What are the differences between Cash and Accrual Accounting?

Cash and accrual accounting are the two methods of accounting used by businesses to record transactions in their books of accounts. Every business needs to maintain its books and keep them up to date for better management in the long term. For that matter, irrespective of its structure and size, it needs to keep details of all the monetary transactions. Cash and accrual basis of accounting are the two methods widely used for this purpose. The difference between cash and accrual accounting is the ‘timing’ of recording income & expenses in books of account. Before one decides on which method of accounting to opt for, one must understand the meaning and the differences between the two.

Meaning of Cash and Accrual Accounting

Let us first discuss the meaning, and then we will detail the difference between cash and accrual accounting in the following paras.

Accrual Accounting

It is the accounting method where the transactions are recorded as and when they happen. The key is the occurrence of the event or the happening of the transactions. The transfer of money between the two transacting parties is not important. The transaction is recorded immediately after it occurs. Thus in this method, the transactions are recorded when the amount becomes due/payable or whenever the money becomes receivable.

Cash Accounting

In cash basis method of accounting, the main event is the exchange of money. Therefore, this method only records the transactions when the money transfers between the transacting parties. Thus, we can say that in this accounting method, the time of the event occurrence is of no importance. That means whether the activity or event had taken place in the past, present, or future is of no concern to the accounting staff. The movement of money is the only concern for the accounting staff.

Also, read Accrual vs Deferral.

Difference between Cash and Accrual Accounting

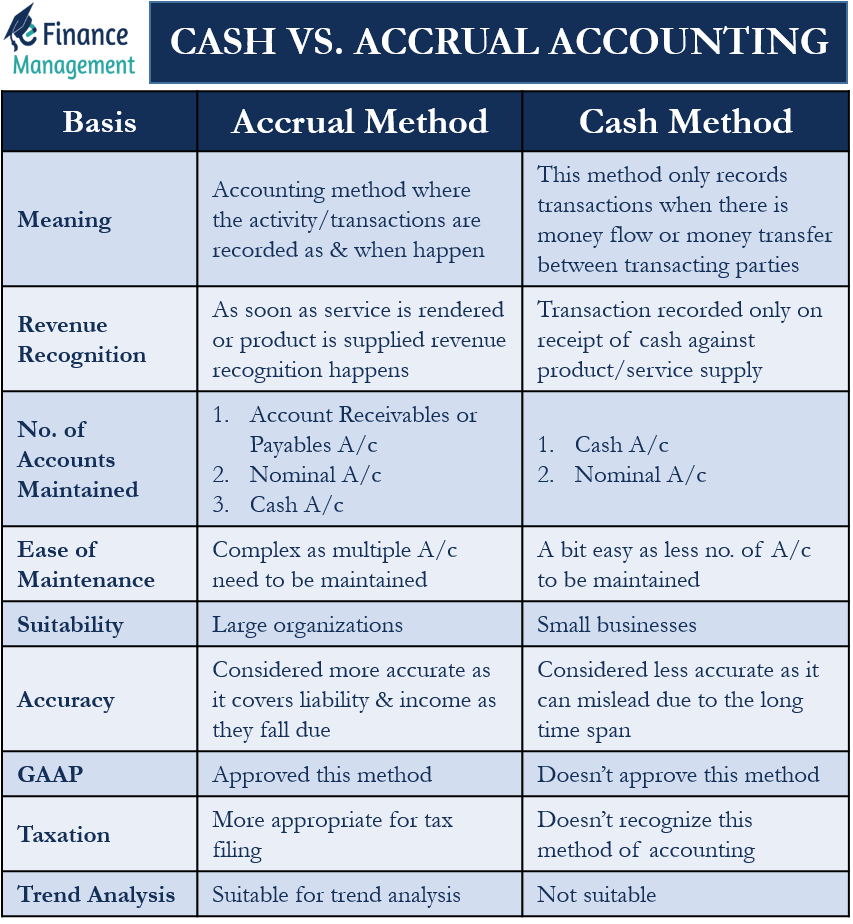

As we now understand the meaning of these two accounting methods, let us now understand the key differences between the two methods. The key differences are:

| Basis | Accrual Method | Cash Method |

Revenue Recognition |

Revenue recognition happens as soon as the transaction is concluded. That means as soon as the service is rendered or the product is supplied or receipt of payment, whichever is earlier. |

