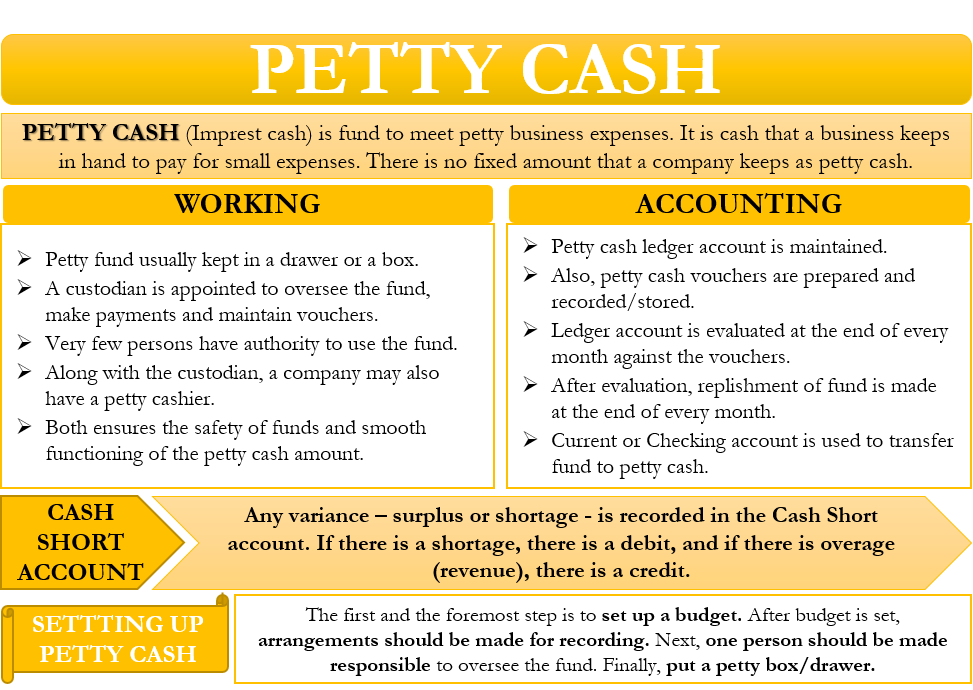

Petty cash, or the petty cash fund or imprest cash, as the name suggests, is the fund to meet petty business expenses. It is the fund or cash that a business keeps in hand to pay for small expenses, such as postage due, reimbursement, office supplies, food or drinks, etc.

We can also say that these are the expenses that a company pays without writing a check. Or when the company feels it is unreasonable to issue a cheque. There is no fixed amount that a company keeps as petty cash. Instead, the amount varies from company to company depending on its size. Businesses usually have a petty fund of between $50 and $500.

Petty cash is an exception to two basic internal controls that businesses use to protect some money from theft and fraud. These two controls are – depositing cash into the bank as and when it receives cash and using a check to make a payment. When it comes to petty cash, companies keep money in hand (not a bank). Also, the payments are made in cash and not by check. The purpose is clear, and it is to meet small expenses.

Petty Cash – How it Works?

Businesses usually keep the petty fund in a drawer or a box. They also appoint a custodian to oversee the fund. The responsibility of the custodian is to release payment, request for replenishments, and maintain vouchers.

Even though the amount is small, it does not mean that anyone can access petty funds and for any purpose. Several businesses take it very seriously and practice strict controls to manage the fund. Very few persons have the authority to use the fund. Moreover, the companies also define the activities for which the fund amount can be used.

Along with the custodian, a company may also have a petty cashier. The petty cashier is responsible for issuing a check to the petty account, making accounting entries, and managing the account. If there is a petty cashier, then the custodian is responsible for making payments and collecting receipts for the purchases.

Having both – a custodian and cashier – ensures the safety of funds and smooth functioning of the petty cash amount.

Accounting

Companies maintain a petty cash ledger account to record all such transactions. Also, the companies maintain petty cash vouchers to keep a record of each payment made, including the amount, item, and date.

The petty cashier generally evaluates the account at the end of every month. The cashier uses the vouchers and ledger account to check if the amount left in the account matches with the money in hand. At any time, the sum of the vouchers or receipts plus the money left should be equal to the original balance in the fund.

Also Read: Cash Flow Management

After the evaluation, the cashier replenishes the fund for the next month. A business uses its current or checking account to fund the petty account. The journal entry to transfer the fund is to debit the petty account and credit the bank account. A custodian can request to replenish the fund even before the end of the month if the petty balance drops below a preset level.

A point to note is that there are no journal entries for the spending from the petty fund. However, for every replenishment, a journal entry is made. The journal entries are needed whenever there is a shortage or excess in petty cash account/balance. So apart from replenishment, journal entries are made whenever there is an error in the petty cash balance.

Cash Short Account

Cash Short is an account similar to the income statement. One can use it to record daily sales as well. For instance, a retailer can use it to compare regular cash sales with cash in the drawer. Any variance – surplus or shortage – is recorded in the Cash Short account. If there is a shortage, there is a debit, and if there is overage (revenue), there is a credit.

For Example, suppose a business that has a shortage of $20 is the petty fund, and the balance in the fund is $50. And the preset balance is $300. To replenish the balance, the cashier needs to issue $250. The entry for this will be:

Petty expenses Dr. $230

Cash Short (Over) Dr. $20

Cash Cr. $250

With the company’s growth, a company may also decide to raise the base amount of petty funds. Increasing the amount will require a journal entry, and it would be similar to the entry for replenishment.

How to Set Up a Petty Cash Fund?

Any business must follow the following steps to set up a petty fund:

Set a Budget

The first and most crucial thing is to define the amount of petty cash. For this, the business must look at past expenses to determine how much should the fund amount be. A business can also decide to split the petty fund department-wise or one fund for the company. Also, a business must decide on a timeline for when it would replenish the fund. It could be monthly or when the fund balance falls below a set threshold.

Make Arrangements to Record Transactions

The next thing is to make arrangements to record the transactions. A company can decide to record the operation on a spreadsheet or use accounting software. Also, a company must print vouchers to keep a record of payments. Also, the arrangement must be made to get receipts of the expenses. These vouchers and receipts help in evaluating and managing the petty account.

Assign Access

One person is made responsible for overseeing the fund, including tracking expenses and spending money. Also, a company must clearly state the employees that can use the fund. These employees need to contact the custodian when they need cash for petty expenses. Any other employee who needs petty cash usually needs to get permission from the manager.

Secure Petty Fund

The petty cash should be kept in a box or drawer. The cash box or drawer key should only be with the custodian. An extra key could be with the manager—also, copies of records made in case of an accident or deletion.