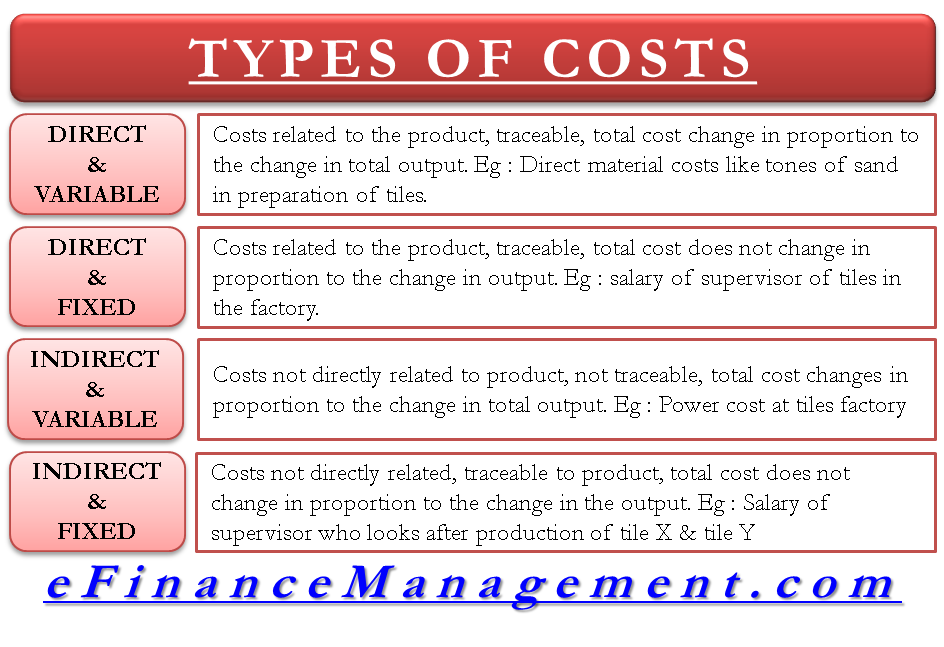

Broadly types of costs are classified as direct and indirect, fixed and variable, etc. The relationship of direct & indirect costs with fixed & variable costs is crucial for understanding a real interpretation of costs in any manufacturing business. At the very outset, it should be clear that all costs can be classified into direct/indirect and fixed/variable. In brief, we can say that any cost is categorized under one of these categories: direct and variable, direct and fixed, indirect and variable, indirect and fixed.

Before understanding the above dual cost classification concepts, let us recapitulate the basic definitions of direct, indirect, variable, and fixed costs.

Direct costs are those costs that are related to the product, and the amount of expense is easily assignable/traceable to the product. These costs are assigned to the product based on the cause and effect relationship.

Indirect costs are those costs that are related to the product, but the amount of expense is not traceable in an economically feasible manner. These costs are allocated to the product based on some reasonable basis.

Total variable cost is that cost that changes in proportion to the change in output, like direct material costs. Per unit, variable cost remains fixed.

Total fixed cost is that cost that does not change in proportion to the change in output, like the monthly salary cost of a supervisor. Per unit, fixed cost is variable.

Now let us look at those dual cost classifications:

Direct and Variable Costs

These are costs related to the product, traceability, and whose total cost changes in proportion to the change in total output. This is simple to understand, and the best simple example can be the direct material costs like tones of sand in the preparation of tiles.

Direct and Fixed Costs

These are those costs related to the product and traceability but whose total cost does not change in proportion to the change in output. It is a little difficult to visualize. An example of such a cost can be the supervisor’s salary of tile x in the factory where tiles x and y are manufactured. Here we know that the cost is incurred because we are manufacturing tile x. But this cost will not increase or decrease in tandem with the change in the manufacturing output of tiles as its nature is fixed for a period.

Also Read: Types of Costs and their Classification

Indirect and Variable Costs

These are those costs that are not directly related to the product. And therefore not traceable but whose total cost changes in proportion to the change in total output. For example, power cost at tiles factory where tile x and tile y are manufactured. Here, we know that the increase in output of any of the tiles – x or y will increase the power cost. That makes it a variable cost, but at the same time, the power cost cannot be easily allocated to tile x or tile y. It is tough to say how much power cost is incurred for tile x or tile y; it is an indirect cost.

Indirect and Fixed Costs

These costs are not directly related, traceable to the product, but whose total cost does not change in proportion to the change in the output. It is again simple to visualize cost. An example can be the supervisor’s salary, who looks after the production of both tile x and tile y. Here, we can see that the salary cost is a fixed cost that would not change with the change in the output of the tiles. But at the same time, it is difficult to say how much the cost of his salary is because of tile x or tile y. Therefore the cost is indirect.

Also, read about other Types of Costs and their Basis of Classification.

I think there is a typo in point 4. I think it should read “These are those costs which are NOT directly related, traceable to product but whose total cost does not change in proportion to the change in the output”.

Hi Alan,

Thanks for the suggestion, we have made the correction in the post.

Thanx