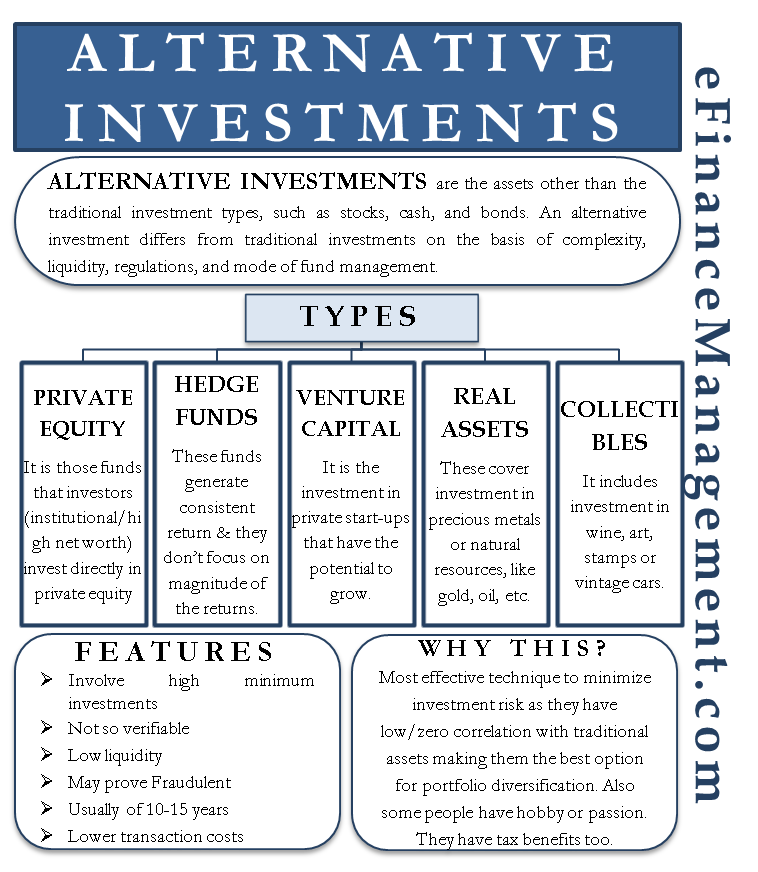

Alternative investments are assets other than the traditional investment types, such as stocks, cash, and bonds. An alternative investment differs from traditional investments on the basis of complexity, liquidity, regulations, and mode of fund management. Some examples of alternative investments are Private Equity, Hedge Funds, Estate, and Commodities. Investment in wine, art and rare coins are also an example of such an investment.

Since alternative investments are complex and are relatively riskier, they are usually done by institutional investors or high-net-worth individuals.

Alternative Investment – Features

- Alternative investments usually involve high minimum investments when compared to stocks or mutual funds.

- Investors normally don’t get any verifiable performance data to make an informed decision about investing in alternative investments.

- Unlike traditional investments, most alternative assets have low liquidity due to less number of buyers. For instance, selling a rare coin is more difficult than shares of any blue-chip company.

- Since alternative investments face fewer regulations, they are more prone to scams and fraud.

- Alternative investments are usually for an investment horizon of 10-15 years.

Why Go for Alternative Investments?

As we all know, diversification is the most effective technique to minimize investment risk. Since alternative investments usually have a low or zero correlation with traditional assets, it makes them the best option for portfolio diversification.

Another reason why people go for such an investment is that it is their hobby or passion. For instance, many have a hobby of collecting rare coins, maintaining a collection of wine, etc.

Types of Alternative Investments

Private Equity

It is the funds that the investors – institutional investors or high net worth investors – invest directly in a private company. Private companies use these funds for their expansion, like acquiring another company or buying a new asset.

Also Read: Various Avenues and Investments Alternative

Since most of the investors don’t have the expertise to select the private company to invest in, they take the help of Private Equity Firms. These firms raise funds from such investors and invest them in private companies. The private equity industry has largely been unregulated, but after the 2008 crisis, they are also facing supervision under the Dodd-Frank Wall Street Reform and Protection Act.

Hedge Funds

These generate a consistent return and ensure the safety of capital for the investors. Such type of investments doesn’t focus on the magnitude of returns. Since they have little correlation to the equity market, they help diversify portfolio risks.

Though hedge funds are also a pool of assets, they differ from Mutual Funds for several reasons. They face fewer regulations and hence, can invest in an array of assets. Hedge funds are known to invest in risky assets and derivatives.

Venture Capital

It is the investment in private start-ups that have the potential to grow. It may sound similar to Private Equity, but there is a difference – Private Equity invests in mature private companies, while Venture Capital is for startups. Investment in such an asset class carries high risk, but the returns could also be big.

Also Read: Portfolio Investment

Real Assets

Such alternative investments cover investment in precious metals or natural resources, like gold, oil, etc. Such assets have an inverse relationship with the US Dollar and thus, are a good hedge against the market movements. One can invest in these assets in several ways, like exchange-traded funds, billions, etc. Investment in real estate is also a good example of such an asset class.

Collectibles

It includes investment in wine, art, stamps, or vintage cars. However, the valuation of the collectibles is an issue as there are no set rules.

Managed Futures

Managed Futures are futures contract positions taken by actively managing money managers, who are mostly commodity traders and help companies and businesses hedge their positions against losses. Most positions in futures contracts are commonly taken in energy, agriculture, and currency markets.

Transaction and Tax

Investment in alternative assets often requires a high initial investment. However, the transaction costs are relatively lower since the turnover is less. Talking of tax benefits, such investments may result in tax benefits as investors usually hold them for a period of more than a year. This leads to comparatively lower capital gains tax.

Rising Participation of Retail Investors

Alternative investments have largely been seen as a forte for wealthy investors, but it is also getting popular among retail investors. Though the majority of retail investors still have limited availability to most of the alternative assets, opportunities to invest in commodities and real estate are widely available now via ETFs.