International Trade Theory is simply the theory explaining international trade. Or these are the theories that explain or justify why a country or a company does international trade. Or how a company or a country can profitably carry out international trade.

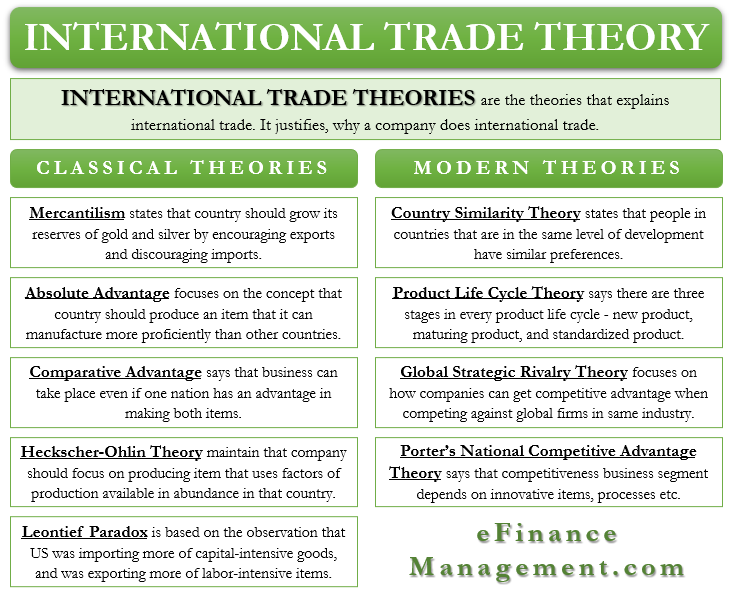

Primarily there are two types of International Trade Theory – Classical Country-Based Theories and Modern Firm-Based Theories.

Classical Country-Based Trade Theories

These are historical theories that evolved from 1500 onwards. They are more from the country perspective rather than firm or company oriented. Hence, these are also called country-based theories. Following are the Classical Country-Based Theories:

Mercantilism

This was one of the earliest theory of international trade, and it came around the sixteenth century. As per this theory, a country should grow its reserves of gold and silver by encouraging exports and discouraging imports. The theory implies that a country should have a trade surplus with exports more than imports.

Many nations made progress using this approach between the 1500s to the late 1800s. These nations put restrictions on imports, which we now refer to as protectionism. Even though it is one of the earliest theories, it still is relevant in the modern era.

Also Read: Comparative Advantage

Countries such as Germany, Japan, Taiwan, China, and more, still encourage exports and discourage imports. These countries follow protectionist policies, as well as provide subsidies to the domestic industry so that domestic industries remain competitive.

Absolute Advantage

This is among the best theories of international business. Adam Smith, in his book The Wealth of Nations in 1776, challenged the validity of the mercantile theory and raised serious objections. Smith’s theory talks about the country focusing on producing an item that it can manufacture more proficiently than other countries. With each country focusing on producing what they do best, the result is a boost in the efficiencies.

Unlike Mercantilism, Smith’s theory says that the government shouldn’t regulate or restrict trade between the two countries. Instead, the trade should depend on the market factors. Smith argues that gold and silver shouldn’t determine a country’s wealth; instead, the deciding factor should be the standard of living of citizens.

Comparative Advantage

Smith’s theory was better, but it was not very practical. The argument against it was a country may be efficient in producing both the items or the other country doesn’t have an absolute advantage in either item. In order to provide a resolution to this issue or shortcoming, David Ricardo introduced the theory of comparative advantage in 1817.

Ricardo says business can still take place even if one nation has an advantage in making both items. In such a case, the comparative advantage comes into play. Comparative advantage focuses on relative productivity differences, while absolute advantage focuses on absolute productivity.

For example, a person can repair both AC’s and washing machines. But repairing AC’s gives him $100 while repairing washing machines give him $50. Given he has continuous work on both items, every time he repairs a washing machine, he loses $50 (by not repairing AC). Thus, he will earn more if he repairs only AC’s.

