What is Fractional Reserve Banking System?

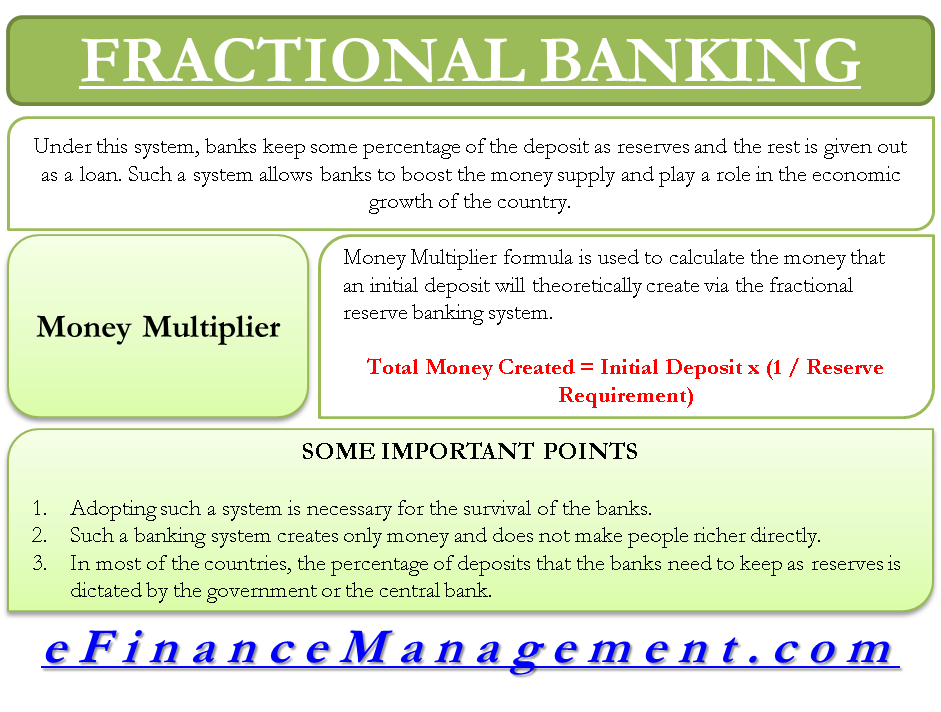

Fractional banking or Fractional Reserve Banking System is a type of system that most countries currently practice. Under this system, banks keep some percentage of the deposit as reserves, and the rest is given out as a loan. Such a system allows banks to boost the money supply and play a role in the country’s economic growth.

A point to note is that the countries’ central bank is responsible for controlling the money supply. However, in the modern-day, such responsibility is actually undertaken by the commercial banks with the help of the fractional banking system.

Fractional Banking System Example

Let’s understand the fractional banking system with the help of a simple example. Assume there are two countries, A and B. Country A uses fractional banking, while B follows 100% reserve banking.

Suppose country B has a money supply of $100 million. Banks in this country only take deposits and don’t give out loans. So this way, banks provide customers with a safe place to park their funds. Also, banks will be able to return all money if all depositors come to withdraw at the same time. In this case, the money supply in the economy remains unchanged as whatever money people have, they deposit it in the bank.

Now, let us talk about country A, which also has a money supply of $100 million. Banks in this country keep 10% of the deposits as a reserve, while the rest is given out as loans. In this case, the bank assumes that not all depositors will line up to withdraw simultaneously. So, out of the $100 million, the banks keep $10 million as reserves and loan out $90 million.

Talking of the supply of money, it increases with this banking system. There was already $100 million of the money supply, which was there with the bank. After the loans, the borrowers again have $90 million of money. So, the total money supply is $190 million.

Money Multiplier

A money multiplier is the total money created in the economy in the form of credit creation. To understand it better, let us see it in more detail.

Example of Money Multiplier

In the case of country A, $190 million is not the end. If the borrower of $90 million deposits the money again, the bank would create more money. It will keep 10% ($9 million) as reserves and give out $81 million as a loan. So, total money supply is now $271 million ($100 million+ $90 million + $81 million).

Also Read: Advantages and Disadvantages of Banks

The process will go on repeating. We use a Money Multiplier formula to calculate the money that an initial deposit will theoretically create via the fractional reserve banking system.

Formula of Money Multiplier

Total Money Created = Initial Deposit x (1 / Reserve Requirement)

In our case, the total money supply would be $1 billion ($100 million x (1 / 0.10).

What’s the Need for having Fractional Banking System?

Many may have a question whether boosting the money supply is the only function of fractional banking. Yes, it is somewhat true, this can be one significant characteristic of fractional banking, but the money supply is not the primary reason why banks adopt this system. In fact, adopting such a system is necessary for the survival of the banks.

Banks take deposits from the people and then lend those funds to the borrowers. The interest it earns from borrowers is its revenue, while the interest it pays to the depositors is an expense. So, to make a profit, banks charge more on the loans than it pays to the depositors.

Fractional Banking History

Such a banking system came into being to address the issues during the Great Depression. Almost all depositors made withdrawals at the time, resulting in banks going bankrupt. Thus, experts came up with reserve requirements to prevent banks from investing depositors’ funds in risky instruments to avoid such issues.

However, the concept of fractional banking is much older and was in existence during the gold trading era. When people deposit their silver and gold coins at goldsmiths, they get a promissory note in return. These notes were actively in use for commercial transactions. The goldsmiths soon realized that not all depositors would withdraw simultaneously. Thus, they started issuing loans and transitioned from just being the storehouse of valuables to what we currently know as banks.

Creates Money, Not Wealth

Note that such a banking system creates only money and does not make people richer directly. In fact, by taking a loan, the borrowers are taking debt and have to pay interest on it. So, it won’t be wrong to say that fractional banking increases the liquidity in an economy and does not necessarily make the economy wealthier.

Who Decides the Reserves?

The government or the central bank dictates the percentage of deposits that the banks need to keep as reserves in most countries. This percentage is for the minimum requirement of reserves, meaning banks can maintain higher reserves if they want.

Maintaining higher reserves boost the confidence of the depositors in the bank. But, at the same time, it limits the growth opportunities for the bank. Banks, however, are paid interest on excess reserves. This acts as an incentive for banks to keep more reserves.

Conclusion

The fractional banking system is much more complicated than what has been explained above. However, the system’s core functionality remains the same as described.