Stock Split Definition

A stock split of 5:1 means breaking down of 1 share of $10 face value into 5 shares of $2 face value. In other words, it is an action by the board of directors to divide the company’s outstanding shares into multiple shares in a pre-decided split ratio. For example, a company has 4 million shares outstanding. The split ratio is 2-for-1, which means that the shareholder will receive two shares for every single share held. So the shares outstanding after the split would become 8 million.

Stock Split Example

Let’s take a hypothetical example to understand the concept of the stock split in detail:

Company X has announced a stock split of 5-for-1. The details about the company before the split are given in the table. No. of outstanding shares is 0.5 million or 500,000. Once the stock split takes place, the no. of shares outstanding in the market will increase to 2.5 million. The company will issue the additional 2 million shares (2.5 – 0.5) to its existing shareholders.

| Description | 5-for-1 Stock Split | ||

| Before Split | Split Effect | After Split | |

| No. of shares outstanding….(A) | 0.5 million | X 5 | 2.5 million |

| Face Value of share….(B) | $ 10/ Share | / 5 | $ 2/ Share |

| Equity Share Capital= (A)*(B) | 5 million | 5 million | |

| Market Price of share….(C) | $ 200/ Share | / 5 | $ 40/ share |

| Market Capitalization= (A)*(C) | 100 million | 100 million | |

The stock split will reduce the face value and stock price. The face value and the stock price will be divided by 5 to give the effect of the stock split, i.e., the Face value of $ 10/ share becomes $ 2/ share after the split. The stock price of $ 200/ share becomes $ 40/ share post the split.

The interesting thing to note here is that equity share capital and market capitalization are not affected because of the split. The increase in outstanding shares is compensated by the proportionate decrease in face value and stock price. So, the stock split does not create any economic value for its shareholders. Ex. An investor purchased 100 shares in this company at $ 200/ share. After the split, their shares will be converted into 500 shares, and the market price will drop to $ 40/share. So the value of his investment remains at 20,000 even after the split.

Stock Split’s effect on Stock Price

In the above example, theoretically, the stock price should decrease proportionately to $ 40/ share so that the value of every shareholder’s holding does not change. In practical life, this adjustment in the price is driven by the market participants. Hence there is no surety that the price will exactly be $ 40/ Share. Also, the investors analyze the objective, benefits, and disadvantages of the split to know its effect on the company. All this information will be reflected by the market in the stock price.

Advantages of Stock Split

Trader / Investor-Friendly Price

The main purpose of the stock split is to bring the price to a better level than it is currently trading at. Some companies share prices have risen so high that small investors may not be attracted to buy the share. For example, the price of an XYZ stock has increased to $2000. If its competitors from the industry are trading at a lower price, then small investors might be discouraged from buying the XYZ stock. The stock split will make it affordable for small investors to buy the XYZ stock. Hence this action will drive the price up due to an increase in the demand.

Increase in Liquidity

As a result of the stock split, more no. of shares will be floating in the market. So the increased liquidity will bring efficiency in the market price of the share.

Effect on Cash Dividend: It is normally seen and read in books that dividend incomes of investors increase after the stock split. For example, an investor holds 100 shares of a company, and it pays $ 2 per share, making a total dividend of $ 200 for the investor. Say, the company announced a stock split of 2-for-1. The company may declare a dividend of $ 1.2 per share, making a total dividend of $ 240 (200* $1.2 / share) for the same investor. So, the investor’s dividend income increased here by 20%.

Also Read: Bonus Share

Ease in Portfolio Management Activities

It is a common practice in portfolio management to increase or decrease exposure to certain stocks in the portfolio. Smaller denominations make it easy for the portfolio managers to exactly perform the buying and selling to set the decided % allocation of the stock.

Overtake the Market Returns: Studies have shown that the stocks that have gone through the stock split have normally outperformed the market. Studies prove that a stock split has a positive psychological effect on the investor’s mind. The above-listed advantages increase the demand for the stock, which drives the stock price upward.

