Meaning of Asset Coverage Ratio

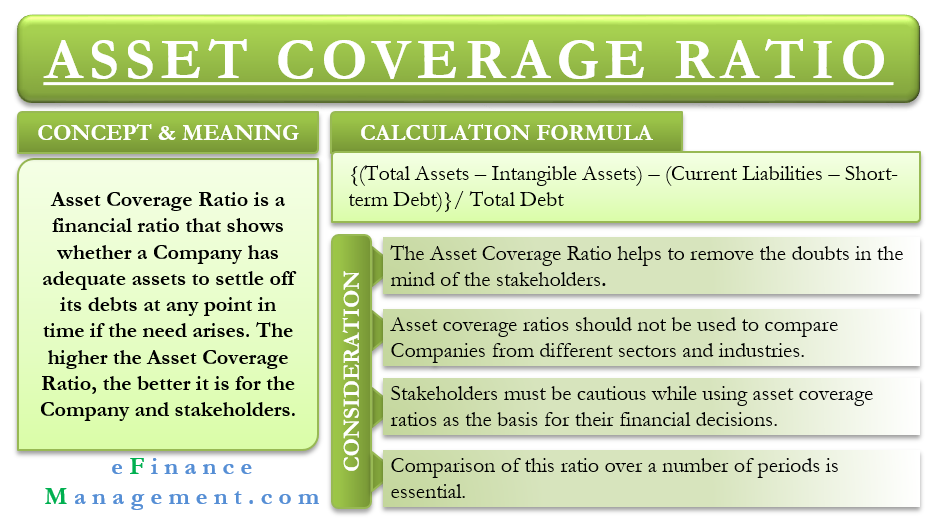

The Asset Coverage Ratio is a financial ratio that describes how well a company is in a position to repay its debt. It shows whether a Company has adequate assets to settle off its debts at any point in time if the need arises. This information is vital to its stakeholders- be it shareholders, creditors, lenders, or analysts to gauge its financial well-being and strength. This ratio instantly reveals how many assets a company has compared to its debt obligations.

Banks, creditors, and other investors require a minimum asset coverage ratio to provide funds to a Company. However, their minimum requirement varies across industries and sectors, based on the nature of businesses.

The higher the asset coverage ratio, the better it is for the Company and its stakeholders. The higher ratio denotes a company has more assets than its debt obligations. Therefore, it will be less risky to invest or provide debt to such a company.

Need and importance of Asset Coverage Ratio

A Company usually has three broad sources of finance, namely Long term, medium-term, and short-term sources of finance. All these three types of sources can be clubbed into Equity Capital, Debt, and Retained Earnings. Equity capital comprises the Company’s equity, and its holders are the owners of the Company. Therefore, if the Company does not make a profit during a particular period, the Company need not pay anything to them.

Also Read: Coverage Ratio and its Types

On the other hand, the Company will have to pay interest and the principal amount for its debt obligations regularly. Bond and debenture holders, banks, and other financial institutions need to be repaid. A Company cannot default on its debt repayment under normal circumstances. Otherwise, its goodwill and creditworthiness in the market can be severely damaged. Also, creditors may invoke legal proceedings against the Company.

In such a crisis, the Company might have to sell off its assets to pay its debt obligations. A Company with a good asset coverage ratio will be in an excellent position to do so and vice-versa. Therefore, this ratio is significant for the stakeholders of the Company. They would like to provide debt to only those Companies that can cover their payments by selling off their assets if the need arises.

Calculation of asset coverage ratio

The formula for asset coverage ratio comprises the following elements-

Assets– It denotes the Total Assets of the Company and includes both Fixed and Current Assets and tangible and intangible assets.

Intangible Assets- All those assets which cannot be touched or seen physically, but there is a value in a Company’s Balance sheet. These include goodwill, patents, trademarks, etc.

Current Liabilities- It includes all the liabilities of the Company, which are due within one year. Such liabilities are Accounts payable, interest payable, bank overdraft, etc.

Short-term debt- It includes debt that is due within one year.

Total debt– It includes both short-term and long-term debt of the Company.

The formula for calculation is:

{(Total Assets – Intangible Assets) – (Current Liabilities – Short-term Debt)}/ Total Debt

Example:

Let us take the situation of XYZ Pvt.Ltd., details of which are as under:

Year-2018

Total Assets – US$ 50 million.

Intangible Assets – US$ 10 million.

Current Liabilities – US$ 10 million.

Short-term debt – US$ 5 million.

Total debt- US$50 million

Asset Coverage Ratio= {(50 -10) – (10-5)}/50 = 0.70

Now let us assume that the Company has an excellent financial year, and it raises more equity capital too. Hence, it adds to its Total assets by US$50 million. Other figures remain the same.

Also Read: Cash Flow Coverage Ratio

Now, in the year 2019, the equation will change to:

{(50+50 -10) – (10-5)}/ 50= 1.70

Interpretation

The ratio has changed drastically for the Company from the previous year. It has become much more attractive and safer for investors and lenders. They can also compare this ratio with ratios of other companies within the same industry. It can be a major guide for making financial decisions for all the stakeholders. The asset coverage ratio of 1x or more is good. It means the Company has sufficient assets to cover its total debt.

Read Coverage Ratio and its Types for more details about other types of coverage ratios.

Important Considerations

- A Company may increase its borrowings during a period and increase its asset base. It means it is purchasing more assets with the loans. A stakeholder might feel that the Company is consistently increasing its debt and take it as a negative cue. But a more in-depth look at the asset coverage ratio can remove the doubts and throw light and convince that assets are also increasing.

- Asset coverage ratios should not be used to compare Companies from different sectors and industries. A 1x ratio might be right for some industries, whereas, for some other industries like capital goods, a higher ratio is the norm.

- Stakeholders must be cautious while using asset coverage ratios as the basis for their financial decisions. If a Company is required to sell off its assets to pay for its debt obligations, it will be a distress sale. Therefore, the assets will fetch a far lesser value in the market than their actual book value. This amount may not cover the entire debt obligation of the Company. It could be the other way round also for landed properties where real market value may be more.

- If a company has an asset coverage ratio of, say, 1.2 in a particular financial year, stakeholders may assume that all is well. But a comparison of this ratio over a number of periods is essential. The Company might be experiencing a decreasing Asset coverage ratio year after year. This should be an alarming situation for any stakeholder, meaning that either the assets are continuously decreasing or the debt is increasing.

Also, the asset coverage ratio should again be checked for multiple periods while comparing two companies. It will show which Company is financially improving and the decision to invest or lend be taken accordingly.

Conclusion

The asset coverage ratio is an essential financial tool to gauge the solvency and well-being of any Company. Through this ratio, one can have an overview of the leverage and asset backup status of the Company. But this ratio has its limitations too. Therefore, analysts and stakeholders should also use other financial ratios like the Debt to Equity ratio and Interest coverage ratio along with this ratio to assess a company’s financial position and standing.