Fly High is an airline company. They expect that the prices of jet fuel will rise over a period of three months. So, as the prices of jet fuel will increase, the cost of flying passengers will also rise. They may or may not be able to raise the prices of their tickets or passenger fare with the rise in fuel prices. If they do not increase the passenger fare, their profits from each seat in the airplane they sell will go down. So, what is the option with the airline, and what steps should they take to ensure that their profits do not go down? The answer lies in entering into the cross hedge.

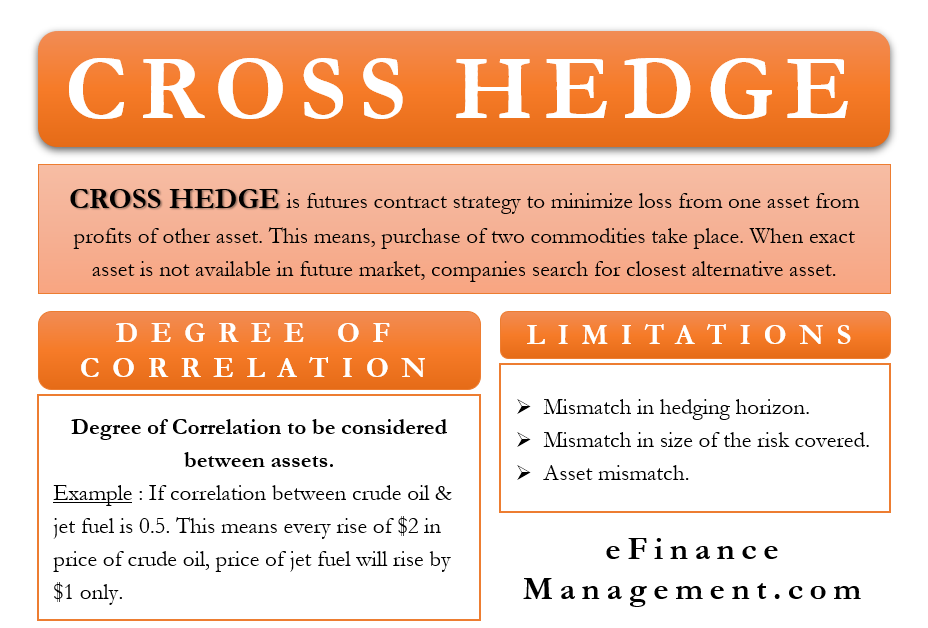

Cross Hedge is a futures contract strategy or a financial strategy to offset or minimize the loss from one asset from the profits of the other asset. In a cross hedge, you purchase two different assets/security/commodities in the futures market with a positive correlation in the movement of their prices. You do this because you consider holding just one of the assets as risky.

What is this Futures Market?

The futures market is a platform where the buyers agree to buy something, and the sellers agree to sell it at a predetermined price and on a specified future date. This kind of contract, in which the price of the item is set on today’s price, but the delivery is to be made on a future date, is called a futures contract.

Positive correlation in the prices of two assets will mean that if the price or value of one of the assets rises, the price of the other will also rise.

Cross Hedge Real World Scenario: 1

So, if the Fly High airlines expect the cost of jet fuel to rise in the future, they can purchase crude oil in the futures market. If the price of jet fuels rises in three months’ time, the price of crude oil, we expect, will also rise (since their prices are positively correlated). Now, fly high has purchased crude oil at today’s low price, and they will get it after three months when the prices will be higher. They can sell that crude oil at that higher price in the future. This way, the risk of profits going down because of the increase in jet fuel price is taken care of. The profits they will make with crude oil trading will compensate for any loss with rising in jet fuel prices. This process is called cross hedging.

Cross Hedge Real World Scenario: 2

Consider the opposite situation. What if a company expects the prices of its asset(s) to go down? Fly high airlines won’t be worried about this as this will bring down their costs. But if you are the owner of a gold mine and you expect the value of your stock of gold (inventory) to go down, you will have a lot to worry about. How do you cover this risk? You can sell that asset or a related asset at today’s price in the futures market.

Suppose you are holding a substantial amount of gold inventory, and you can make profits on them as long as the prices are above $1400 per ounce of gold. Currently, the prices are around $1500 per ounce. But you expect prices to fall below $1300 per ounce and stay there for a long time. How can you cover this risk?

You can sell gold in the futures market at today’s prices and sell all the inventory of gold you hold. But you are not able to find gold futures contracts to cover your risk. So, you enter into a cross hedge by selling platinum in the futures market as prices of gold and platinum are highly correlated. So, you sell that amount of platinum in the futures market, which is roughly equal to the value of your gold inventory. Now, when the gold prices fall below $1400 per ounce, you will make losses. But you will cover the losses by delivering platinum which you now purchase at a low price, but you had sold it at a higher price in the past through a futures contract.

When is Cross Hedge Recommended?

In general, businesses or other entities can cover this risk of a rise or fall in the value of their asset through futures contracts. The need for cross hedging arises when the exact asset is not available in the futures market. So, when the perfect asset is not available for hedging, companies search for the closest alternative asset. The task is to find an asset in the futures market which shows a positive correlation in its price with the asset we already own or will have to purchase.

However, in businesses, as in life, you cannot cover all the risks. There is still a risk that the prices of the two assets may not show that positive correlation in the future. In our example, you know that the prices of gold and platinum will both fall. But it may happen that the prices of platinum start rising while the gold is falling. In that case, you will make losses in gold and an additional loss by purchasing platinum at a higher price.

Degree of Correlation

In cross hedging, we also have to consider the degree of correlation between the two assets. Suppose the correlation between crude oil and jet fuel is 0.5. That means for every rise of $2 in the price of crude oil, the price of jet fuel will rise by $1 only. That means you need to purchase only half the quantity of crude oil to cover the entire quantity of jet fuel.

Problems in Cross Hedging

Cross Hedge is a technique that suffers from some limitations because of the following factors.

- Mismatch in hedging horizon. You expect the prices of gold to remain down in the November-December period. But your futures contract in platinum expires in March next year.

- Mismatch in size of the risk covered. It may happen that you want to cover the prices of all the gold that you will mine in the next year, but you do not get such a big futures contract.

- Asset mismatch. There may not be a good alternative asset for you to engage in a cross hedge. The prices of the assets do not correlate properly with each other. Or worst, they may correlate highly in one period and poorly in another period. In that case, the cross hedge itself becomes risky and is not useful.

it is very educative on portfolio you may need to be hedged.