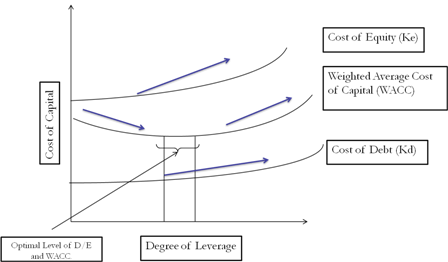

The traditional approach to capital structure suggests an optimal debt to equity ratio where the overall cost of capital is the minimum and the firm’s market value is the maximum. On either side of this point, changes in the financing mix can bring positive change to the firm’s value. Before this point, the marginal cost of debt is less than the cost of equity, and after this point, vice-versa.

Capital Structure Theories and their different approaches put forth the relationship between the proportion of debt in the financing of a company’s assets, the weighted average cost of capital (WACC), and the company’s market value. While the Net Income Approach and Net Operating Income Approach are the two extremes, the traditional approach, advocated by Ezta Solomon and Fred Weston, is a midway approach, also known as the “intermediate approach.”

Traditional Approach to Capital Structure

The traditional approach to capital structure advocates that there is a right combination of equity and debt in the capital structure, at which the market value of a firm is maximum. As per this approach, debt should exist in the capital structure only up to a specific point, beyond which any increase in leverage would result in a reduction in the value of the firm.

It means that there exists an optimum value of debt to equity ratio at which the WACC is the lowest and the firm’s market value is the highest. Once the firm crosses that optimum value of debt to equity ratio, the cost of equity rises to give a detrimental effect on the WACC. Above the threshold, the WACC increases, and the firm’s market value starts a downward movement.

Assumptions under Traditional Approach

- The interest rate on the debt remains constant for a certain period, and after that, it increases with an increase in leverage.

- The expected rate by equity shareholders remains constant or increases gradually. After that, the equity shareholders start perceiving a financial risk, and then from the optimal point, the expected rate increases speedily.

- As a result of the activity of rate of interest and expected rate of return, the WACC first decreases and then increases. The lowest point on the curve is optimal capital structure.

Diagrammatic Representation of Traditional Approach to Capital Structure

Example Explaining Traditional Approach

Consider a fictitious company with the following data.

| Particulars | Case 1 | Case 2 | Case 3 | Case 4 | Case 5 |

| Weight of debt | 10% | 30% | 50% | 70% | 90% |

| Weight of equity | 90% | 70% | 50% | 30% | 10% |

| Cost of debt | 10% | 11% | 12% | 14% | 16% |

| Cost of equity | 17% | 18% | 19% | 21% | 23% |

| WACC | 16.3% | 15.9% | 15.5% | 16.1% | 16.7% |

From case 1 to case 3, the company increases its financial leverage, and as a result, the debt increases from 10% to 50%, and equity decreases from 90% to 50%. The cost of debt and equity also rises, as stated in the table above, because of the company’s higher exposure to risk. The new WACC is decreased from 16.3% to 15.5%.

As observed, with the increase in the company’s financial leverage, the overall cost of capital reduces, despite the individual increases in the cost of debt and equity, respectively. The reason is that debt is a cheaper source of finance.

Now, look at the situation in case 3 to case 5, the company increases its financial leverage further, and as a result, the debt is increased from 50% to 90% and equity from 50% to 10%. The cost of debt and equity rises further. The new WACC is increased from 15.5% to 16.7%. As observed, with the increase in the company’s financial leverage, the overall cost of capital increases.

The above exercise shows that increasing the debt reduces WACC, but only to a certain level. After that level is crossed, a further increase in the debt level increases WACC and reduces the company’s market value.

Also Read: Capital Structure Analysis

Read Capital Structure & its Theories to know more about what is capital structure and what are its different theories. Let us now look at the first approach.

Quiz on Capital Structure Theory

This quiz will help you to take a quick test of what you have read here.

calculations are wrong in the second table

We have corrected the calculation. Thank you for your feedback

Hello, please I’ll like to know who proposed the traditionalist approach to capital structure and in what year.

An interesting discussion is worth comment. I do believe that you need to write more on this topic, it might not be a taboo subject but usually, folks don’t speak about such issues. To the next! Many thanks!!

What’s up very cool blog!!

Guy .. Excellent .. Wonderful

.. I’ll bookmark your website and take the feeds also?

I’m glad to seek out so many useful information right here within the

submit, we want to develop extra strategies on this

regard, thank you for sharing. . . . . .

Hi there…in traditional approach are tax is included or not in the calculation…for example if a question ask required amount of $50,000 before interest and tax expense.. so that means we will compute interest expense and tax out or compute both since tax rate is not mentioned.. it’s like a tricky question.. thanks.. your help we be much appreciated

Thanks for the query. Please note that the beauty of adding debt to the capital structure is that apart from this being a source of external funding, the effective cost of servicing the debt is lower. Because the interest payouts on the debt portion are tax-deductible. Hence, it gives a significant benefit to the company by reducing the interest cost on the debt to the extent of tax saved. In other words, the taxable income stands reduced to the extent of interest payouts. Hence, for all calculations, we need to consider the impact of taxation while analyzing and determining the optimum debt-equity ratio. Without this impact considered we will not reach to a right and proper conclusion. Hope this will clarify the situation, please. Thanks