Heckscher-Ohlin Theory

We also call this theory Factor Proportions Theory. Both Comparative and Absolute advantage theory doesn’t tell which item a country should produce. Instead, the two theories assume that open markets would help nations realize the item they have an advantage in producing.

Eli Heckscher and Bertil Ohlin, in the early 1900s, came up with a solution. They maintain that a company should focus on producing the item that uses factors (land, labor, and capital) that are in abundance in that country. If a country uses the factor that it has in abundance, then it would also help bring down the cost of production.

For example, India and China have an abundance of labor. Thus, these countries take up the production of items that are labor-intensive.

Leontief Paradox

Wassily W. Leontief, in the early 1950s, found that Factor Proportions Theory has some exceptions. Leontief found that the US, which has an abundance of capital, should export capital goods and import labor-intensive goods. But, what was actually happening was the exact opposite.

Leontief found that the US was importing more of capital-intensive goods and was exporting more of labor-intensive items. Such findings of Leontief got popular as Leontief Paradox. Later, the economists found that labor in the US was more productive and in steady supply. And this was why the US exported more of labor-intensive goods.

Modern Firm-Based Theories

These theories came up after World War II and were largely developed by business school professors and not economists. Such theories came up after the rise in the popularity of the MNCs (multinational companies).

The above (country-based theories) theories address the concern of countries and not companies. Thus, to address the need of the companies, the professors came up with Modern Firm-Based Theories. Following are more international trade theories or the Modern Firm-Based Theories:

Country Similarity Theory

Steffan Linder, a Swedish economist, came up with this theory in 1961. It explains the concept of intra-industry trade. As per this theory, the people in countries that are in the same level of development have similar preferences. Linder suggests that the companies first produce for the domestic market. Later, the same company can find a foreign country in which it can export the same product.

Product Life Cycle Theory

One can find this theory in almost every college textbook. The credit for this theory goes to Raymond Vernon, a Harvard Business School professor. This theory, which came in the 1960s, says there are three stages in every product’s life cycle. These stages are – new product, maturing product, and standardized product.

The theory assumes that a country that came up with a new product should produce that product. This theory also explains why the US was a manufacturing success after World War II. PC’s are a good illustration of the Product Life Cycle theory.

Global Strategic Rivalry Theory

Economists Paul Krugman and Kelvin Lancaster came up with this theory in the 1980s. This theory focuses on how companies can get a competitive advantage when competing against global firms in the same industry. The theory says a company can get a sustainable competitive advantage by developing barriers to entry. Such barriers may be research and development, economies of scale, intellectual property rights ownership, and more.

Porter’s National Competitive Advantage Theory

Porter, in 1990, came up with a theory to explain national competitive advantage 1990. The theory says that the competitiveness of a country’s business segment depends on the ability of that segment to come up with innovative items, processes, and more. Porter explains why some nations have a competitive advantage in some segments.

To identify this, Porter lists four determinants. These are local market resources and capabilities, local market demand conditions, local suppliers and complementary industries, and local firm characteristics. Along with these four factors, Porter says that government also plays a crucial role in shaping the competitive advantage of the industry.

Which International Trade Theory is Most Popular?

Over time, all these international trade theories have helped companies, countries, researchers, and governments to understand international trade. All theories may not be applicable to all countries and may not help in understanding the trade tactics of all companies.

Thus, there is no single dominant theory that is popular globally. Instead, one may apply at least one of the above international trade theories to a company or a country.

A point to note is similar to how these theories evolved over the past 500 years. We would see new theories or update to current theories in the future to better explain the current international business environment.

RELATED POSTS

- Differences Between International Business and International Trade

- Principle 5: Trade can make everyone better off

- Absolute Advantage vs Comparative Advantage – All You Need To Know

- Competitive Advantage vs Comparative Advantage – All You Need to Know

- What are the Disadvantages of Incoterms?

- Difference Between Industry, Commerce, And Trade

Great job