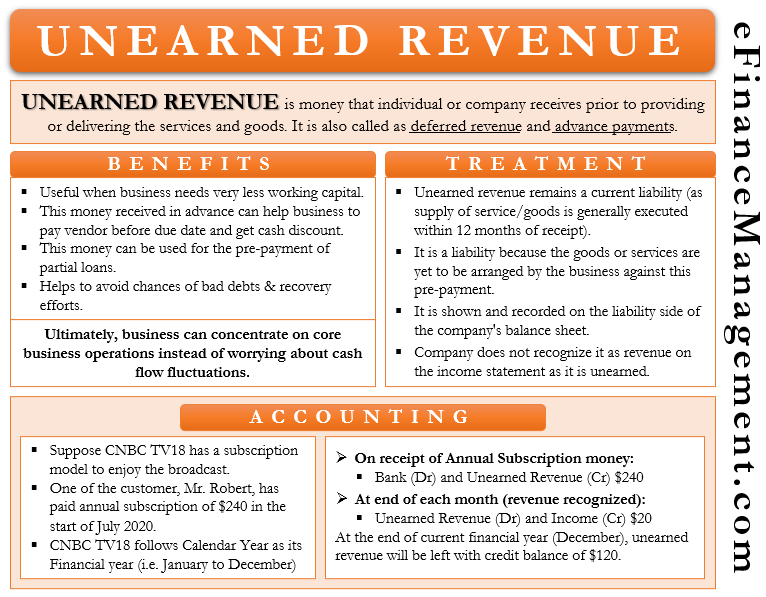

Unearned revenue is the money that the individual or company receives before providing or delivering the services and goods. It can be the prepayment for the goods and services that a person or a company is to provide to the purchaser in the future. This prepayment is the liability for the seller equal to the revenue earned until the company provides the services.

The unearned revenue is also called as deferred revenue and advance payments.

Meaning

The companies which sell their products on a subscription basis are the ones who commonly use this method and have a good amount of unearned revenue during and at the end of every year. The subscription-based services and products generally require the customer to subscribe and make payments in advance. This advance payment could range from a period as low as a week to a year or more even. A few examples of such unearned revenue are advance payment of rent, OTT subscription, payment of apartment maintenance expenses, purchase of airline and train tickets, magazines and newspaper subscriptions, the annual payment for the use of software, license fees, etc.

Advantages of Unearned Revenue

Receiving the payment before fulfilling the services has many benefits:

- In such business models, the business may need a very, very limited amount of working capital, thus saving a lot on interest costs.

- Instead, the business can deploy this advance cash received gainfully and earn interest or get cash discounts from the vendors.

- This cash money can be used for the pre-payment of partial loans reducing the ultimate borrowing costs.

- The advance receipt also avoids the chances of bad debts and recovery efforts.

- Thus, the business can concentrate on the core business operations instead of worrying and managing cash flow fluctuations regularly.

Treatment of Unearned Revenue

As we understood from the earlier explanation, unearned revenue is an advance or pre-payment. Or like pre-payment expenses, this is also a kind of pre-payment receipt. Hence, its treatment should also be like the treatment we give to pre-paid expenses in our books of account.

Therefore, as we treat pre-paid expenses as our assets, this unearned revenue remains a liability for the company. It is a liability because the goods or services are yet to be arranged by the business against this pre-payment. And hence, this is shown and recorded on the liability side of the company’s balance sheet. Moreover, since the business or service is not executed as yet, this money can not be treated by the business as revenue earned. Therefore, the company does not recognize it as revenue on the income statement, and it directly appears on the balance sheet.

Further, this unearned revenue finds a place in the balance sheet as part of the current liability. Because usually, all such supplies or services are executed within a period of 12 months. Of course, the ultimate or full delivery may take more than a year in a few situations. Hence, sometimes it could be shown in the balance sheet under the heading, long-term liability.

Accounting and Journal Entries

As we know, the accounting system follows certain basic principles. One of the principles is Revenue Recognition. As per this principle, any receipt or payment received from the customer can not be treated as revenue. It becomes revenue only when the company has completed all those activities (supply of goods or services) that have been agreed between the parties for that deal. Therefore, the pre-payment is no more revenue earned until the business supplies the goods or services to the customer. Hence, it would remain a liability and can not find a place in the income statement and will continue to remain a part of the current liability.

Example of Unearned Revenue

Suppose CNBC TV18 has a subscription model to enjoy the broadcast. Depending upon the types of services, the monthly subscription varies from $25 to $100. As usual, it provides a concessional rate for half-yearly and yearly subscription packs. So, Mr. Robert has subscribed to its basic plan of $25 a month but with a yearly subscription offering, say @$250. And this subscription runs from 1st July to 30th June. And assume the calendar year is the financial year for the company.

Here, the subscription amount of $240 is a pre-payment receipt or unearned revenue for the company. Because no services have so far been availed by or provided to Mr. Robert. Moreover, 6 months will fall during the current financial year, and the later part of 6 months will fall in the next financial year.

Journal Entries for Unearned Revenue

The stagewise journal entries will be as follows:

- Invoice raised and money received for an annual subscription from Mr. Robert.

(a) Subscription Receivable A/c Dr 240

To Unearned revenue A/c Cr 240

(b) Bank Account Dr 240

To Subscription Receivable A/c Cr 240

As we discussed, since the entire money received today is unearned, Unearned Revenue will be credited, and thus a liability is created.

2. At the end of each month, the subscription revenue earned toward the services provided during the month needs to be taken to the revenue account. Therefore, every month an amount of $20 (240/12) will be taken to the subscription account. And the entry would be

Unearned Revenue A/c Dr. 20

To Subscription A/c Cr. 20

In the alternate, a lump sum entry for 6 months (July to December) can also be passed to account for the subscription earned against the services provided belonging to the current year.

3. At the end of the current financial year (December), the unearned revenue will be left with a credit balance of $120 after debiting the 6 months earned revenue. This will be taken to the balance sheet as part of the current liability. And this will again be adjusted in the next financial year as earned revenue by June of the next financial year.

Importance of Recognizing

Unearned and earned revenue is significant to accurately report in the income statement and liabilities side of the company’s balance sheet. It protects against the treatment of this as an asset or income and thus guarding against the overvaluation of the company’s net worth.