Here, the transaction will be recorded only on receipt of the cash against the product or service supply. |

No. of Accounts Maintained |

For every transaction, usually, the entries happen in three accounts :

|

In cash accounting usually, entries happen only in two accounts :

|

Ease of Maintenance |

This is a slightly cumbersome task as it requires multiple accounts to be maintained. |

This is an easier task as a lesser number of accounts are to be maintained |

Suitability |

It is suitable for large organizations. Because they do transactions on credit also. And the movement of cash and the happening of transactions usually have different dates and volumes. |

This is suitable for small businesses as, normally, their day-to-day transactions are of a cash nature. |

Accuracy |

It is a more accurate method as it covers the liability and income as they fall due, like payables and receivables. This is in line with the standard accounting principles. Because this way, it records all income and expenses during the accounting period itself. Thus this helps in reflecting the true and fair position of the business and performance for the period. |

This method is considered less accurate. Sometimes, it can mislead due to the long time span of the actual payment made or received. It makes it difficult to make a periodical comparison also. And does not give the true idea of the performance of the business. |

GAAP |

The GAAP approves this method |

The GAAP does not approve this method |

Taxation |

This method is more appropriate for tax filing as it is believed to be more accurate in reality. And the taxation guidelines also work on similar lines. |

This method does not convey the actual performance of the period and is less accurate. Hence, the taxation rules generally do not recognize this method of accounting. And for all taxation purposes, the taxpayer has to make proforma, necessary adjustments to the profit and loss account derived using this method. |

Trend Analysis |

This is suitable if a company wants to know its trend analysis as it takes the events into account as soon as they occur. |

This is not suitable for trend analysis as the transactions are recorded after the payment is received or made. It might be possible that the payment is made before or after the occurrence of the event, so this will not give a fair view. |

Example of Cash and Accrual Accounting Methods

A Ltd., a supplier of clothes, sold goods of $500,000 to X Ltd. on 15th January for cash. The transactions will be recorded in the following fashion under both these methods:

On Cash Basis

Journal entry for the sales transaction on 15th Jan:

| Date | Particulars | Dr. Amount | Cr. Amount |

|---|---|---|---|

| 15th Jan | Cash A/c Dr. | 500,000 | |

| To Sales | 5,00,000 | ||

| (For goods sold on a cash basis) |

On Accrual basis

Let us assume the credit period to be 1 month for the transaction that happened on 15th Jan. In this case, there will be two separate entries passed on two different dates – the first one on the date of the transaction and the second one on the date when the money will be received after one month, as discussed below:

| Date | Particulars | Dr. Amount | Cr. Amount |

|---|---|---|---|

| 15th Jan | X Ltd. A/c Dr. | 500,000 | |

| To Sales A/c | 500,000 | ||

| (For goods sold on credit) |

| Date | Particulars | Dr. Amount | Cr. Amount |

|---|---|---|---|

| 15th Feb | Cash A/c Dr. | 500,000 | |

| To X Ltd. | 500,000 | ||

| (For cash payment received) |

Conclusion

Since both methods have their own benefits and drawbacks, it is difficult to say which is best among the two methods. It depends upon the size of the business and the nature of the business too. So the preference or choice has to be made in line with the business requirements. The difficulty or ease for the purpose of taxation also remains an important consideration to avoid a lot of duplication.

Continue reading Fundamentals of Accounting to learn about various other accounting fundamentals.

Many thanks for your good efforts Allah bless you