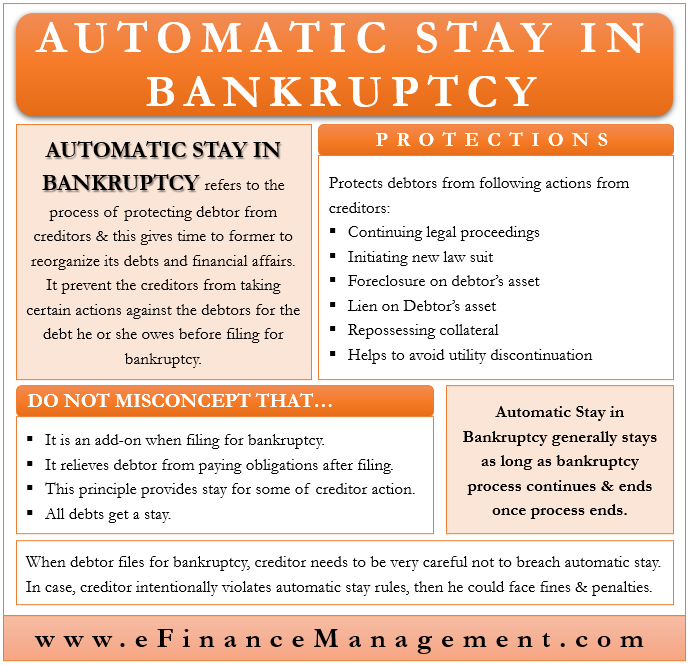

Automatic Stay is a term related to the process of bankruptcy filing. As the word suggests, it protects the debtor from the creditors, giving the former time to reorganize its debts and financial affairs. Or, we can say it prevents the creditors from taking certain actions against the debtors for the debt they owe before filing for bankruptcy.

Specifically, this provision prevents creditors from continuing with any legal action, filing a new lawsuit against the debtor, and taking over the debtor’s property. The automatic stay temporarily ends the collection proceedings, but the EMI s and interest continue to accrue. Note that this provision doesn’t apply to criminal cases or to some specific family law or governmental investigation.

Automatic Stay provisions are enumerated under Section 362 of the United States Bankruptcy Code. This section covers persons, as well as companies. The provisions of this section are applicable to all sorts of filings and chapters under the Code. However, it doesn’t give protection to the non-debtor entities, like guarantors, codefendants, corporate officers, and more.

Protections Under Automatic Stay in Bankruptcy

Automatic Stay in Bankruptcy protects the debtors from the following action of the creditors:

- Continuing a legal proceeding against the debtor.

- Initiating a new lawsuit against the debtor.

- Foreclosure on debtor’s asset or property.

- Create or enforce a lien on the asset or property of the debtor.

- Repossessing collateral.

- It also helps a person to avoid disconnection of utilities for 30 days or longer if they are unable to pay utility bills, such as water, electricity, and more.

- If a person is facing eviction, then the automatic stay could delay it temporarily.

- If you receive public benefits and you get more than what you are entitled to, then the agency would normally collect the overpayment. But, if you are under automatic safety, the agency can not collect the overpayment from you.

Along with protecting a debtor from these actions, the automatic stay has one more objective. And that it ensures that all creditors are treated on an equal footing. Or it ensures that no single creditor gets access to the debtor’s assets and property. Once a person files for bankruptcy, it is very likely that the creditors do not get the full amount that they owe. Instead, they would get their claim in proportion to the debt owed and the amount recovered from the debtor’s limited assets.

Misconceptions of Automatic Stay in Bankruptcy

There are a few misconceptions about Automatic Stay in Bankruptcy, and these are:

- There is a misconception that Automatic Stay in Bankruptcy is an add-on when filing for bankruptcy. Instead, it is a fundamental principle of bankruptcy that triggers automatically when one files for bankruptcy. Or, we can say, this provision is effective the moment a person files for a bankruptcy petition.

