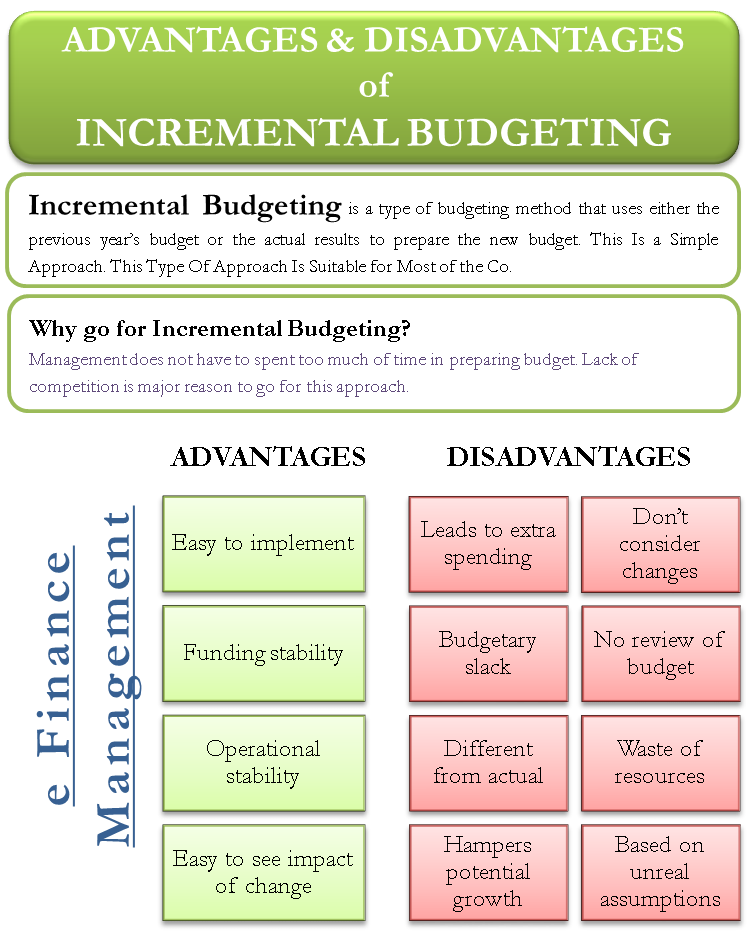

Incremental budgeting is an important part of management accounting based on the premise of making a small change to the existing budget to arrive at a new budget. Only incremental amounts are added to arrive at the new budgeted numbers. An insight into the advantages and disadvantages of incremental budgeting may help understand the concept better.

Advantages of Incremental Budgeting

Easy to Implement

Being easy to implement is a major reason why businesses go for this approach. Also, it does not require a lot of detailed analysis like other budgeting techniques.

Funding Stability

Incremental Budgeting favors the programs or projects that require funding for multiple years. The approach ensures that the funding keeps flowing to the program.

Operational Stability

This approach makes sure that the departments operate on a consistent basis. Also, it leads to fewer conflicts if all the departments are treated similarly.

Easy to Detect the Impact of Change

Budgets are mostly the same year after year under this approach. But, if management makes any change made to it, one can easily identify it by comparing it with earlier budgets.

Stability in Budgets

This budgeting approach ensures that no large deviations are seen in the budget year after year as it gradually changes the budget requirement. With this type of budgeting, a company is likely to have stable budgets year on year.

Disadvantages of Incremental Budgeting

Leads to Extra Spending

This is the biggest disadvantage of this approach. It is a known fact that each department tries to get as much as it can to fund its operations. So, if incremental budgeting is in use, the department will try to spend as much money as they possibly can to ensure that they get a similar amount for the next budget.

Don’t Consider Changes

This approach assumes that everything stays the same as last year with minimum changes. Thus, it fails to take into account the changing circumstances.

Budgetary Slack

Managers, when using this approach, factor in little revenue growth but more expenses. They do this to ensure they always get favorable variances.

No Review of the Budget

When a similar budget is carried forward next year, those who review the budget have little incentive to carry out a comprehensive check. This leads to inefficiencies rolled into the new budget as well.

Different from Actual Results

When a company uses a previous year’s budget for the new budget, the difference between the budget and actual results increases. For instance, the budget for year 1 was $1000, but actual spending was $1800. On the basis of incremental budgeting, the year 2 budget could be $1100, but actual spending was $2000. In this way, if the budget and actual spending don’t match, the difference may widen.

Also Read: Budgeting Examples

Waste of Resources

Suppose the previous budget allocates a certain sum to a specific business unit. Then, the new budget will also allot funds to the same unit even if the unit doesn’t need it or needs a lesser amount.

Hampers Potential Growth

As the budget allocates funds in a similar way year after year, it often gets difficult to get funds for new activities. This leads to a conservative business environment that kills innovation and risk-taking.

Based on Unreal Assumptions

This budgeting method assumes that there is no need to analyze the objectives and activities of the department. Also it also assumes no significant change in policy and financing approach.

Conclusion

Overall, it can be said that though incremental budgeting is easy to implement, it has the potential to destroy the business in the long term. To avoid such a fate, a business must thoroughly analyze its income and expenses (both current and future) and make the budget accordingly.