What is Revolving Debt?

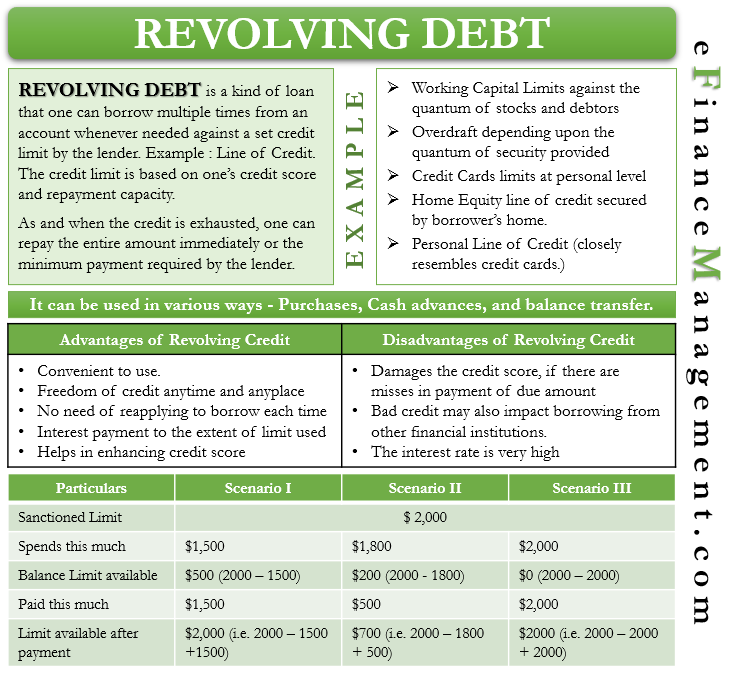

Debt is something that a person, people, or businesses have borrowed from another entity and need to repay it in specific time duration. Moreover, the borrower also needs to pay some money as interest on the borrowed amount, i.e., Principal in financial terms. Revolving debt is a kind of loan that one can borrow multiple times from an account whenever needed against a set credit limit by the lender. One such example of revolving debt is a line of credit.

Therefore, the term revolving signifies that the account allows the borrower to borrow again and again. As and when the credit is exhausted, one can repay the entire amount immediately or the minimum payment required by the lender. They are thus freeing the line of credit for use. And the limit goes back to the initial amount set for the account.

In other words, in revolving debt, every payment resets the limit back up to the original sanction. Hence, the withdrawable balance may always remain within the initial sanction limit.

Thus, it can be said that the revolving debts are types of credit accounts that have set credit limits decided by the credit provider, generally, a financial institution or Bank, based on one’s credit score and repayment capacity.

Also Read: Revolving Credit Facility

Examples of Revolving Debt

Commonly known revolving debt accounts are:

Working Capital Limits

In working capital limits, the overall limit up to which a company can borrow is decided. After that, the company can continue to borrow up to that limit against the quantum of stocks and debtors. And this draw-down limit may vary month on month depending upon the value of stocks and debtors.

Overdrafts

Depending upon the quantum of security provided and other aspects, a banker or institution sanctions an overdraft limit to the entity. The entity then can use this limit to meet its regular requirements and can draw money as and when needed in this case.

Credit Cards

On a personal level, the limit to spending with a credit card is predetermined. The credit cardholder can pay or withdraw money until the set credit limit is reached. However, there is a monthly payment mechanism for the amount used. If the payment is missed on the due date, the outstanding balance will attract interest on the outstanding amount, and further spending and credit period benefits are not allowed. These are also called as unsecured accounts. In the case of non-payment, it is going to impact the borrower’s credit score as an asset does not back these.

Home Equity Line of Credit

Also called HELOC, it is a revolving credit account given to the borrower, which is secured by the borrower’s home. There is a set limit on drawing money from these accounts. These lines are usually backed by an asset, i.e., the house. In the case of Non-payments, the home under consideration may be at stake.

Also Read: Revolving Letter of Credit

Personal Line of Credit

It is a kind of loan generally approved by Bank or credit union. This credit account gives access to a pre-approved sum of money to the borrower up to a specific time duration. This credit account very closely resembles credit cards.

Usage of funds in a Revolving Account

There are various ways in which the revolving account can be used, namely:

Purchases

Cash advances, and

Balance transfer (in case of credit cards and home credit line)

Example of Revolving Debt Calculations

Let us try to understand the revolving debt limit calculation Under various situations:

| Credit Card Limit | (In $) | ||

| Scenarios | I | II | III |

| Sanctioned Limit | 2000 | ||

| Bill Cycle Date | 15th of every month | ||

| Due Date | 1st of every month | ||

| Spends up to Bill Cycle | 1500 | 1800 | 2000 |

| Limits Available | 500 | 200 | 0 |

| (2000-1500) | (2000-1800) | (2000-2000) | |

| Payment on Due Date | 1500 | 500 | 2000 |

| Limits Available After payment | 2000 | 700 | 2000 |

| (2000-1500+1500) | (2000-1800+500) | (2000-2000+2000) |

Significance of Revolving Debt in credit score calculation

There are two kinds of debts revolving and installment debts. An installment debt is a kind of loan which has to be paid back in regular fixed monthly installments. Each installment comprises part of the principal amount borrowed and interest levied on it. Examples of installment debts are term loans, student loans, vehicle loans, personal loans, etc.

As compared to installment debt, revolving debt has a more significant impact on the individual’s or business’s credit score. Because revolving debts serve a strong indicator of the risk involved with the borrower, how promptly and regularly the individual repays the due amount and pays in full balance, the higher and better will be the credit score. Payment history is also crucial in determining an individual’s credit score.

So to improve credit score, a person should firstly pay off revolving debts like credit card debts before paying off installment debts. Because revolving debts have a significant impact on credit scores being unsecured, and the interest rate is also higher for these debts.

Therefore, for revolving debt, it is crucial to pay off the full balance every payment cycle timely. Part-payment and paying the minimum balance set by the lender results in higher interest levied on the balance amount and a reduced credit score.

Pros of Revolving Debt

- Revolving debts are very convenient to use.

- Revolving debts provide freedom of credit available to the individual borrower anytime anyplace for making payments and purchases.

- The borrower does not need to re-apply for credit every time. Once you pay the balance due, the credit limit resets, and you can borrow the money.

- The best part of revolving debt is that the borrower has to pay interest only to the extent of the limit used, though the sanctioned limit is higher.

- It helps in establishing a credit score for individual borrowers. Credit scoring models use the information of an individual’s revolving debts to calculate credit scores.

- Security and fraud protection is better for revolving accounts than paying through cash or debit cards.

Cons of Revolving Debt

The potential downsides of revolving accounts are:

- If the borrower is unable to handle the revolving account efficiently and delays or misses paying back the balance, it damages the credit score and credibility of the individual.

- Bad credit ratings affect the credibility of the individual in the application of other loans from financial institutions.

- Credit cards have very high-interest rates. So one should ensure to pay the credit card and such dues in time to avoid the high-interest burden.