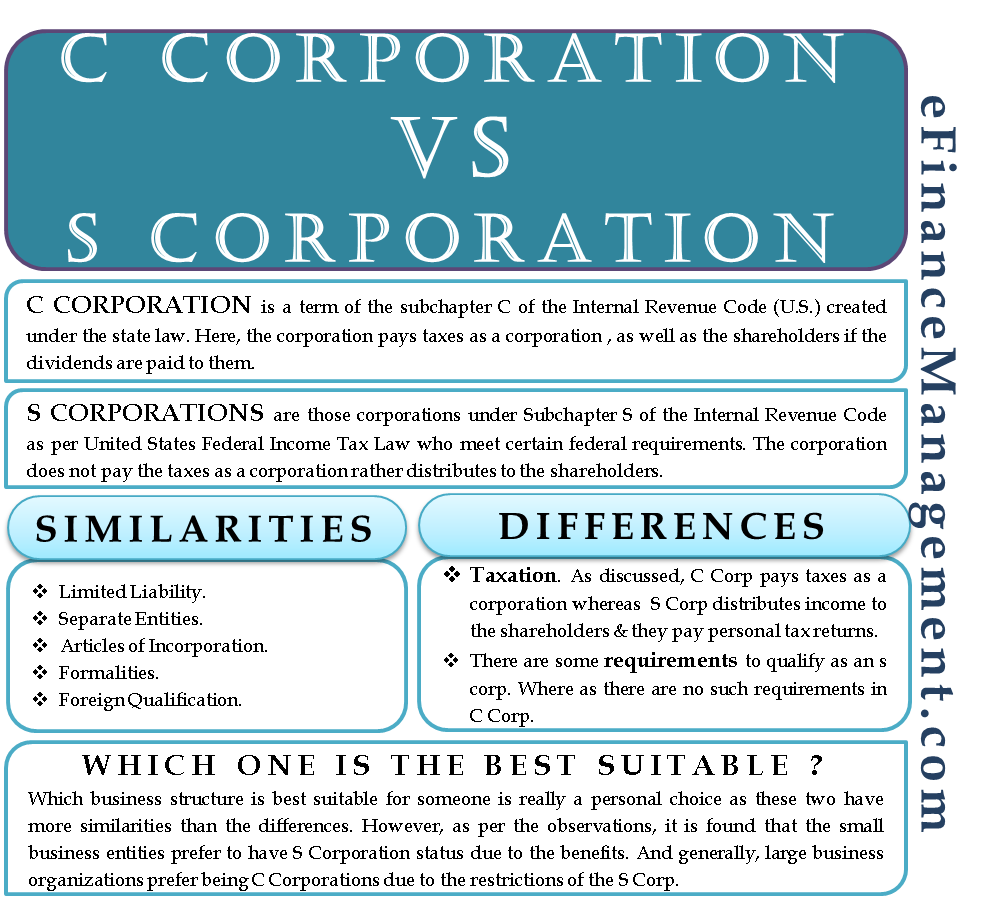

When one wants to start a business, he has to decide which business structure he should opt for. There are many business structures such as LLC (Limited Liability Company), corporations, general partnerships, sole proprietorship, etc. But to start a corporation, one needs to decide which corporation is to be formed? Whether C or S? Hence, in this article, we discuss the similarities and differences of both of them so that one can come to know which business is to be started.

What is C Corporation?

C Corporation is a term of the subchapter C of the Internal Revenue Code (U.S.) created under the state law. Here, the corporation pays taxes and the shareholders on the dividends paid to them.

What is S Corporation?

Whereas S Corporation, under the subchapter S of the Internal Revenue Code (U.S.), is also created under state law. But they need to file Form No. 2553 (Election by a small business corporation) to achieve S Corp. status. Here, the income or the losses are distributed to the shareholders. The shareholders then pay taxes on their own personal tax returns at the rates applicable to them.

C Corporation Vs. S Corporation- The Similarities

Limited Liability

There is limited liability of the shareholders, meaning they don’t have to pay from their personal pockets for the debts and obligations.

Separate Entities

Both are treated as separate entities different from their owners under the law.

Articles of Incorporation

Both of them have to file this document within the state. Regardless of C or S corp., this document is called Articles of Incorporation or Certificate of Incorporation.

Also Read: Corporation

Formalities

The corporate formalities are also more or less the same for both of them. Whether it is C or S Corporation, they both have shareholders, employees, members, officers, etc. The shareholders elect the board of directors who make decisions and oversee the policies and strategies. Formalities include conducting meetings, keeping accurate records, filing annual reports, returns and fees, issuing stock, directors and board meetings, etc.

Required a foreign Qualification

If the owner is doing business in a state other than his state of incorporation, he needs to comply with certain legal formalities. This may include hiring a registered agent, payment of annual fees, etc.

C Corporation Vs. S Corporation- The Differences

Taxation

In C Corp, the corporation pays taxes at the corporate level. These are separate taxable entities. They file Form 1120 to pay for tax returns. If there is a dividend distribution, the shareholders need to pay taxes on that as well after paying at the corporate level. Hence, the issue of double taxation arises here. But if the profit distribution is in the form of salary, any benefits or bonuses, etc., it reduces the tax expenditure. It would help the deduction as an expenditure while reporting the financial statements at the end of the year. But still, some shareholders who may not be the employees cannot escape from dual taxation. In the case of loss, they can only be carried forward to reduce tax liability, unlike S Corporation, wherein it is actually set off against the income.

Whereas S Corporation is a pass-through tax entity. There is an income or loss allocation to the shareholders on the basis of the contribution of their capital to the corporation. Their contribution calculation would include the initial contribution plus any subsequent contribution, less any distributions made, divided by the total amount of the capital of all the shareholders. On the basis of this ratio, they pay taxes on their own personal tax returns at the rates applicable to them. Also, there is a benefit in case of losses; they can be set off against any other income they have.

Also Read: C Corporation

Requirements

The state laws make no difference between the two of them in case of requirements. However, to elect as an S Corp, one needs to fulfill certain requirements such as:

- S Corp cannot have more than 100 shareholders. Also, they need to be U.S. citizens only.

- Certain estates, trusts, and individuals with only one stock are only allowed to form an S Corp.

- Ineligible persons are nonresidents, aliens, partnerships, and corporations.

Whereas there is no such compulsion in C Corporation regarding the number of shareholders. Also, they have flexibility in issuing employee stock options which gives some shareholders more voting power than the others. Also, the shareholders need not be natural citizens of the country. They can be corporations or partnerships.

However, which business structure is best suitable for you is really a personal choice as it has more similarities than differences. Hence, the above-discussed similarities and the differences will help you find the best suitable option out of the two. However, as per the observations, it is found that the small business entities prefer to have S Corporation status due to the benefits. And generally, large business organizations prefer being C Corporations due to the restrictions of the S Corp.