What is Cash Conversion Cycle?

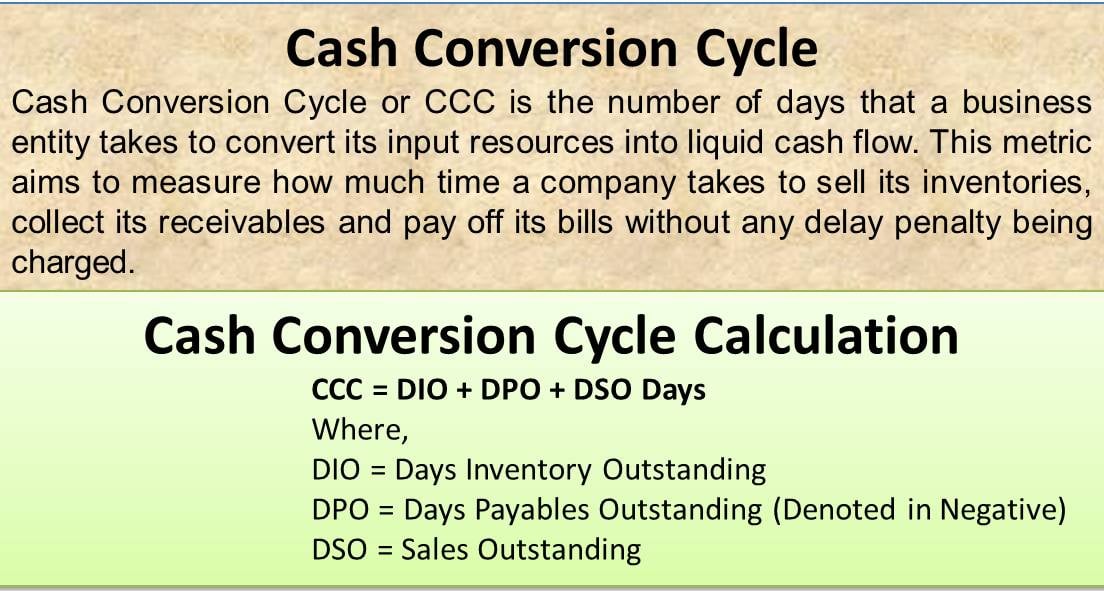

The Cash Conversion Cycle or CCC is the number of days a business entity takes to convert its input resources into liquid cash flow. This metric aims to measure how much time a company takes to sell its inventories, collect its receivables and pay off its bills without any delay penalty being charged. Every dollar that is tied up to the process of production till it is recovered as sales are scrutinized to calculate the cash cycle of an entity. A lower number of days are the most desirable when it comes to Cash Conversion Cycle. It is also known as the operating cycle or working capital cycle.

How to Calculate Cash Conversion Cycle?

The length of a cycle can be measured using the following formula:

CCC = DIO + DPO + DSO Days

Where,

DIO = Days Inventory Outstanding

DPO = Days Payables Outstanding (Denoted in Negative)

DSO = Days Sales Outstanding

Let us see an example of it to understand it further.

Example

Let’s assume a company, XYZ, runs its production cycle for making automobiles. The cars are stored in their warehouse for a period of 12 days. It takes XYZ 17 days to collect the receivables from the sale of each car and 10 days to pay back the credit to its vendors.

Cash Conversion Cycle of XYZ = 13 + (-10) + 17

CCC = 20 days

By the above example, we understand how cash conversion cycle takes into consideration the time taken to manufacture, sell and collect dues for an inventory.

Factors affecting Length of Cash Conversion Cycle

The length of the cash conversion cycle can be influenced by several factors. These factors can vary depending on the nature of the business and its industry.

Also Read: Operating and Cash Operating Cycle

Inventory Management

The efficiency of managing inventory levels plays a significant role in the cash conversion cycle. Holding excessive inventory can extend the cycle by tying up cash, while inadequate inventory levels can lead to stockouts and lost sales.

Accounts Receivable Policies

The time it takes for a company to collect payment from its customers impacts the cash conversion cycle. Lengthy payment terms, slow collections, and high levels of outstanding receivables can increase the cycle duration.

Accounts Payable Policies

The terms and timing of payments to suppliers affect the cash conversion cycle. Companies that delay payments to suppliers can extend the cycle, while prompt payment practices can help reduce it.

