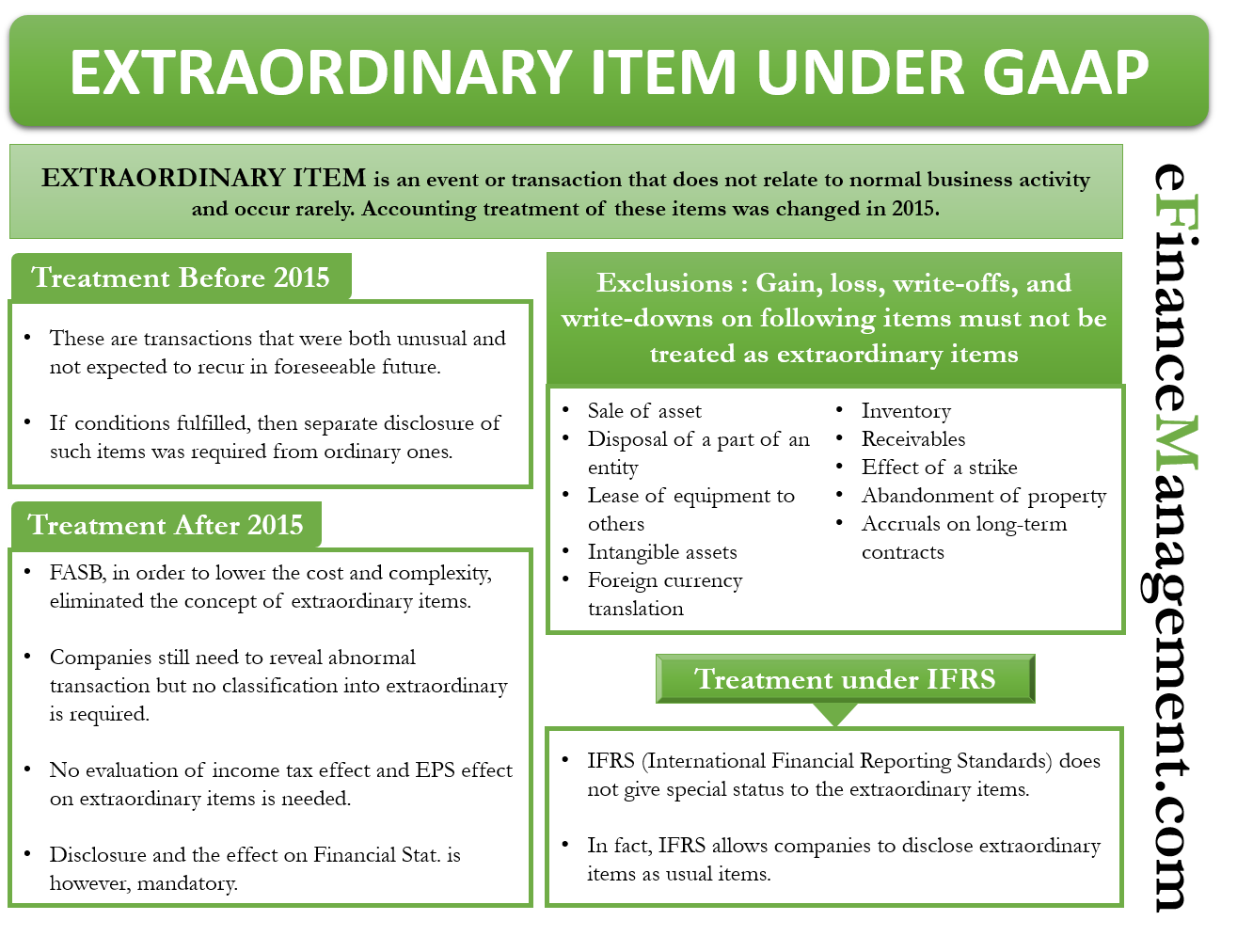

Extraordinary items in accounting are an event or transaction that does not relate to normal business activity and occur rarely. The treatment of extraordinary items under GAAP (Generally Accepted Accounting Principles) was changed in 2015.

Treatment Prior to 2015

Extraordinary items were defined as transactions that were both unusual and not expected to recur in the foreseeable future. So, if an event or transaction meets both these requirements, then the company needs to separate the transaction from ordinary operations.

Before 2015, companies had to spend a lot of time determining if a specific transaction or event was an extraordinary item. After that, a company had to show any gains or losses (net of taxes) from the extraordinary items separately on the income statement after calculating the income from continuing operations. Extraordinary items were shown separately from the operating earnings, as the former is one one-time gain or loss. Also, companies do not expect these transactions to recurring in the future.

Why Extraordinary Items were Eliminated?

Financial Accounting Standards Board (FASB), in 2015, did away with the concept of extraordinary items. They did this mainly to lower the cost and complexity of making the financial statements. FASB found that it is extremely rare for companies to report extraordinary items. However, auditors and regulators still spend a lot of time deciding if an event requires special reporting.

The threshold for extraordinary items under GAAP was so high that only a few businesses reported them. When FASB was discussing about eliminating extraordinary items, it found only 30 instances of extraordinary items over the past five years. Moreover, events such as September 11, 2001, terrorist attacks, and the Japanese tsunami in 2011 didn’t even qualify as extraordinary items.

Treatment of Extraordinary Items under GAAP

A point to note is that FASB only did away with the need for companies and auditors to identify whether a transaction or event is so rare to qualify as an extraordinary item. Companies still need to reveal abnormal transactions or events, but they now don’t have to differentiate them as an extraordinary items. Also, companies now don’t need to evaluate the income tax effect on extraordinary items. Moreover, there is no need to present an EPS (Earnings Per share) effect.

So, the reporting and disclosure requirements for extraordinary items remained more or less intact even after the GAAP update. Companies no longer need to describe such events and their effects. But, they do have to disclose the unusual events and their effect on the income statement. Also, extraordinary items under GAAP can now be given more specific names, such as “loss from a fire at the factory.”

GAAP specifically noted that gain, loss, write-offs, and write-downs on the following items must not be treated as extraordinary items;

- Sale of asset

- Disposal of a part of an entity

- Lease of equipment to others

- Intangible assets

- Foreign currency translation

- Inventory

- Receivables

- Effect of a strike

- Abandonment of property

- Accruals on long-term contracts

An example of an event classified as extraordinary is the destruction of the facility by an earthquake. Or damage to crops from the weather in the region where such damages are rare.

Treatment Under IFRS

IFRS (International Financial Reporting Standards) does not give special status to the extraordinary items. There is no special distinction for items of operational nature that are rare. In fact, IFRS allows companies to disclose extraordinary items as usual items, such as revenue, post-tax gains or losses, finance costs, and more.

IASB (International Accounting Standards Board), the organization overseeing IFRS, ceased recognizing extraordinary items since 2002. Prior to 2002, IFRS had a separate disclosure requirement for the income or expenses of abnormal size or nature. Such disclosures either came in the income statement or the notes section of the report.

RELATED POSTS

- All 10 GAAP Principles – Meaning, Importance And More

- Comprehensive Income – Meaning, Purpose, And More

- Difference between Income Statement and Statement of Comprehensive Income

- Changes in Accounting Policies – Reason, Disclosure, Exemption and Example

- Types of Accounting Transactions – Explanation and Examples

- Accounting Information