Indirect Quote is a concept in the foreign exchange market or the forex market. Such a quote details the number of foreign currency a person requires to purchase a unit of the domestic currency. For example, for a person living in the U.S., an indirect quote when dealing in euros will be 1.2 Euros per 1 USD, or they need 1.2 euros to buy one USD.

Indirect Quotation shows the exchange rate, indicating whether the currency is gaining or losing against the other (counter) currency. The primary use of the indirect quote is to determine the rates at which investors can trade currencies.

The quote is not just for purchasing but could also be for selling the domestic currency. Another name for such a quote is “quantity quotation.” Because through this quote, one comes to know of the quantum of foreign currency one needs to buy or sell a unit of the domestic currency. In such a quote, the domestic currency is described as the base currency, while the foreign currency remains the counter currency.

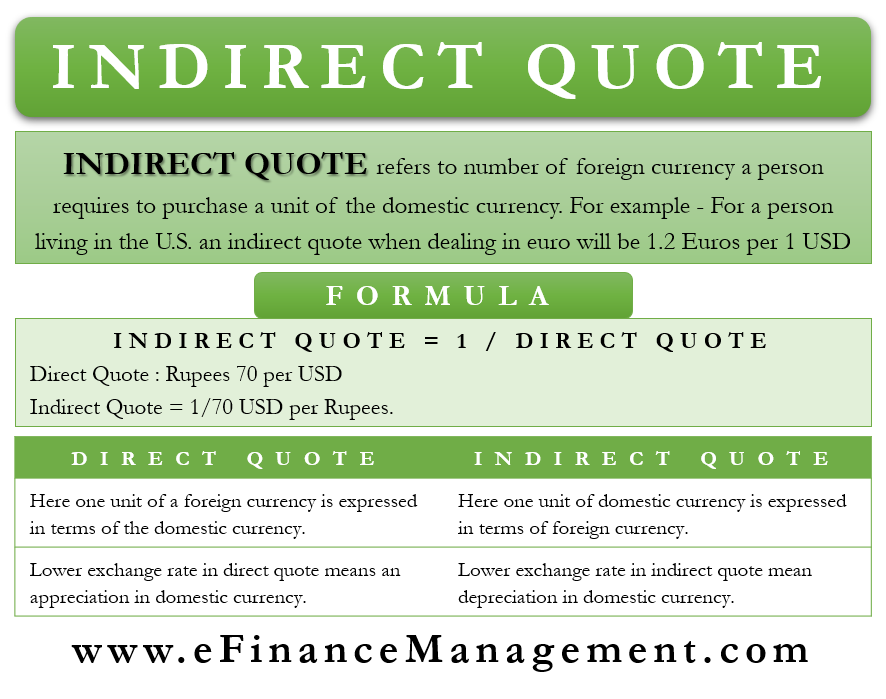

An indirect quote is the reverse of a direct quote or “price quotation.”

Formula for Indirect Quote

As said above, the quantity quotation is the opposite of the direct quote. So, one can get this quote by finding the inverse of the direct quote or 1/Direct Quote.

In a case where the foreign exchange is on the basis of the bid and ask spread, one can find the indirect quotation by taking an inverse of both the prices and then switching their places. The direct ask would be the indirect bid, and the direct bid would now be the indirect ask.

So, if a direct quote is (a – b), then the indirect quote would be (1/b − 1/a).

Examples of Indirect Quote

An example of this will better help us to understand the concept of indirect quotations.

Mr. A is from the U.S., and Mr. B is from Britain. The former wants to invest in Britain and thus, is in talks with Mr. B. Mr. A is detailing the amount that he is willing to invest in Britain.

To get a clear idea of the investment, it is important that Mr. B make the quote either direct or indirect. If Mr. B uses an indirect quotation, then he would use one unit of his domestic currency (GBP) and express it in the USD, which is Mr. A’s domestic currency.

Suppose Mr. B gets the quote 1 GBP equals 1.20 USD. This means that for every one unit of GBP that Mr. B owns, Mr. A would pay 1.2 USD.

Also Read: How to Read Currency Pair?

Let’s take another example. Suppose Mr. A is a resident of the U.S. and converts 500,000 USD to 451,392 EUR. In this case, find the indirect quote for Mr. A.

Here in this example, a USD will become the domestic currency For Mr. A. And the counter currency will be the Euro. So, the indirect quotation would be (451,932/500,000) 0.903, or 1 USD equals 0.903 EUR.

Now, the direct quote, in this case, would be the reverse of the quantity quotation, or (1/0.903) 1.107.

Another example: For an EU resident, the direct bid-ask quote for USD is 1.3391 − 1.3392. To get the indirect quote, we just need to find the inverse of the prices and then switch their places. So, for an EU resident, the indirect quotation rate for the euro and USD would be (0.7467 − 0.7468).

Thus, the new bid (inverse of the direct ask 1.3392) would be 0.7467. And the new ask (inverse of the direct bid 1.3391) would be 0.7468.

Direct vs Indirect Quote

In a direct quotation, one unit of a foreign currency is expressed in terms of the domestic currency. The reverse will be the treatment in the case of Indirect Quotation. Therefore, one unit of domestic currency is expressed in terms of foreign currency in the case of an indirect quotation.

Since the U.S. dollar is the most popular currency in the foreign exchange market, it serves as the base currency against most other currencies, such as the Canadian dollar, Indian rupee, and more. Though there exist a few exceptions, and those exceptional currencies are the British pound, Euro, and a few more. For these currencies, the exchange rate indicator is mostly in the form of an indirect quote.

Let’s take an example, suppose the Canadian dollar is trading at 1.20 to the USD. This is the direct quote. The indirect quote for a Canadian would be 0.833 USD.

A lower exchange rate in a direct quote means an appreciation in the domestic currency, or it is getting stronger. On the other hand, a lower exchange rate in an indirect quote would mean depreciation in the domestic currency, or it is becoming weaker.

Now suppose, in the above example of the Canadian dollar, the direct quote changes to 1.30, and the indirect quote would change to 0.769. This implies that the Canadian dollar is weaker now because now a Canadian gets just 0.769 USD in exchange for one Canadian dollar.

Cross Currency

In a cross-currency rate, the exchange rate of one currency is expressed in another currency other than the USD. To find direct or indirect cross-currency rates, the first one needs to determine the type (direct or indirect) of the quote being used.

For example, if the Japanese yen to USD is 90 (one USD equals 90 JPY) and one USD equals 1.25 Canadian dollars, then find the yen to CAD cross-currency rate. For a Canadian, an indirect quotation would be 72 (90/1.25) or 1 CAD equals 72 yen. The direct quotation would be 0.013.

Thanks, I am learning a lot from your blogs.