Production Efficiency

The speed and efficiency of the production process can impact the cash conversion cycle. Delays or inefficiencies in manufacturing or service delivery can lengthen the cycle by increasing the time it takes to convert inputs into finished products or services.

Also Read: Operating Cycle Calculator

Sales and Demand Patterns

The volume and timing of sales affect the cash conversion cycle. Higher sales volume or faster sales turnover can shorten the cycle, while lower sales or seasonal fluctuations may extend it.

Payment Processing and Cash Management

The efficiency of payment processing and cash management practices can impact the cash conversion cycle. Timely processing of payments, effective cash flow forecasting, and optimizing cash utilization can help reduce the cycle duration.

Supplier Relationships

The terms negotiated with suppliers and the strength of relationships with them can influence the cash conversion cycle. Favorable payment terms and collaborative partnerships can help shorten the cycle.

Industry and Market Factors

Industry-specific characteristics, market dynamics, and competitive pressures can also impact the cash conversion cycle. Industry norms, customer expectations, and market conditions can influence payment terms and inventory turnover rates.

Negative Cash Conversion Cycles

A negative cash conversion cycle refers to a situation where a company’s operating cycle results in a net inflow of cash before paying its suppliers for the resources used in production. In other words, it means that a company receives cash from customers before it needs to pay its suppliers or vendors for the inputs or materials used in the production process.

This occurrence typically happens when a company has favorable payment terms with its customers, allowing it to collect payments quickly, while also having favorable payment terms with its suppliers, giving it more time to pay for the resources it used. As a result, the company can effectively use the time gap between collecting cash from customers and paying suppliers to generate a net positive cash flow.

Industry Benchmarks for Cash Conversion Cycle

Industry benchmarks for the cash conversion cycle can vary depending on the nature of the industry, the business model, and the specific circumstances of a company. However, here are some general benchmarks for certain industries:

- Retail: Retail businesses typically aim for a cash conversion cycle of around 30 to 60 days. This includes the time it takes to purchase inventory, sell it to customers, and collect payment from customers.

- Manufacturing: Manufacturing companies often have longer cash conversion cycles due to the time required for production and inventory management. A typical benchmark for manufacturing can range from 60 to 120 days, depending on the industry and production processes involved.

- Wholesale and Distribution: In the wholesale and distribution sector, the cash conversion cycle can range from 30 to 90 days. This includes the time it takes to purchase goods from suppliers, store them in warehouses, sell to customers, and collect payment.

- Service Industries: Service-based businesses, such as consulting firms or software companies, may have shorter cash conversion cycles compared to manufacturing or retail. A benchmark for service industries can range from 15 to 45 days, as they often have fewer inventory-related processes.

It’s important to note that these benchmarks are approximate ranges and can vary significantly depending on factors such as industry dynamics, business size, product pricing, payment terms, and the efficiency of operational processes. Companies should compare their cash conversion cycle against industry peers and consider their specific circumstances when assessing their performance in managing cash flow and working capital.

The cash conversion cycle has a direct impact on cash flow within a business. It affects the timing and availability of cash throughout the operational cycle. A shorter cash conversion cycle enhances cash flow by accelerating the conversion of resources into cash, reducing the amount of cash tied up in inventory and receivables, and improving the timing of cash inflows and outflows. Efficient management of the cash conversion cycle is vital for maintaining a healthy cash flow position and supporting the financial stability and growth of a business.

Cash Conversion Cycle vs Working Capital Cycle

The cash conversion cycle and the working capital cycle are two related concepts in finance and operations management, but they focus on different aspects of a company’s cash flow and working capital management.

| Basis | Cash Conversion Cycle | Working Capital Cycle |

|---|---|---|

| Purpose | Measures the time it takes to convert input resources into cash flow | Represent overall time it takes to convert current assets into cash |

| Focus | Focuses on the specific activities of selling inventories, collecting receivables, and paying off bills | Encompasses management of all current assets and current liabilities |

| Interpretation | Indicates the efficiency of cash flow and liquidity managemen | Reflects comprehensive management of working capital to support operational needs |

Conclusion

Cash Conversion Cycle analysis is an important metric because we understand the lock-in period of an investment for the purpose of production. A lot can be told by analyzing the CCC of a company. Delays in collecting dues and overproduction can result in long cash cycles. As a firm can only pay its bills through cash and not profits, a long cash cycle can lead to several problems, the most extreme being bankruptcy. The lower the number of days, the more efficient the company is at using its cash resources.