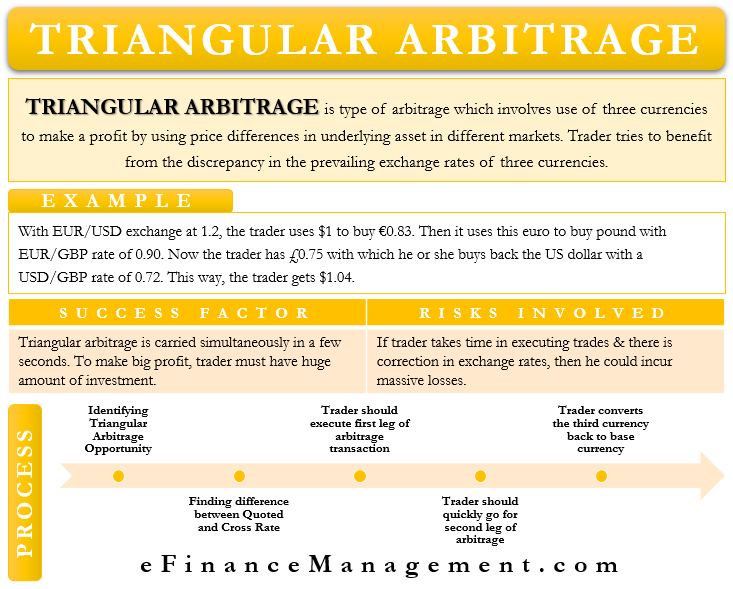

Arbitraging is a strategy that traders deploy to make a profit by using the price differences in an underlying asset in different markets. Such a strategy is more common in the forex or currency market. Triangular arbitrage is a type of currency arbitrage, and as the name suggests, it involves the use of three currencies.

In this, a trader tries to benefit from the discrepancy in the prevailing exchange rates of three currencies. To execute this arbitrage, a trader simultaneously trades all three currencies to earn profits from the trade. Actually, the trader makes a trade by using the first currency to buy the second and then using the second to buy the third, and then converting the third to the first. All these transactions take place with the ultimate aim of converting intermediary currencies into the first one.

Such an arbitrage or any arbitrage basically exploits inefficiency in the market and the opportunity available amongst the various currencies. Currency value differs between the markets, making it overvalued at one place and undervalued in the other market. That is how the inefficiency occurs, and seasoned traders take advantage of it. The most common currencies that provide arbitrage opportunities are EUR/USD, USD/GBP, and EUR/GBP.

Triangular Arbitrage Example

Let’s take a simple example to understand such an arbitrage. Suppose a trader identifies an arbitrage opportunity with the US dollar, Euro, and Pound. With EUR/USD exchange at 1.2, the trader uses $1 to buy €0.83. Then it uses this euro to buy the pound with a EUR/GBP rate of 0.90. Now the trader has £0.75, with which they buy back the US dollar with a USD/GBP rate of 0.72. This way, the trader gets $1.04.

So using the discrepancy in the exchange rates, the trader was able to earn a profit of $0.04. In the example, the US dollar is the base currency- used this to get other currency conversions, and finally, all get converted back to USD.

Crucial Success Factors or Risks of Triangular Arbitrage

Note that all the three trades (or legs) in triangular arbitrage are carried simultaneously in a few seconds. This is because an arbitrage opportunity does not exist for very long (in some cases a few milliseconds), and the mismatch in the currency rates gets corrected very quickly. That is why such profit-making opportunities are very rare.

In theory, the triangular arbitrage or any arbitrage is a risk-free profit. But, if a trader takes time to execute the trades and there is a correction in the exchange rates, they could incur massive losses.

Another point to note is that the price differences between the exchange rates (if there are any) are very minimal. So, to make a big profit, the trader must have a huge amount of investment.

For instance, in the above example, if a trader invests just $100, they would make a profit of just $4. But, if the investment is $10,000, then the profit would be $400. However, the trader also risks losing all money if the trade doesn’t execute properly.

To make a profit from the trade, the trader must also be aware of all the transaction costs and charges per transaction. If the profit a trader makes falls short of compensating for these charges, then the trader would incur a loss. Also, knowing the costs help the trader to decide whether or not to execute a particular trade.

Triangular Arbitrage Process

Executive triangular arbitrage involves the following process or steps:

The first is identifying an opportunity for triangular arbitrage. Such an opportunity exists only if the quoted exchange rate is not the same as the cross-currency exchange rate. One simple way to determine if there is an arbitrage opportunity is to use the below cross-currency value equation:

A/B x B/C x C/A = 1

A is the base currency in this equation, while B and C are counter-currencies. An arbitrage opportunity may exist if the equation does not equal one.

Second, once a trader confirms an arbitrage opportunity, then they need to find the difference between the quoted and cross-rate.

Third, if the difference (between quoted and cross-rate) is enough to make a profit on trade after incurring other costs and charges, the trader should then execute the first leg. And it is, trading the base currency for the other.

Fourth, the trader should now quickly trade the second currency for the third one. This is the second leg of this arbitrage.

Fifth, in this final step (and the third leg), the trader converts the third currency back into the base currency.

Automated Trading Platforms

As said above, the opportunities to make a profit from a triangular arbitrage are very rare and exist for just seconds. So, trading manually and making a profit is almost impossible. The existence of a huge number of traders makes the foreign currency market very active. This allows the market to constantly and quickly correct the market inefficiencies.

As per the researchers, triangular arbitrage opportunities arise for just up to 6% of the time during trading hours. Thus, traders make use of software and robotic trading platforms to profit from such rare opportunities. These software and platforms identify the arbitrage opportunity and execute the trade accordingly.

Such platforms have in-built algorithms that execute the trade once certain conditions are met. Before adopting these platforms, it is always wise to test them with the historical data, as well as test their speed in executing simultaneous trades. Also, traders can customize this software and algorithms to include their rules.

Final Words

Arbitrage is already a rare profit opportunity, and triangular arbitrage is rare. In fact, in an ideal market, there are no arbitrage opportunities. So, to benefit from such rare opportunities, a trader must make use of state-of-art software that helps them not only to quickly identify such opportunities but also execute the trades within seconds.

In addition to the currency market, the triangular arbitrage strategy is also present in the cryptocurrency world. Since crypto exchange and market are currently in the development phase, the arbitrage opportunities in this market are comparatively more than in the forex market.