which is a return from a U.S. Treasury bill in the U.S.

- Deduct risk-free return from expected equity return and multiply it by the Beta of stock.

Examples

1. Calculate expected market risk premium if expected return from S&P500= 8%, return from US 10 year T Bill= 3%

Equity Risk Premium= Expected equity Market Return – Risk Free Return = 8% – 3% = 5%

2. Taking the same expected return and return from the US, calculate the equity risk premium and expected return from the stock of Apple if the Beta of the stock is 1.3.

Equity Risk Premium= (Expected equity Market Return – Risk Free Return)*Beta = (8%-3%)*1.3 = 6.5%

Expected Return = Risk Free Return + Risk Premium = 3%+6.5% = 9.5%

So, taking into consideration the risk an investor is taking in Apple, he must get at least a 9.5% return.

3. Taking the same expected return and return from the US, calculate the equity risk premium and expected return from the stock of Berkshire if the Beta of the stock is 1.5.

Also Read: Market Risk Premium

Equity Risk Premium = (Expected equity Market Return – Risk-Free Return)*Beta = (8%-3%)*1.5 = 7.5%

Expected Return = Risk Free Return + Risk Premium = 3%+7.5% =10.5%

Same way, the investor will expect at least a 10.5% return from Berkshire, taking into consideration the risk he faces.

Do Different Equity Stocks have Different Risk Premium?

The answer to the above question is YES. As we have seen in the above example, different stocks carry a different risk premium depending upon the stock volatility in the past. Generally, Large Cap Blue chip stock has a lower equity risk premium than Midcap Stock.

Interpretation

A higher equity risk premium indicates higher risk. Hence, the investor will also expect higher returns.

Benefits

- Easy to use.

- Gives investors an immediate idea of whether or not the stock is worth investing in, as the investor needs to be adequately rewarded against the risk.

Limitations

Equity Risk Premium is highly subjective in nature. As we take assumptions while calculating input, each investor might get a different equity risk premium for the same stock. So, the expectation of the return from the same stock can be different for different investors. E.g., While taking an expected market return, someone might take the Historical return of the market over a period of 3-5 years. In contrast, another investor would use the Dividend Discount model or some other method to calculate equity market return.

Conclusion

Due to its easiness and application in day-to-day investments in real practical life, it is widely used among investors.