Book Value of Equity Meaning

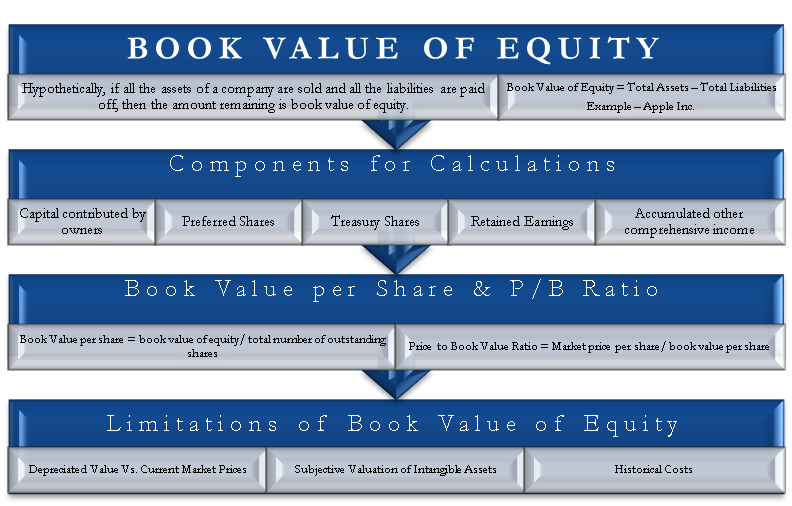

The book value of equity, more widely known as shareholder’s equity, is the amount remaining after all the company assets are sold, and all the liabilities are paid off. In other words, as suggested by the term itself, it is the value of the asset which reflects in the balance sheet of a company or books of a company.

Formula

From this understanding, we can now derive the formula of the book value of equity as follows:

Book Value of Equity = Total Assets – Total Liabilities

Book Value of Equity Calculation

Following are the important components of the formula of Book Value. Let’s understand each component for precise calculations.

Capital Contributed by Owners

This is the amount that owners contribute to the company. This component is commonly known as common stockholder’s equity or common stock of the company.

Preferred Shares

Preferred shares can be classified as equity or financial liabilities. This classification is based on their characteristics. For example, perpetual, non-redeemable preferred shares are classified as equity. On the other hand, preferred shares with the mandatory redemption of a fixed amount at a fixed future date are considered to be a financial liability.

Treasury Shares (Treasury Stock / Repurchased Stock)

These are the shares that have been repurchased by the company, and the company holds them as treasury shares rather than canceling them.

Retained Earnings

This is the cumulative amount of earnings that have not been paid to the owners of the company as dividends.

Accumulated Other Incomes

Other comprehensive income includes:

- Net income (As per income statement)

- Other comprehensive income (As reflected in accumulated other comprehensive income)

Noncontrolling Interest (Minority Interest)

This is the equity interests of minority shareholders in the subsidiary companies held by the parent. The parent company does not wholly own these subsidiary companies.

Also Read: Net Book Value Calculator

For better understanding, let’s look at an example:

Following is the balance sheet of Apple Inc. as on 31/09/2017

In the above financial statement, the book value of equity is US$ 134.05 billion (as highlighted). This amount includes common stock, retained earnings, and other equity. If we apply it to the formula –

Book Value of Equity = Total Assets – Total Liabilities

Apple Inc. (Book Value) = US$ 375.32 billion – US$ 241.27 billion = US$ 134.05 billion

Book Value per Share

For the purpose of analysis, we divide the book value of equity by the total number of shares to make the book value per share. Book value per share represents the firm’s equity on a per-share basis. This means if the company dissolves, the shareholders will receive an amount per share as per book value per share.

The formula for book value per share = book value of equity / total number of outstanding shares

Taking the above example of Apple Inc., we can calculate the book value per share as follows:

Book Value per Share = US$ 134.05 billion/ 5.126 billion shares = US$ 26.15

Therefore we can say if Apple Inc. dissolves on 31/09/2017, shareholders will get US$ 26.15 per share.

Also read – Market Value of Equity

Limitations of Book Value of Equity

There are some limitations to using the book value of equity as a metric for measuring a company’s performance. We are listing a few of them below:

Depreciated Value vs. Current Market Price of Assets

Depreciation is an accounting phenomenon, i.e., there is no accurate measure to calculate the rate of depreciation. The book value of an asset completely depends on how aggressively a company depreciates its assets. This means the sale price of an asset may or may not be equal to its depreciated book value. If a company has depreciated its asset very aggressively, the chances are that the sales price will be higher than the book value. This means the reported book value of equity is lower than the actual book value & vice versa.

Also Read: Market Value of Equity

Subjective Valuation of Intangible Assets

Intangible assets include assets like goodwill, patent, trademarks, and the like. The issue with the value of intangible assets is that it is very subjective. The book value is only a perception of the price of intangible assets. The market perception of the price of intangible assets may be very different from the book value. If the market perceives the price of an intangible asset as lower than its book value, this means the reported book value of equity is higher than the actual book value & vice versa.

Historical Costs

Suppose a company bought a piece of land in the year 2012. As of today, the value of land has appreciated by 40%. But the book value of this land will reflect the purchase price of the land. This will reduce the reported book value of equity. Unless the company has updated its balance sheet with fair values of assets and liabilities, the book value of equity will not reflect the real picture.

Price to Book Value Ratio

The price to book value or P/B ratio is a relationship between the market price of a company’s share and its book value.

The formula for the P/B ratio is:

P/B ratio = Market Price per Share / Book Value per Share

Let us again go back to our example of Apple Inc. & try to interpret its P/B ratio

P/B ratio of Apple Inc. as on 31/09/2017 = US$ 154.12 market price per share/ US$ 26.15 book value per share. = 5.89 i.e. 6 approx.

From the P/B ratio of Apple Inc., we can interpret that Apple Inc’s stock is selling at 6 times the book value.

On the final notes, we can conclude that to interpret anything from the book value of equity; it is important that the book value reflects the fair value of its assets and liabilities. As an investor or analyst, we must be sure that the company’s balance sheet that we are analyzing is marked to market, i.e., reflects the most recent market price of assets and liabilities.

Read about various Equity Valuation Methods here.