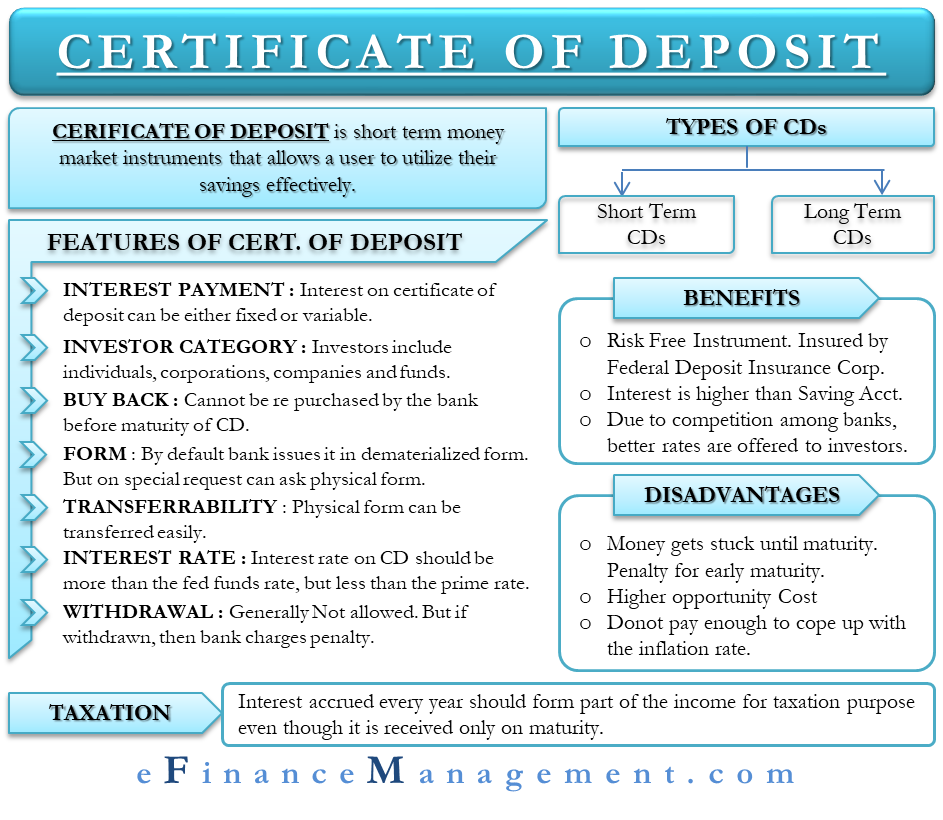

A Certificate of Deposit or CD is a short-term negotiable instrument of the money market that allows users to utilize their savings effectively. It is basically an agreement between an investor and a bank, where the former agrees to put a fixed sum of money for a fixed time period. In exchange, the bank agrees to pay interest on the amount deposited.

We can also call them a special form of term deposits traded in the secondary money market. The yield to maturity of the Certificate of Deposit determines its trading price. The interest rate on the CD can be fixed or variable, and regardless of its duration, it is mandatory for the bank to pay the interest on time.

CDs help banks to collect funds to make loans. The interest that the bank pays on the Certificate of Deposit is less than what it charges for the loan. This allows the bank to make a profit.

Features of Certificate of Deposit

- A bank can issue a Certificate of Deposit to individuals, corporations, companies, and funds.

- A bank can’t purchase their CD before maturity.

- Banks can issue CDs in only dematerialized form. If investors want, they can ask the bank for a physical form as well.

- If a CD is in a physical form, they are easily transferable.

Short and Long-term CDs

The short-term CDs are usually for up to a year and have no coupons or interest payments. At the end of the maturity, depositors get the principal amount and the interest due.

In the case of a long-term CD, the bank pays coupons (or interest) at regular intervals, such as every quarter or six months. Also, a long-term CD gets a higher return than a short-term CD. This is because the risk is higher in the long term as the holder holds the certificate for a longer-term, resulting in more uncertainty.

How Interest Rates on CDs Are Set?

The funds that a bank can get from the nation’s central bank (Federal Reserve) costs the lowest. However, banks could only use these funds for very short-term reserve requirements. To meet their other requirements, banks borrow from other banks at the Libor rate (London Interbank Offer Rate).

Another rate that helps decide the interest rate on CDs is the prime rate. It is the lending rate that the bank charges from its best customers. Banks must rate CDs below the prime rate in order to make a profit.

The interest that the bank gets from the borrowers is its income. Banks’ expenses are the interest paid to the depositors of money market accounts, other banks, and CDs. Thus, to make a profit, the interest rate on CDs should be more than the fed funds rate but less than the prime rate.

Early Withdrawal – Is it Allowed?

As said above, the Certificate of Deposit is for a fixed period, so the depositor is not expected to withdraw it early. However, banks do allow an early withdrawal but charge a penalty for it as well. The penalty amount will depend on the duration left for maturity. In general, the penalty equals the interest rate.

Benefits of Certificate of Deposit

- It is a risk-free instrument, which means your funds are safe with banks. Since FDIC (Federal Deposit Insurance Corporation) insures Certificate of Deposits, it acts as a guarantee that you won’t lose the principal amount.

- CDs get a higher interest rate than the savings account or the interest-bearing checking account.

- Since there is competition among banks for the depositor’s funds, some banks offer better rates than others. This means you can try different banks to get the highest interest rate.

Disadvantages

- The biggest limitation of a Certificate of Deposit is that your money gets stuck until maturity. Though you can always withdraw it early, you have to bear a small penalty as well. Nowadays, some banks do offer flexibility in terms of the amount that you can withdraw without any penalty. So, do ask your bank if it offers any such facility.

- Since your money gets stuck, you may lose some profitable investment opportunities. For instance, if, during the CD period, the rate of interest rises on the other instruments, you will lose the interest you would have earned. To avoid this, you can go for a no-penalty CD or something similar that allows you to withdraw the amount easily.

- Even though CDs pay more interest rates than a savings account, sometimes they don’t offer enough to compensate for the inflation rate. In case the inflation rate is more than the interest rate on CD, you will lose in the real term.

Money Market Accounts and Funds – How They are Different?

Since CDs are a source of funds for the money market deposit accounts, the interest on the latter is less. However, it offers the flexibility to withdraw funds anytime without any penalty. Also, FDIC ensures these deposit accounts, so there is no risk.

Talking of money market mutual funds, they invest in CDs and other financial instruments as well. It also allows you to take out funds anytime, but FDIC does not insure it.

How to Choose a CD?

Below are a few useful guidelines that could help you to choose the best Certificate of Deposit;

- The longer the investors are willing to let their funds with the bank, the more the interest rate they will get.

- If you expect an interest rate to rise in the near future, then you should first select the CD with a short-term. After that, after it matures, you can reinvest it at a higher interest rate.

- If you expect the interest rate to drop in the future, then select a longer tenure for the CD. This will ensure that you get more interest rates even if the rate drops.

Tax Treatment of Interest Earned on CDs

If you have a CD, the bank will regularly credit the interest amount at regular intervals, like every quarter or after six months. When a bank credits the interest, the same will show up in your account as interest income. Thus, similar to other interest income, you should also report this as part of your income when you file a tax return.

Most people, however, feel that since they can’t actually withdraw the interest on CD when the bank credits them, they should be taxed only at maturity. This is wrong as interest becomes taxable as soon as the bank adds it to your account.