Soft Currency: Meaning

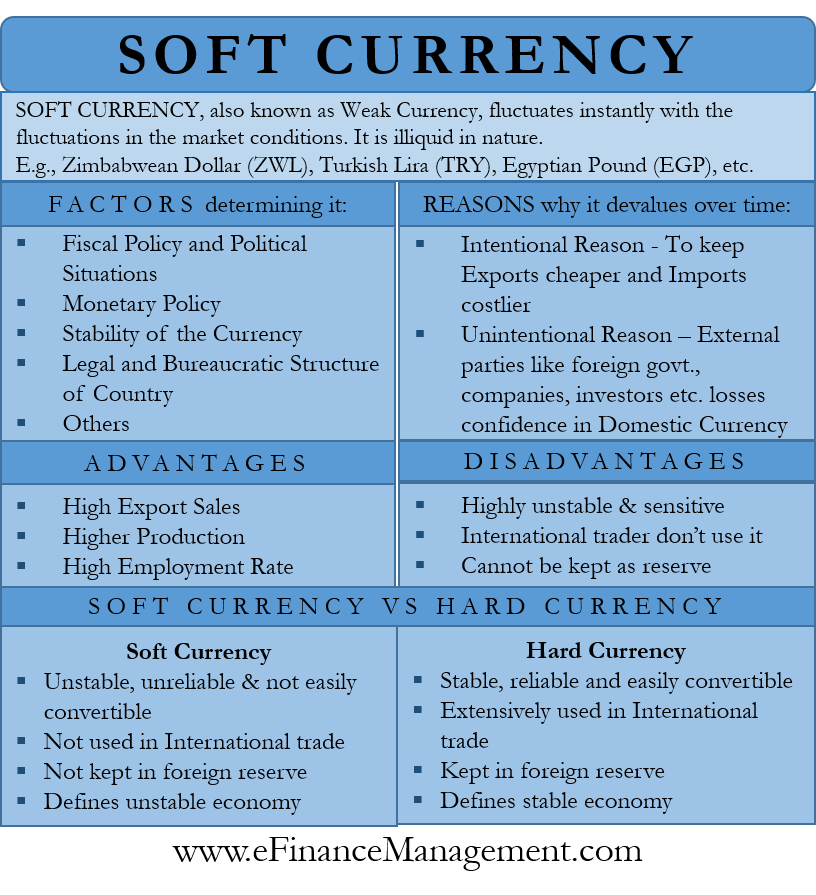

Soft Currency is a currency that fluctuates instantly with the fluctuations in the market conditions. Moreover, this type of currency is highly volatile in nature and reciprocates directly to the external and/or internal environment. Soft Currency is mostly seen in developing countries where the economic and political conditions are sensitive in nature. Since this type of currency is unstable in nature, it is mostly not preferred as a foreign exchange reserve by the counties. International traders also avoid trading in the soft currency because of this instability. Soft currencies are illiquid in nature.

Often, the countries with a soft currency peg their currency to some stable and globally recognized currency. Most countries with soft domestic currency face a lot of hyperinflation, and the Gross Domestic Product (GDP) of the country is also very low. When it comes to foreign open markets, the soft currency mostly has very less value. As a result, it isn’t easy to trade in an international open market with the help of soft currency. Although in a black market, soft currency can be traded for hard currency. Due to various circumstances, a hard currency today can turn into a soft currency tomorrow and vice versa.

The other name for Soft Currency is Weak Currency.

Factors Determining Soft Currency

There are many factors used to differentiate between hard currencies and soft currencies in the international markets. Following are a few factors that help in the identification of soft currencies:-

Fiscal Policy and Political Situations

The first important factor is the fiscal policy and political spectrum of the country. If a country shows weak signs in its fiscal policies, then there are very few chances of economic growth and development. Secondly, if the political situation is volatile with continuous change in political parties and ruling body, then also it creates a negative influence on the growth and development of the country. All these fiscal and political situations hamper the currency and make it a weak currency. As a result, mostly a country with a low-key fiscal and political situation has a weak currency.

Monetary Policy

Secondly, the important factor is the monetary policy of the country. Mostly, the Central Bank of the country formulates monetary policy, which regulates the printing and circulation of the currency in the economy. A weak monetary policy might increase the supply of currency in the economy, leading to a devaluation of the currency. Thus monetary policy is a second factor.

