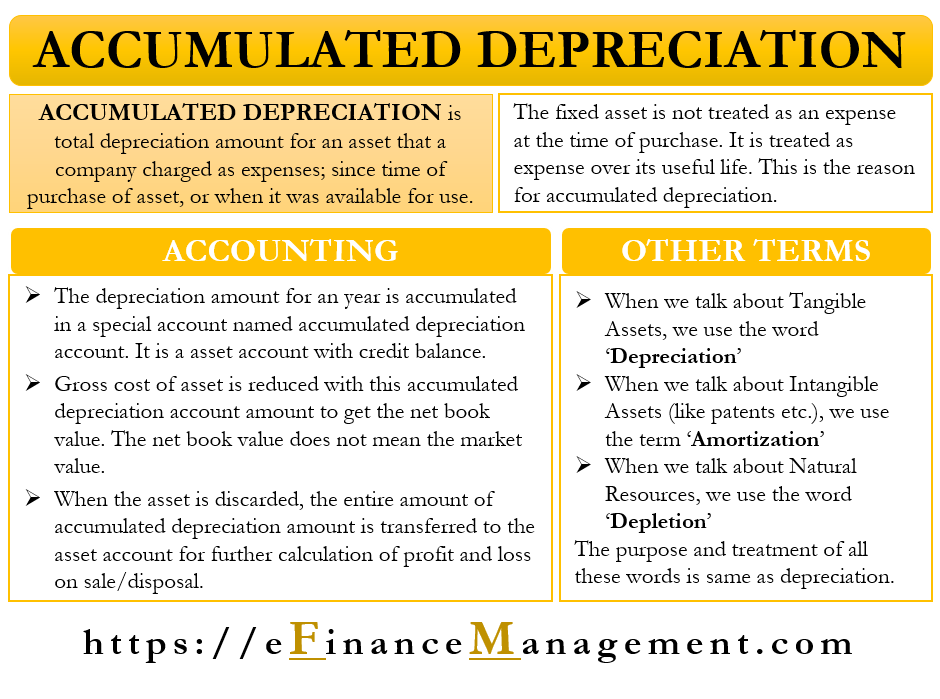

Accumulated depreciation is the total or cumulative depreciation amount of an asset. That is to say; this accumulation is since its purchase by the company and up to a specific date. Or, we can say it is the total depreciation amount for an asset that a company charged as expenses; since the time of purchase of the asset or when it was available for use. In short, we can also say it is the sum of the annual depreciation amount provided so far for the fixed asset.

The accumulated depreciation amount increases over time as more depreciation accumulates. Or, we can say it goes on increasing as the yearly depreciation amount accumulates. This A/D amount will rise quickly if the company uses an accelerated depreciation method. Under this method, a higher provision of deprecation remains in the initial years.

Why Accumulated Depreciation?

We capitalize fixed assets as and when a company purchases them. That is to say, a company does not treat it as an expense when it acquires the asset. However, the company recognizes its cost over its useful life through depreciation. A company treats this depreciation amount as an expense.

Such a treatment is in-line with the GAAP’s (generally accepted accounting principles) matching principle because the company recognized the proportionate cost of the asset in the years when it contributed to producing revenues.

Also Read: Depreciation

Accounting

The amount of yearly depreciation comes under a particular account, the accumulated depreciation account. It is an asset account with a credit balance, or specifically a contra asset account. In other words, A/D comes on the asset side, and the gross value of assets is subject to the deduction of this amount.

Gross cost or the historical cost is the original price of the asset or the amount representing the asset’s purchase price. If we subtract the accumulated depreciation amount from the initial cost, we get the net cost of the asset or its current book value. It is the amount that comes on the balance sheet.

Such treatment allows stakeholders to quickly determine the relative age of the asset, depreciation, and its value on the books. A point to note is that the current book value is not the market value of the asset. It is because depreciation is just an allocation technique.

Some companies do not reveal the amount of A/D on the balance sheet. They only show the net asset value. To find the A/D amount in such a case, you will have to search the financial statement disclosures from the company.

Also Read: Accelerated Depreciation Method

When the company discards or sells the assets, it transfers the entire balance of the accumulated depreciation account to the asset account. It combines this amount with any profit or loss from the sale of fixed assets. It allows it to eliminate the asset (original cost) from the balance sheet. In the absence of such entries, a business would build up a large number of fixed assets on the balance sheet.

Example

Let us understand the journal entries with the help of a simple example. Company ABC buys machinery costing $10,000 and estimates its useful life for ten years. The company uses a straight-line method to charge depreciation. The machine has no scrap value.

In this case, the annual entry for charging depreciation to the accumulated depreciation account will be:

Depreciation Expense Dr. $10,000

Accumulated Depreciation Cr. $10,000

At the end of five years, the A/D, in this case, will be $50,000, but the yearly depreciation will remain the same at $10,000.

After ten years, when the company retires the machine, it will pass the following reverse entry. And it will remove the asset and the accumulated depreciation from its accounts:

Accumulated Depreciation Dr. $10,0000

Assets – Machinery Cr. $10,0000

In the above example, we used the straight-line method to calculate the depreciation. However, a company can also decide to use the diminishing balance method for the purpose. And in this method, even the A/D amount at the end of the asset’s useful life will be $10,0000. But the annual depreciation amount (except for the first year) will be different.

As advised by the IRS, the companies should use MACRS (Modified Accelerated Cost Recovery System) method to depreciate the assets. This method is the same as the diminishing balance method, with a difference that in this IRS decides the asset’s life based on asset type.

Accumulated Amortization and Depletion

Accumulated Amortization and Depletion are similar to the accumulated depreciation. All are contra-asset accounts and work the same way, with the only difference being the asset they relate. Whenever we talk about tangible assets, for example, property or plant and equipment, we use the term depreciation.

And, for intangible assets, like patents, licenses, or trademarks, we use the term amortization. Similarly, when talking about natural resource-related assets, we use the term depletion like mines or oil platforms.

Good

Good analysis