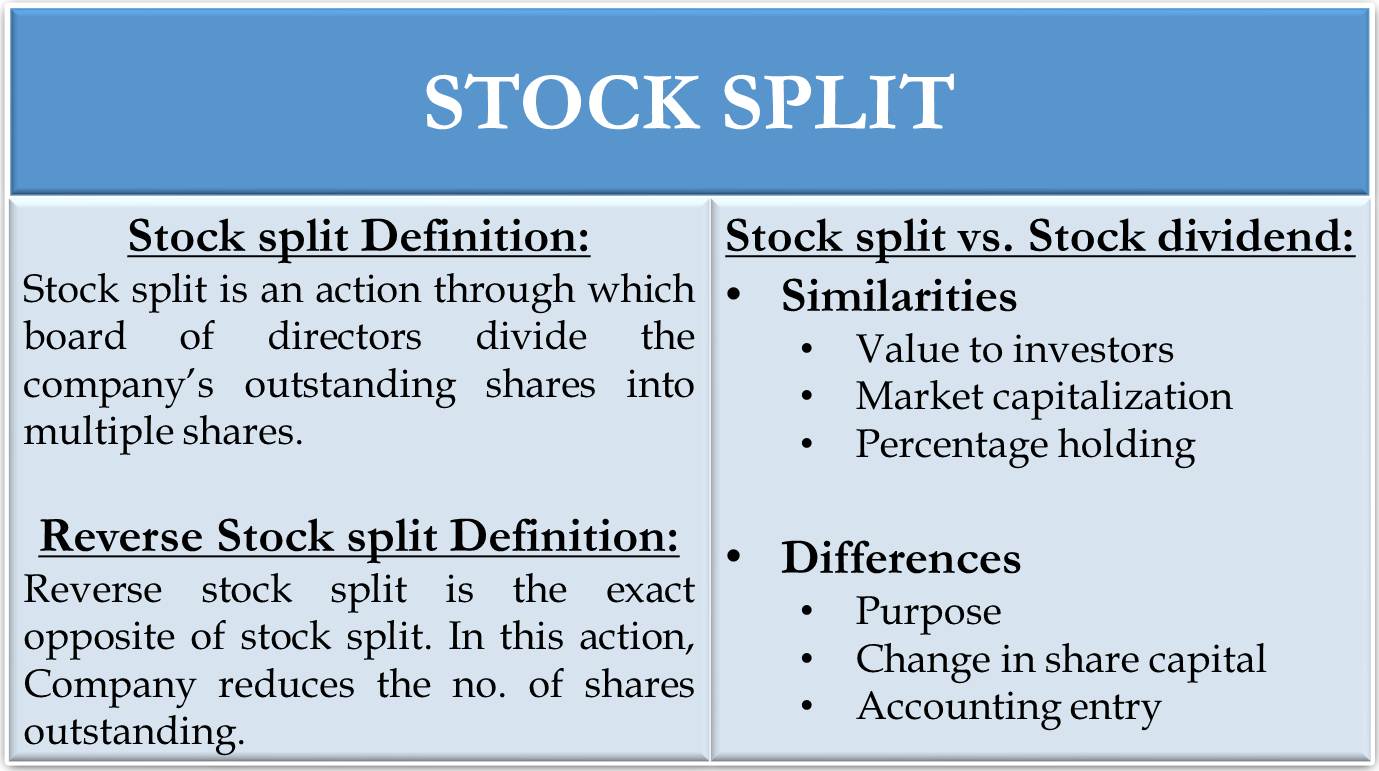

Stock Split vs. Stock Dividend

Stock split and stock dividend are often misunderstood to be the same, but they are different in nature. Let’s discuss the similarities and differences between both of them:

Similarities

Value to Investor

Both the actions will not create any major economic value for investors as the value of their investment remains unchanged.

Market Capitalization

Market capitalization is unaffected because an increase in outstanding shares will be proportionately adjusted by a decrease in market price.

Percentage Holding

The shareholders’ percentage holding in the company remains constant in both actions.

Differences

| Points | Stock Split | Stock Dividend (Bonus share) |

Purpose |

The purpose is to bring the stock price to a lower range for attracting small ticket size investors. | The purpose is to preserve cash for future needs, which is used as a substitute for cash dividends. |

Change in Share capital |

The face value of a share is reduced, and shares are increased. So the share capital remains constant. | Face value is unchanged, and shares are increased. So the share capital increases. |

Accounting entry |

Face value and shares are proportionately adjusted internally, so the balance sheet structure does not change. | An increase in share capital is capitalized by reducing the reserves. |

Reverse Stock Split

A reverse stock split is the exact opposite of a stock split. In this action, the company reduces the no. of shares outstanding, and the market adjusts the price upward for the split. For example, a company’s stock is trading at $ 1/ Share with 20 million shares outstanding. The reverse split ratio is 1-for-10, which means you will receive 1 share for every 10 shares held. After the split, no. of shares outstanding will be 2 million (20 million/ 10), and the market price will be adjusted to $ 10/ share ($1/ Share * 10).

A reverse stock split does not add any economic value to investors like the stock split. Similarly, market capitalization and equity share capital remain unchanged.

The purpose of reverse stock splits is to increase the share price when the company feels it is selling at a low price. It provides a negative signal for the market that the company might be going through some financial difficulty. Also, a minimum price is mentioned to remain listed under exchange rules. So, there are chances that the company might want to move the stock price to a higher range to avoid being delisted. The company should think it through before announcing the reverse stock split.

Conclusion

The management knows better about the company’s future than anybody else. A stock split decision in itself sends many signals about the company’s growth prospects. The market will analyze the information conveyed by these decisions and reflect it in the market price. So the impact of a split on share price might be different from the theoretical concept.

Stock splits and stock dividends have similar economic significance, but they have different purposes and accounting entries. Also, a stock split drastically affects many ratios, like Earnings per Share (EPS), Book Value per Share, etc. So if you see a sudden increase or decrease in the data, you should check for such corporate actions and use the data cautiously.