- Another misconception is that Automatic Stay in Bankruptcy relieves the debtor from paying the obligations that are due after filing for bankruptcy. The debtor needs to pay all obligations as they fall due after filing for bankruptcy. These obligations could be employee wages, operating expenses, vendor payments, mortgages, etc. In case a debtor is unable to pay its obligations after the bankruptcy filing, the court may do away with the automatic stay or even dismiss the bankruptcy case.

- One more misconception is that this principle provides a stay for some of the creditor actions. In reality, this stay gives some time to the debtor to negotiate and address the financial challenges they face. And thus allows him to group all his assets and liabilities and work out a reasonable and feasible plan to pay off the creditors over a period of time.

- Not all debts get a stay. There are some debts that do not get stay protection even after a person files for bankruptcy. These debts include loans from pensions, child support, and IRS tax deficiencies.

Creditors

When a debtor files for bankruptcy, the creditor needs to be very careful not to breach the automatic stay. If a creditor intentionally violates the automatic stay rules, they could face fines and penalties. If the violation is unintentional and the creditor takes corrective action quickly, then they may not face fines and penalties. A debtor may also take legal action against a creditor who forces them to make the payment once an automatic stay is in place.

Also, in a specific case, a secured creditor may get approval from the court to bypass the automatic stay. For instance, if a debtor’s asset is not necessary for the reorganization, then a creditor – after getting the court’s permission – may move to foreclose on the property. Also, if the debtor does not directly own a property, then automatic stay doesn’t apply to it.

Another case where a creditor may get relief from the automatic stay is when the value of a property or collateral may suffer due to an ongoing bankruptcy case. A creditor may also get relief if the debtor’s actions in any way result in the waste of resources. Or the debtor’s actions result in mismanagement and damage to the assets.

A creditor may also get relief from the automatic stay in case of single asset real estate bankruptcy. Even in such a case, the secured debt amount should be less than $4 million.

Length of Automatic Stay

As said above, the automatic stay is not an add-on. Thus, it stays as long as the bankruptcy process continues and ends once the process ends. Another thing that determines its length is whether the collection is towards the debtors personally or towards the property.

The type of bankruptcy filing also determines the length. For instance, the process of Chapter 13 bankruptcy is usually lengthier than Chapter 7.

It may also be the case when a debtor has more than one bankruptcy filing simultaneously. This happens when a debtor first files for Chapter 7 bankruptcy and then goes for a Chapter 13 filing or vice versa. If the debtor has one pending case in the previous year and files another bankruptcy, the automatic stay will remain only for 30 days in the second case. The court, however, may decide to extend it. Moreover, sometimes in such cases where there is a frequency of such filings, the automatic stay may not trigger at all.

If there are two pending cases in the previous year, there won’t be any automatic stay when the debtor files a third case. The debtor, however, may get the protection if they file a motion for it and the court agrees to it.

Example of Automatic Stay in Bankruptcy

Suppose A’s business was not doing well due to the coronavirus pandemic. And because of this, he was unable to pay his mortgage and credit card payments. Mr. A files for Chapter 7 bankruptcy and thus, get an automatic stay from the creditors.

A’s creditor, however, filed for relief from the automatic stay. The creditors argue that A’s store is in a prime location, and thus, they could benefit from the appreciation in prices. Also, the creditors suggest giving it on rent to another party or disposing of the property.

Mr. A has already told the court that his financial conditions may not improve. And if the court believes that the possibility of improvement in financial condition is remote. Then the court, at the request of the creditors, may relieve them from the applicability of automatic stay.

Final Words

The automatic stay principle is very crucial for achieving the objective of the bankruptcy, which is to make payments to the creditors. Also, this principle gives time and an opportunity to the debtor to reorganize its finances in a creditor action-free environment. In the absence of such a clause, both debtors and creditors may stand to lose. However, it is not an absolute one. And in some exceptional cases on merits, the court may stay the applicability of automatic stay. Moreover, this is not applicable to family court matters, criminal court matters, personal injury claims, etc.