Stability of the Currency

The third important factor is the stability of the currency. The currency, which has been stable over the years, is not a weak currency. If the country’s monetary and fiscal policy is satisfactory, but the currency has been unstable over the years. In this situation also, the currency tends to be a soft currency only. The long-term stability of the currency is of immense importance.

Other Factors

The fourth important factor influencing the nature of currency is the legal and bureaucratic structure of the country. If the country has a weak legal and bureaucratic structure in place, then it might turn out a hard currency into a weak currency. If a country is facing a lot of corruption, then it might hamper the growth of the country. A country with a high corruption rate creates a negative impact and, as a result, might have a weak currency in place. A stable and strong military protects the country from invaders. There are high chances that a country with a weak military can easily be a prime target for invaders.

All these factors or even one factor might lead to the country’s currency being classified or treated as a soft currency. The factor responsible might change from country to country.

These factors are non-exhaustive in nature.

Why Soft Currency Devalues Over Time?

There could be majorly two reasons which could lead to the devaluation of the soft currency. Firstly the developing countries might intentionally devalue the currency. In order to keep the exports cheaper and imports costly, the developing counties intentionally devalue the currency. Devaluation of the currency can be done by making changes in the money supply and monetary policy of the country.

The second reason is an unintentional attempt, which leads to the devaluation of the currency. External parties like foreign governments, companies, investors, etc., lose confidence in the domestic currency. This could be because of many factors, including the factors mentioned earlier.

These reasons are non-exhaustive in nature.

Advantages of Soft Currency

Soft Currency is advantageous only when the country is benefiting from its exports. A weak currency will lead to higher export sales, which will ultimately lead to higher production followed by a higher employment rate. Sometimes, developing countries face a trade deficit, where imports are higher than their exports. In such a situation, the country intentionally devalues the currency, making it a weak currency.

Disadvantages of Soft Currency

- First of all, one of the biggest disadvantages of a weak currency is that it is highly unstable and sensitive in nature. It reacts directly to the internal and/or external environment.

- International traders do not trade in weak currencies. As a result, these currencies are illiquid in nature.

- The instability of the currency makes it less popular as a reserve amongst the countries. Its sensitive nature stops it from becoming part of the reserve.

- Mostly, a country with a weak currency is unable to attract many foreign traders/investments. This is because of the lack of authenticity exists in the domestic currency. The unstable political atmosphere also drives away prospective investors.

- A country with a weak currency mostly faces low GDP and hyperinflation.

- People do not trust weak currency as much as they trust hard currency. People expect a weak currency to quickly fluctuate in its value in the long run.

- Weak currency loses the purchasing power in a real quick manner if the currency starts collapsing.

These disadvantages are non-exhaustive in nature.

Real-Life Examples

There are many real-life examples of countries having soft currencies. These major weak currencies are Zimbabwean Dollar (ZWL), Venezuelan Bolivar (VEF), Syrian Pound (SYP), Turkish Lira (TRY), and West African Franc (CFA), Egyptian Pound (EGP), etc.

Soft Currency Vs. Hard Currency

| Soft Currency | Hard Currency |

|---|---|

| Weak Currency gets directly influenced by the internal/and/or external markets. | Hard Currency or Strong Currency is not directly influenced by the internal and/or external market. |

| Mostly, developing countries and unstable economies have a weak currencies. | Mostly, developed countries and stable economies have hard currency. |

| Generally, Soft Currency is not kept in the foreign reserves by the government and/or the central bank of the country. | Generally, Strong Currency is kept in the foreign reserves by the government and/or the central bank of the country. |

| Mostly, Soft Currency is not used in international trade. | On the other hand, Hard Currencies are extensively used by counties in their international trades. |

| A country with a weak currency mostly faces unemployment, lower GDP, and hyperinflation. | Whereas a country with a hard currency mostly has an acceptable level of employment, inflation, and GDP growth. |

| Weak Currencies are comparatively unstable, unreliable, and are not easily convertible. | Whereas, Strong Currencies are stable, reliable, and easily convertible. |

These differences are non-exhaustive in nature.

Conclusion

According to some experts, irrespective of many criticisms of Soft Currency, most of the currencies of the world are soft currency only. There are only a few currencies that are hard currency in nature. Although there are many criticisms of the soft currency, it is still an important tool useful for domestic transactions. Export-oriented countries get benefits from the weak currency in an international market. Thus Weak Currency plays an important role in the international environment.