As the word suggests, the Direct Labor Budget relates to the cost of direct labor involved in production/assembly or service. Specifically, this budget shows the cost and hours of direct labor that a company requires for production/extending service. We can say that such a budget allows a company to manage the labor force it needs. Direct laborers are the employees that work on the factory floor to produce a product.

A direct labor budget is not entirely a separate budget but rather a part of the master cost or finance budget. A company prepares this budget after finalizing the production budget. This is because the production estimate serves as an input in estimating the direct labor a company needs. Generally, we prepare the labor budget on a monthly or quarterly basis.

Management may add or reduce the labor hours in between on the basis of the ongoing situation or to account for supply chain disruptions. However, if the management makes such changes, the calculations also need revisions.

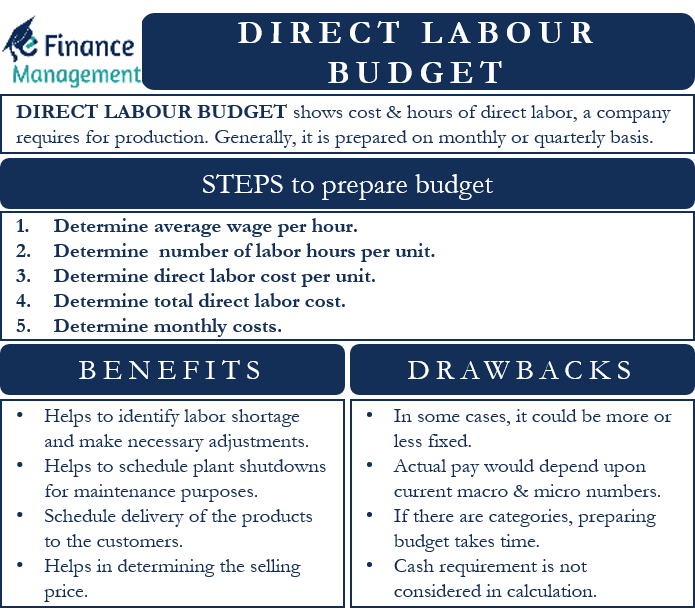

Steps to Prepare Direct Labor Budget

Following are the steps you need to follow to prepare the direct labor budget easily:

To determine this, you first need to determine the average of all wages in the production department. For this, add all wages you pay per hour and divide it by the employee count.

It is the number of labor hours that a firm requires to manufacture one unit. This should include the efforts put in by every unit in a production department. For example, a toy goes through the following production departments – cutting, sewing, and finishing department. Each department requires one hour to make one unit.

Once you have the details of the first two points, then it is a simple multiplication of the two figures. In other words, to get the direct labor cost per unit, we will multiply the labor cost per hour by the direct labor hour per unit. Suppose the direct labor cost per hour is $10; then, with our toy example above, the direct labor cost per unit is $30 ($10 * $3). So, the total direct labor hour per unit will be 3 hours.

For this, we need to multiply the direct labor cost per unit (step 3) by the number of units a company plans to produce. If the toy company plans to produce 3,000 units, then the total direct labor cost will be $90,000 ($30 * $3,000).

In order to give more clarity to the management, one needs to break down the total labor costs by month. For every month, clearly show the units a company plans to produce, direct labor cost per hour, direct labor cost per unit, and total direct labor cost.

Also Read: Production Budget

How to Calculate Direct Labor Cost?

To come up with this budget, one needs to find out labor hours and then labor costs.

The first requirement is to estimate the total labor hours required to achieve the planned production. For this, we need to multiply the planned production and direct labor hours needed to produce per unit.

In the second stage, we multiply the total labor hours (or budgeted Direct Labor Hours Required) with the estimated cost per Direct Labor Hour. This multiplication will give the Budgeted Direct Labor Cost.

Let’s take an easy example to make the concept clear. Suppose Company A estimate to produce 2,000 units in the first half of a year. The company knows that it requires 1.5 direct labor hours to produce one unit, and the cost per direct labor hour is $10.

First, we calculate Total Budgeted Direct Labor Hours Required = 2,000 * 1.5 = 3,000

Now, we calculate the Budgeted Direct Labor Cost = 3,000 * 10 = $30,000.

Now take another example with some more details:

| Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | |

|---|---|---|---|---|

| Production Estimate (units) (A) | 1000 | 1200 | 900 | 1500 |

| Direct labor hour per unit (B) | 2 | 2 | 2 | 2 |

| Total direct labor hrs needed (A*B) | 2000 | 2400 | 1800 | 3000 |

| Direct labor cost per hour (D) | $10 | $10 | $10 | $10 |

| Total direct labor cost (A*B*D) | $20,000 | $24,000 | $18,000 | $30,000 |

Benefits and Drawbacks

Benefits

Following are the benefits of preparing a direct labor budget:

- It helps management to identify labor shortages and make necessary adjustments in time to avoid any production disruption.

- The budget also helps management schedule plant shutdowns for maintenance purposes.

- It helps the management to schedule delivery of the products to the customers.

- It also helps in determining the selling price of the product.

Drawbacks

There are a few drawbacks (or we can say issues) with this type of budget as well:

- One issue with the calculation is regarding cash requirements. Generally, we don’t take cash requirements to calculate such a budget. Instead, the cash requirements are part of the master budget.

- If there are many categories of direct labor, then preparing a budget takes too much time and becomes a complex process.

- The actual payment to the labor would depend upon many current macros and micro factors in the real world. This results in a big variance in the budget and the actual numbers.

- In some cases, the direct labor cost could be more or less fixed (like a fixed cost). In such cases, preparing a budget with full details might be a waste of time.

How it Impacts the Production Budget?

The direct labor budget is not just a part of the production budget, but it is a very crucial component. It impacts the production budget in several ways, such as:

- A production budget considers many factors to come up with an estimate on the number of units. These factors are past sales, past labor budgets, and demand forecasts.

- The average labor cost is very important for the production budget. One can get this number directly from the labor budget.

- It also helps the management to plan its staffing requirement.

Final Words

A direct labor budget is very important for the companies. Those who neglect it face the risk of labor shortages or overpaying because of arranging more labor at the last minute. Nowadays, several software is available that help companies to prepare and adjust their budget easily.