To better understand the advantages and disadvantages of corporations, let’s understand them with the help of an example. Sam is the owner of a retail chain that has started to grow rapidly. However, to take advantage of the growth, he needs more money to support the business. He is also more concerned about liabilities if something goes wrong without his personal fault in such a large business. Considering his case, Tom, a very learned friend and advisor of Sam, advised him to convert his business into a corporation.

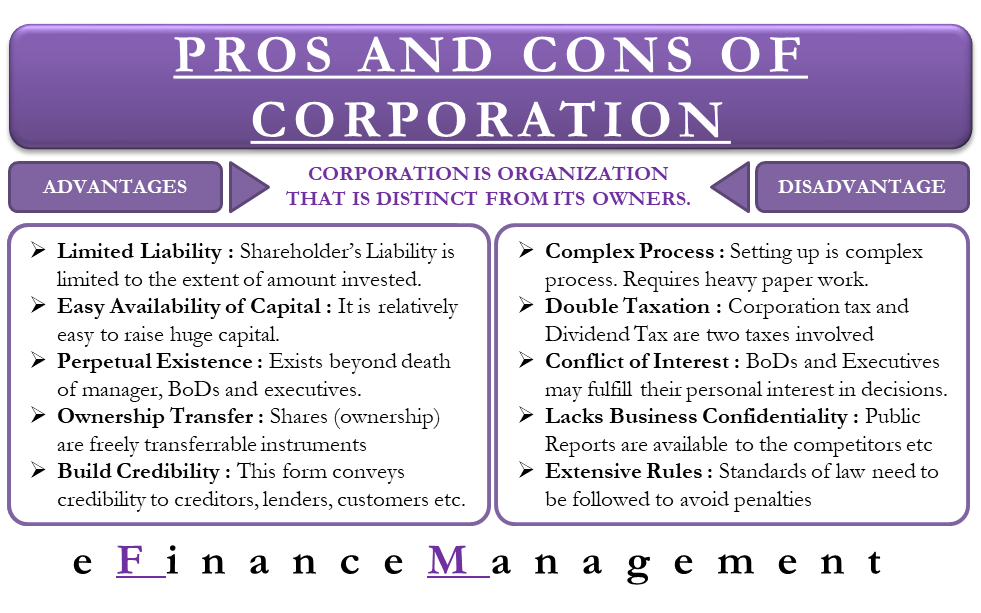

A corporation is a business organization that is distinct from its owners. Shareholders are the owners of a corporation. Shareholders, however, do not run the corporation. They appoint the Board of Directors, who oversee the corporation’s activities. This Board of Directors appoints the officers of the corporation to run the day-to-day operations. The Board of Directors appoints the CEO, CFO, and the COO, among other Chief Executives of the corporation.

Corporations enjoy most of the rights and responsibilities that an individual has: they can enter into contracts, take a loan, sue, and be sued, own assets, pay taxes, hire employees, etc. Some refer to a corporation as a ‘legal person.’ To know more about it, let us see the advantages and disadvantages of a corporation.

Advantages of Corporations

Before converting his business into a corporation, Sam wants to be clear on what he will gain by setting up a separate legal entity. The biggest advantages of having a corporation which Sam could list down are:

Also Read: Corporation

Limited Liability

In a corporation, the company owners are only liable for the amount of money they have invested through purchasing shares. This means that if the company goes bankrupt and has no money left to pay back the creditors and lenders, the money invested by its shareholders into the company (by purchasing its shares) will be used to pay back the creditors and lenders. Hence, the shareholders will lose the amount invested. However, creditors and lenders have no claim on the personal properties and assets of the owners. This is what limited liability means: limited up to the extent of the amount invested.

Easy Availability of Capital

In a corporation form of business organization, it is relatively easy to raise huge sums of capital through the public. Since the total money a company wishes to raise is divided into thousands and lakhs of shares, the price of each share comes out to be very small. A small price allows a number of people to purchase the shares of the company. Hence, it becomes easy to raise a big amount for a corporation by dividing it into smaller units.

Corporations have Perpetual Existence

Another good thing about corporations is that they keep on existing even if the people in charge, like the Board of Directors, executives, and managers, pass away. The corporation’s existence only ends when the Board of Directors and the top executives choose to close it. So, if important people unexpectedly die or get sick, there’s no need to worry. Someone else will step in to take their roles. This also helps the managers make long-term plans and do a better job.

Easy Transfer of Ownership

Ownership in a corporation is typically easy to transfer. In the case of a public company, the shares (instruments of ownership) are freely transferrable. However, in the case of a private company, it is comparatively difficult to transfer shares as there are some restrictions.

Builds Credibility

A corporate form of business organization is considered more stable than other forms of business organization. Also, when you set up a corporation, you can attract top talent in the market to grow your business rapidly. Hence, a corporation conveys the credibility of your business to suppliers, customers are other stakeholders of the business.

Disadvantages of Corporations

There are certain disadvantages of setting up a corporation that Sam must consider before getting into it.

Complex Process

Forming a corporation is an intricately involved procedure, necessitating substantial documentation. Owners must secure numerous approvals from diverse regulatory entities. Furthermore, a corporation is required to meet various standards mandated by different regulatory bodies prior to initiating its business activities. E.g., Sam will have to ensure that his business meets all the criteria set by stock exchanges if he wishes to list his business. All this takes a long time to conclude, which may demotivate the founders.

Double Tax

Till now, all the profits made by Sam’s business were his income, and so he had to pay only a single tax on his income. But, as Sam comes to know, the owners and the promoters of a corporation are taxed two times on their income. Firstly, the corporation has to pay a flat Corporate Tax on its profits. And then, the dividends received by the shareholders are taxed in their hands. This makes it less attractive for business owners to set up a corporation.

Conflict of Interests

If Sam converts his business into a corporate, he will end up giving the decision-making power in the hands of the Board of Directors and the appointed officers. Sometimes, it happens that the Board of Directors and the executives may fulfill their personal interests by making certain decisions. These decisions may not be good for the health of the corporation. E.g., they may decide to pay themselves higher salaries out of the profits, or they may purchase luxury offices for them with expensive facilities, etc. All these types of personally beneficial decisions may harm the corporate. And its image, especially if the corporate is not making good profits.

Corporations Lack Business Confidentiality

After setting up a corporation, Sam will lose the confidentiality of his business. As part of the federal rules and regulations, a corporation must provide shareholders with an annual report and various other reports. These reports present data on sales volume, new assets, profits, debts, and many other qualitative and quantitative information. Since these reports are available for the general public, Sam may end up disclosing his business strategies to his competitors.

Extensive Rules to Follow

There are many standards set by law on how corporations should govern themselves. E.g., corporations must have a Board of Directors, hold meetings at regular intervals, keep certain records and publish some documents and reports periodically. A small mistake of manipulation by any of the top executives could penalize the corporate heavily. E.g., if the accounts department forgets to disclose a liability, say, a bank loan, the federal government may consider it as a fraud and penalize the corporate. Due to this, the corporate may gain a bad image, and its valuation in the stock market may go down. Hence, Sam may get punishment for something which was not under his proper control.

Quiz on Advantages and Disadvantages of Corporations

This quiz will help you to take a quick test of what you have read here.

The lecture is excellent,it contains perfect information about corporation.

It is helpful

it was so helpful and beneficial for improving my knowledge about corporation.

thank you so much.

Hi Mery,

We are glad you liked our content.

Thanks for sharing your experience with us.

Thanks To You The Writer For Good Work Done

Thank you for posting this article.

It is of great value