What is Strategic Alliance (Definition)

Strategic Alliance (SA) is a corporate restructuring strategy. It is an agreement between two entities to pool their resources for achieving a common business goal. They are generally entered when each entity in the agreement possesses some kind of expertise. This expertise, when combined, makes them complete and provides a distinct competitive advantage to both entities. Unlike Joint ventures, SA doesn’t necessitate the creation of a new entity. As a result, the entities involved in SA can continue to operate as independent entities.

Generally, a strategic alliance is entered into to gain geographical presence, achieve economies of scale through alliance for manufacturing, or gain access to research/technology, etc.

Types of Strategic Alliances

Horizontal Strategic Alliance

It is an alliance between companies operating in the same business area. In other words, companies that were competitors previously now join hands to enhance their competitiveness against other competitors in the market. The classic example of this kind of SA is Renault – Nissan Alliance. The SA between both entities is neither by a merger nor by an acquisition. However, it is through a cross-holding agreement. This kind of SA provided both the companies with competitive advantages like economies of scale as the raw material cost can be negotiated for larger volumes, logistics costs can be rationalized, research & development costs can be rationalized, and even marketing and servicing network can be commonly utilized. One new term trending these days in the financial market is bancassurance is also a very good example of this type of alliance.

Vertical Strategic Alliance

This kind of alliance is largely seen between upstream and downstream value chains of firms’ products. E.g., Ink manufacturers enter into a strategic alliance with Pigment manufacturers. This kind of arrangement ensures ink manufacturers with a consistent supply of requisite kinds of Pigment. Further, a car manufacturer entering new geography may enter into an SA with distributors, which enable it to expand rapidly.

Various Ways of entering into a Strategic Alliance

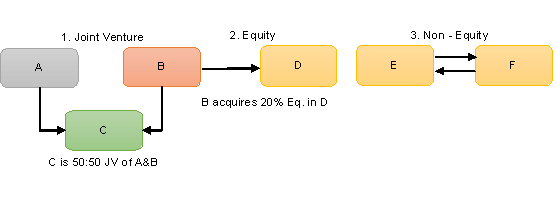

- Joint Venture: Joint Venture is an alliance where two or more entities enter to pool up their resources in the new entity to achieve the tangible business objective.

- Equity Participation: This is an alliance where one entity acquires a substantial equity stake in another entity, so it has control to drive business decisions. (Renault – Nissan Alliance; explained earlier)

- Non–Equity: Entities involved in SA agree to share their core competencies (expert knowledge) in order to create a competitive advantage. Since the creation of a new entity does not take place, it does not require equity participation.

Reasons for Strategic Alliance / Logic behind Strategic Alliance

- Gaining access to a restricted market (China)

- Gaining a foothold in new marker

- Increase the speed of development of new products

- Maintain leadership position

- Leverage upon the befits like economies of scale, lower cost

- De-risking the R&D efforts

- Gain market power (especially pricing power)

- Gain access to know-how

- Pool resources to fund large capital intensive projects

- Gaining a competitive advantage against competitors

Read more about other Corporate Restructuring strategies.

Conclusion

In a nutshell, Strategic Alliances help both the entities in agreement to gain/leverage from the expertise possessed by another one. Since it does not necessitate the creation of a new entity, both the entities can continue to undertake their core activity independent of SA. Entering the right kind of SA reduces the costs and, in a way, enhances the shareholders’ value.

Am really enjoying reading the topic of strategic alliances and it has greatly helped my understanding of the concepts,