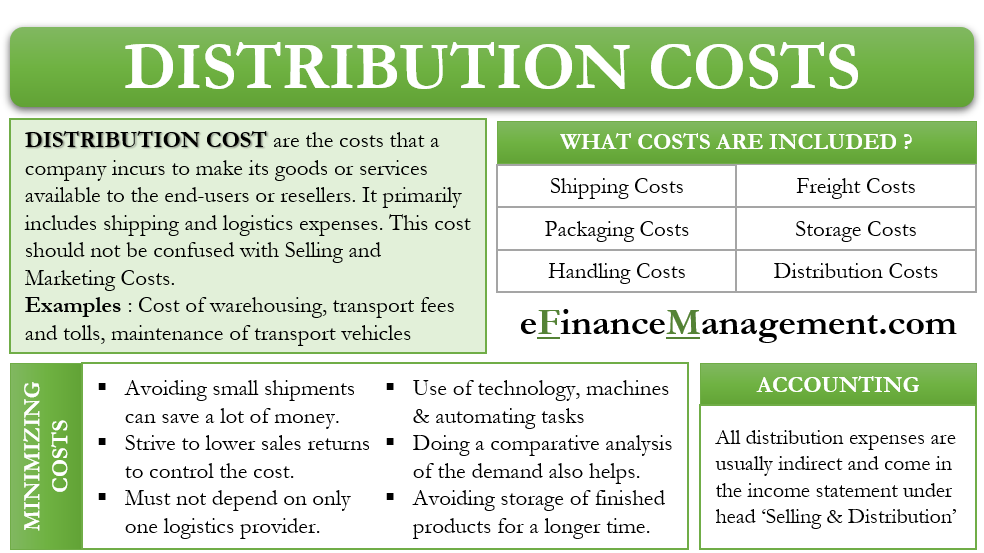

Distribution Costs or the Distribution expenses are the costs that a company incurs to make its goods or services available to the end-users or resellers. It is a broad accounting term that covers several types of expenses.

Some examples of this cost are the expenses on moving the goods to the resellers and end-users, the cost of warehousing, transport fees and tolls, maintenance of transport vehicles, and more.

Distribution Costs could form a significant part of the company’s total expenses, especially in scenarios when the goods are perishable, the volume of goods is massive or when the end-users are in distant areas.

A point to note is that the distribution cost is different and should not be confused with the selling and marketing expenses. The former primarily includes shipping and logistics expenses. The selling and marketing expenses include salaries of marketing staff, sales commission, and advertisement costs.

Also Read: Overhead Costs – Types, Importance, and More

Distribution Cost – What All it Includes?

As said above, it is a broad term for many types of costs. Distribution Costs includes all the costs to ship the product to the end-users or reseller.

It means all the shipping costs at each stage (from the production facility to reseller or end-user) would be part of the distribution expenses. It could be that the manufacturer may have a production facility in one place and a pick-up spot for the shipping agent at another location. The cost that a company incurs on sending goods from the production facility to the pick-up destination will also be part of the distribution expenses.

Handling the cost of inventory at each stage of shipment is also part of the distribution expenses. It will include handling charges at the production facility, pick-up place, warehouse, and sales point.

Similarly, packaging costs and distribution managerial costs are also a part of the expenses of the distribution. The administrative distribution cost would include salary, as well as the office expenses of the distribution manager.

Also Read: Types of Costing

Another essential component is the Freight cost. The freight cost can take various names depending on the distance the company ships the products. For instance, if a company produces and sells the product in one country, then the freight cost could mean the “Trucking” cost.

If a company exports the products, then it would be “Air Freight or shipping cost for a container load or less than a container load. A point to note is that transporting via air is costlier than through LCL. But, air transport would take less time.

In all, we can say that the distribution cost includes the cost of shipping, the cost of packing; the cost of freight; storage cost; handling expenses; and expenses of distribution employees.

Accounting

All the distribution expenses are usually indirect and come in the income statement. They are shown alongside the selling expense, under the head selling and distribution expenses. A point to note is that the accounting treatment of distribution expenses is the same as any other expenses.

We need to subtract the total distribution cost from the gross profit to arrive at the net profit.

For example, Company A has sales of $20,000, while the cost of goods sold (COGS) is $10,000. Transportation expenses are $2,000, salary of distribution manager is $2,000. The net profit in this case will be $6,000 ($20,000 Less $10,000 Less $2,000 Less $2,000).

Sales $20,000

Less: COGS $10,000

Gross Profit $10,000

Less: Distribution Expenses $4,000

Net Profit $6,000

How to Minimize Distribution Cost?

As said above, the objective of every business should be to minimize its distribution expenses. It will allow it to maximize its profit. Moreover, a company would also want to cut its distribution cost to survive the cut-throat price war. A company can reduce its distribution expenses using the following ways:

- Avoiding small shipments can save a company a lot of money. Instead of sending multiple small shipments, a company can send one big shipment.

- One of the critical factors for increased distribution cost is generally the higher quantum of sales returns. Hence, a company should strive to lower the sales returns to control and reduce costs.

- A firm must not depend on one logistics provider. It should continuously negotiate the terms with the logistics provider to get the best deal.

- The use of technology, machines, and automating tasks could also help a company lower its distribution costs.

- Doing a comparative analysis of the demand and how urgently the customer needs will also help.

- Avoiding the storage of finished products for a longer time also reduces the distribution cost. In other words, production is so aligned that there remains a minimum time gap between production and dispatch.

Final Words

A company needs to balance the distribution costs with the demand for the product. The objective of the company should be to minimize the distribution cost. For this, the company needs to carry out a comparative analysis of how urgently the product is required and whether or not it would lose sales because of it.

RELATED POSTS

- Classification of Costs based on Functions / Activities

- Selling, General and Administrative Expenses – All You Need To Know

- Prime Cost – Meaning, Formula, Importance And More

- Material, Labor and Expenses – Classification Based on Nature of Costs

- Carrying Cost: Why You Shouldn't Avoid It?

- Operating Expenses – Meaning, Importance And More